Blog | 19 Dec 2023

Greater downside risks are explored in our Q4 IFRS9 and CECL scenarios

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

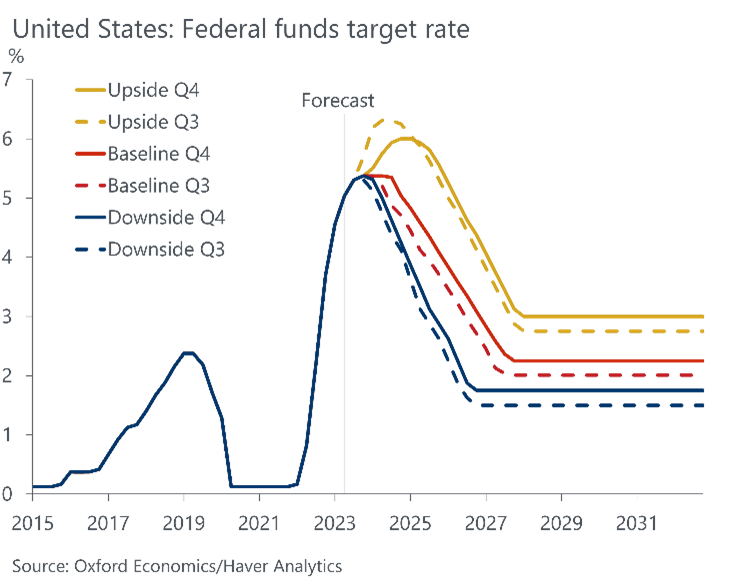

The Q4 update of our IFRS9 and CECL scenarios services paints a more pessimistic view of the balance of risks to the global economy, albeit with a lower peak in policy rates and higher terminal rates than we saw in Q3.

The latest batch of national accounts data for many large economies confirmed that recent economic resilience was maintained in Q3. Nonetheless, the ongoing downtrend in the global composite PMI suggests that this strength could be a last hurrah. Clients responding to our Global Risk Survey have also become more downcast in their expectations around our baseline forecast for global GDP growth compared to the last update. Overall, the net balance of risks to the outlook is more skewed to the downside than in the previous update, with fewer respondents seeing risks as balanced.

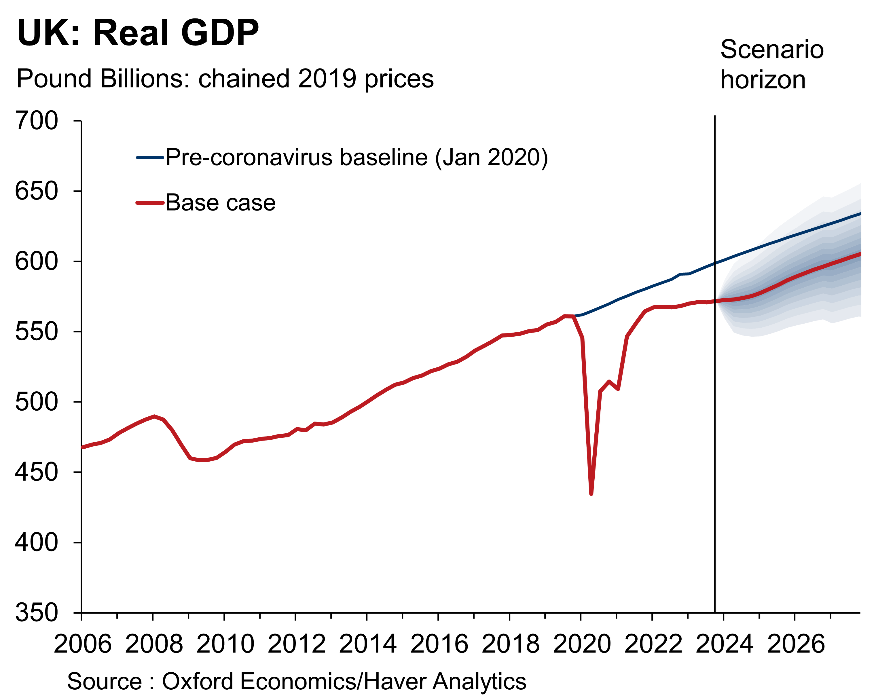

Since September, interest rate expectations for the main central banks have fallen back significantly, as markets adjust to the idea of a longer but lower peak to the current cycle in policy rates. We therefore now see a lower peak in rates in our alternative scenarios than we did in Q3. However, bond yields have risen dramatically since the middle of this year. Decomposing the changes in the forward yield curves into shifts caused by changes in the expected path of policy rates and shifts in the term premia shows that the shift in the forward curve since the start of September has been driven mainly by increases in the term premia. Given the increased inflation risk premium and higher debt burdens for some economies, we think there are stronger grounds to believe that the term premia should now be higher than in the 2010s for all the advanced economies. We have therefore raised our forecasts for bond yields in the long term by 50bps in the US and UK, by 25bps in Germany and about 20bps in Japan.

While interest-sensitive spending looks strong relative to cycles in the 1960s-1990s, it does not relative to the 2004-2007 cycle in which asset price effects were slow to materialise. So, the peak impact on spending may be yet to come, and some leading indicators in the US and Europe point in this direction. As a result, greater upside risk to terminal rates translates into a more pessimistic assessment of the overall risks to the outlook.

Our quarterly IFRS9 and CECL products combine over two decades of forecast errors with our quantitative assessment of the current risks facing the global and domestic economy to produce robust forward-looking distributions for the economy. Using specific percentile points in the distributions of several key metrics such as GDP, unemployment, interest rates, house prices and equity prices we construct five alternative scenarios at a globally consistent level to help clients assess local and global risk and cover the expected lifetime of assets.

Click here if you want to learn more about our IFRS9 service and here for our CECL service.

Author

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

+44 (0) 203 910 8138

Private: Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

Oxford, United Kingdom

Tags:

You may be interested in

Infographic: Key macroeconomic risks impacting global real estate performance

Continued economic growth will help stabilise commercial real estate yields and values before pricing slowly begins to recover next year. We expect global all-property total returns to average 5.3% per year over 2024-2025 in our baseline scenario. However, there are still upside and downside risks that real estate professionals should watch out for. In this infographic, we outline these risks and their impacts on property value.

Find Out More

How to tackle sustainability challenges

Sustainability is a multifaceted challenge, shrouded in complexity. It can make navigating the complex landscape of sustainability daunting, with organisations often struggling to understand their unique challenges and find effective solutions or meet their reporting and disclosure requirements. Why, are companies struggling, even though 97% of businesses consider sustainability a top priority?

Find Out More

Japan: The impact of structural labour shortages on inflation

We have revised up our long-term wage and inflation projections based on a larger impact from structural labour shortages due to adverse demographic trends. Even after raising our wage growth assumptions by 0.5ppts on average over 2024-2030, however, we still forecast inflation only reaching 1.4% in 2030 – well short of the 2% target.

Find Out More

Exploring the plausible ‘What Ifs’ to our 2023 China GDP forecast

On the back of China’s recent consumption outperformance, we now expect the economy to grow by at least 5.5% in 2023.

Find Out More