Breaking out the presidential election-year playbook

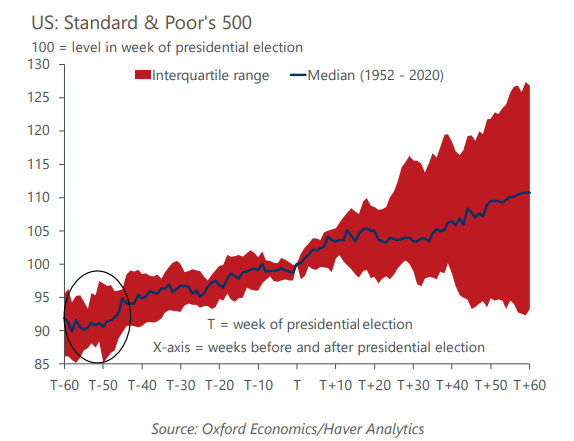

Presidential elections not only have major implications for the future path of fiscal policy and the macroeconomic outlook, but they also impact the economy during the election year itself, albeit modestly. Elections create uncertainty around fiscal policymaking – our analysis suggests the most significant, negative impact occurs in Q4 of the preceding year. This timing is consistent with our expectations based on historical movements in political betting markets.

What you will learn:

- Given recent events on Capitol Hill, we also gauged the economic impact of heightened partisan rancor during election years. We based our assessment on the Partisan Conflict Index, which captures the frequency of newspaper articles reporting political disagreement about public policy within and between national parties. Our modeling shows that increased partisan conflict is a drag on the economy over time.

- Fiscal policy often loosens during presidential election years, and history may repeat itself with the recent passage of a bipartisan tax deal in the House of Representatives. The tax bill is revenue-neutral over a 10-year budget horizon, but the stimulus it would provide to the economy is highly front-loaded. Based on simulations of the Oxford Global Economic Model, we estimate the tax deal would boost real GDP growth by roughly 0.1ppt in 2024 and in 2025.

- Our historical analysis suggests that beliefs that the election will affect monetary policy are overdone. Most of the apparent inaction of the Federal Reserve in advance of an election is driven by two cycles: in 2000, when the Fed began an easing cycle shortly after the election, and in 2016, when the Fed began its hiking cycle in December. We doubt the upcoming presidential election will be a barrier to rate cuts this time as the Fed has signaled since 2022 its intention to shift its tack this year.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More