Latest Reports

Breaking out the presidential election-year playbook

Presidential elections not only have major implications for the future path of fiscal policy and the macroeconomic outlook, but they also impact the economy during the election year itself.

Download the reportNewsletter subscription

Policy in Focus

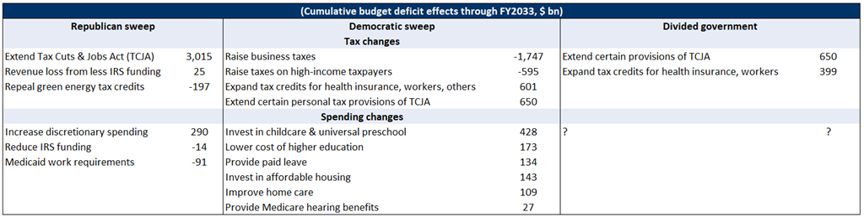

With almost all the provisions from the 2017 Tax Cuts and Jobs Act (TCJA), known as the Trump tax cuts, set to expire at the end of 2025, whoever controls the legislative agenda at that point will have an enormous influence over US tax policy. We consider tax policies under three different scenarios: a Republican sweep of Congress and the White House, a Democratic sweep, and a divided government.

Table 1: Tax and spending policies across three different post-election scenarios

Source: Oxford Economics/Congressional Budget Office/Joint Committee on Taxation/Tax Foundation/US Treasury/White House

We expect Republicans to rush to prevent Trump-era tax cuts from expiring at the end of the year, while Democrats will also feel an urgency to prevent a similarly timed expiration of expanded subsidies for health insurance. In a divided government, a grand bargain that permanently extends key tax priorities of both parties would add at least $1tn to deficits through FY2033, and even more beyond.

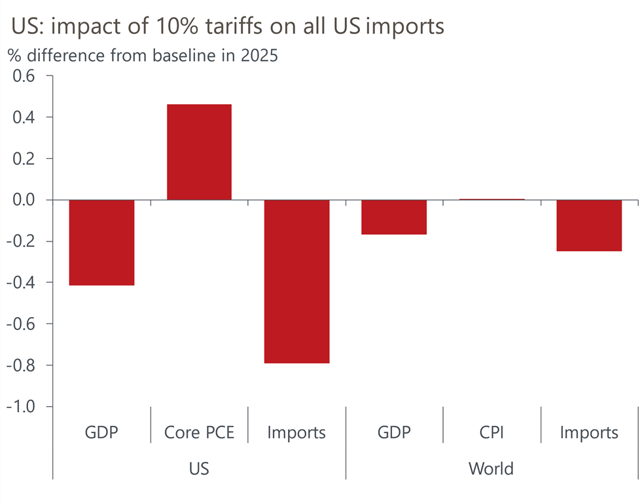

Whoever wins the next election, an increase in protectionist measures, or at the very least, a maintenance of the existing ones, seems a near certainty. Globalization’s role in growing inequality and supply-chain disruptions of the post-pandemic era have formed a powerful argument against China, which allows outside access to strategic sectors and technology, and instead favors domestic manufacturing.

Although, Republicans and Democrats appear to think very differently about how this goal should be achieved. We think the Democrats will continue to favor industrial subsidies and regulation, while a Republican administration would likely turn to imposing more tariffs on the rest of the world.

Our analysis suggests that tariffs have been effective at reducing US-China bilateral trade in some sectors, such as electronics, but it also resulted in significant trade diversion to other Asian economies; there is relatively little evidence that the tariff’s imposed by the Trump administration narrowed the US’ trade balance.

Tariffs generally do not make economic sense because they prevent a country from reaping the benefits of specialization, disrupt the movement of goods and services, and lead to a misallocation of resources. The cost of tariffs is often borne by consumers and producers, not paid by the country, or countries that a tariff is levied against.

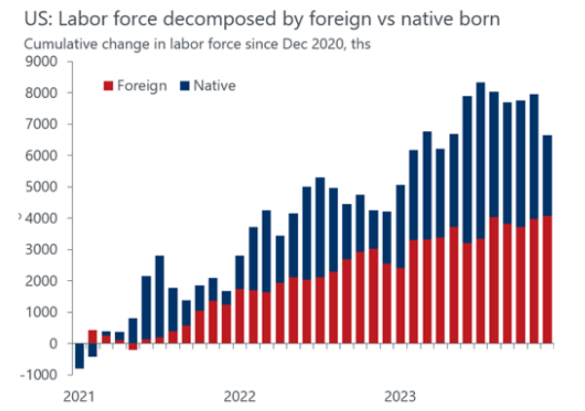

The intensifying debate over border security unfolds against the backdrop of immigration’s pivotal role in shaping the US economy. Immigration has become the key driver of population and labor force growth. Based on our forecast, immigration will account for close to 100% of population growth by 2050.

Contemplating a higher pace of immigration may seem unrealistic in the current political climate, as a surge of immigrants is straining government resources in many areas. However, the economic consequences of the demographic shift in the US—characterised by lower births rates, slower net migration and higher death rates—are significant and will require policymakers to eventually adopt a balanced and forward-thinking approach to immigration policy.

Biden and former President Donald Trump have very different proposals on climate change and environmental policies. Most notably, Trump withdrew the US from the Paris Agreement in 2017, an international treaty on climate change. Biden reversed that decision in 2021.

The impact of climate change on the economy cannot be overlooked. Besides damages brought by changing weather patterns and more frequent natural disasters, there are significant opportunities in fostering a green economy. This includes the development of renewable energy sources and electric vehicles.

Oxford Economics is poised to release a report assessing the implications of climate change on the US economy. To receive this report directly in your inbox upon its release, you may subscribe to our US election newsletter.

Get free trial of our US Elections and economics solutions today

At Oxford Economics, we provide independent, unbiased analysis to guide you through election season uncertainties. Trial today for insightful forecasts and analysis on how the outcomes could shape the US and global economy.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Trusted By