Current Expected Credit Loss (CECL) Services

Oxford Economics' solution for projecting expected credit losses to meet CECL requirements.

Talk to us

Overview

With over 35 years of independent forecasting and risk analysis experience, we are uniquely placed to calculate current expected credit losses under the CECL accounting standards.

Bespoke scenarios for CECL

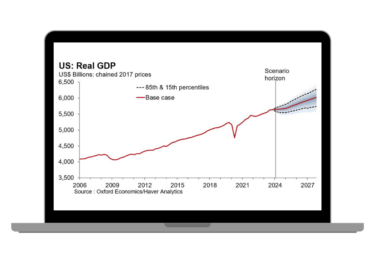

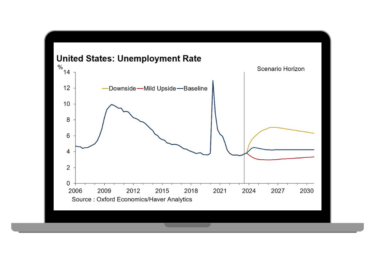

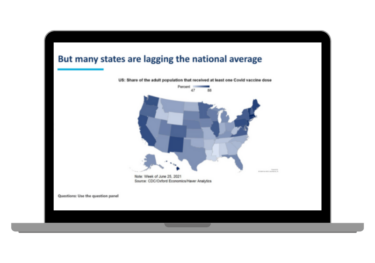

We provide an unbiased view of the forward-looking distribution and associated probabilities for the macroeconomic outlook for the United States, all 50 states and 382 metro areas.

Baseline, upside and downside macroeconomic scenarios

Spanning the probability distribution of forecasts and covering the expected lifetime of assets.

Regular updates

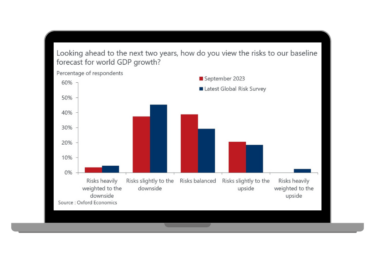

Scenarios for CECL are updated quarterly to reflect emerging risks and changes to the base case.

Extensive reporting

Detailed changes from the last set of scenarios based on our analysis of current trends and risks.

Comprehensive variable coverage

Macroeconomic and financial variable outputs cover the key drivers of impairment. Fully consistent scenario results are available for all US States and Metropolitan Statistical Areas (MSAs).

CECL scenario service

Discover more about our methodology, our approach and the clientele of our service

What is our methodology?

The methodology used to construct our forward-looking distributions is similar to that of major central banks when assessing the risks around their central projections.

Based on these robust distributions, we derive coherent economic scenarios along with their probability. Crucially, our approach ensures that the only changes to scenarios from quarter to quarter are due to a transparent assessment of emerging or receding risks.

What is our modelling approach?

At the centre of our approach is our renowned Global Economic Model, which integrates individual country models through global assumptions about trade volume and prices, competitiveness, interest and exchange rates, capital flows and commodity prices.

The model’s unique open-architecture framework enables us to assess the impacts of adverse scenarios on economic indicators and a range of asset classes.

What are our endorsements?

Oxford Economics is a key advisor to some of the world’s largest financial institutions which rely on our Global Economic Model for their stress testing and other regulatory requirements.

We support major financial institutions in the UK, Eurozone, Asia, Middle East and Africa with our IFRS 9 solution.

“CMHC’s Stress Testing and ORSA team has started this year using Oxford Economics for the purpose of stress-testing. Our experience has been very positive. The software is sound, intuitive and user friendly. But most of all, it allows the user to understand the links between the variables and for a certain degree of customisation.”

“Services provided are always delivered timely according to the agreed timetable. Output is solid and in discussions OE has shown to be very responsive and proactive. Turnaround time is quick.”

“We wanted to bring our climate assumptions and scenarios more in line with those used by central banks in their climate stress test analysis, so we have worked with Oxford Economics to apply their climate macro model to our productivity, GDP and inflation forecasts.

Oxford Economics has always been available to respond to our queries and provided insightful explanations for the impact of carbon pricing on macroeconomic activity in their model. We are very satisfied with their rigorous approach in modelling climate change and are happy to have collaborated with them.”

Resources and events

Research Briefing

How inflation eroded governments’ debts and why it matters

Blog

Downside risks remain amid a more balanced outlook in our Q1 IFRS 9 and CECL scenarios

Research Briefing

QE makes a difference – and it’s here to stay

News

Oxford Economics Introduces Proprietary Data Service

Webinar

Air travel recovery to resume in 2022 post-Omicron

Webinar

UK Outlook: How many times will the MPC hike in 2022?

Webinar

Has Asia’s inflation peaked?

Webinar

The transformation of Japan from a goods to capital exporter

Greater downside risks are explored in our Q4 IFRS9 and CECL scenarios

Featured

Contact us

If you would like to find out more about our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Trusted By