Blog | 04 Apr 2024

Downside risks remain amid a more balanced outlook in our Q1 IFRS 9 and CECL scenarios

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

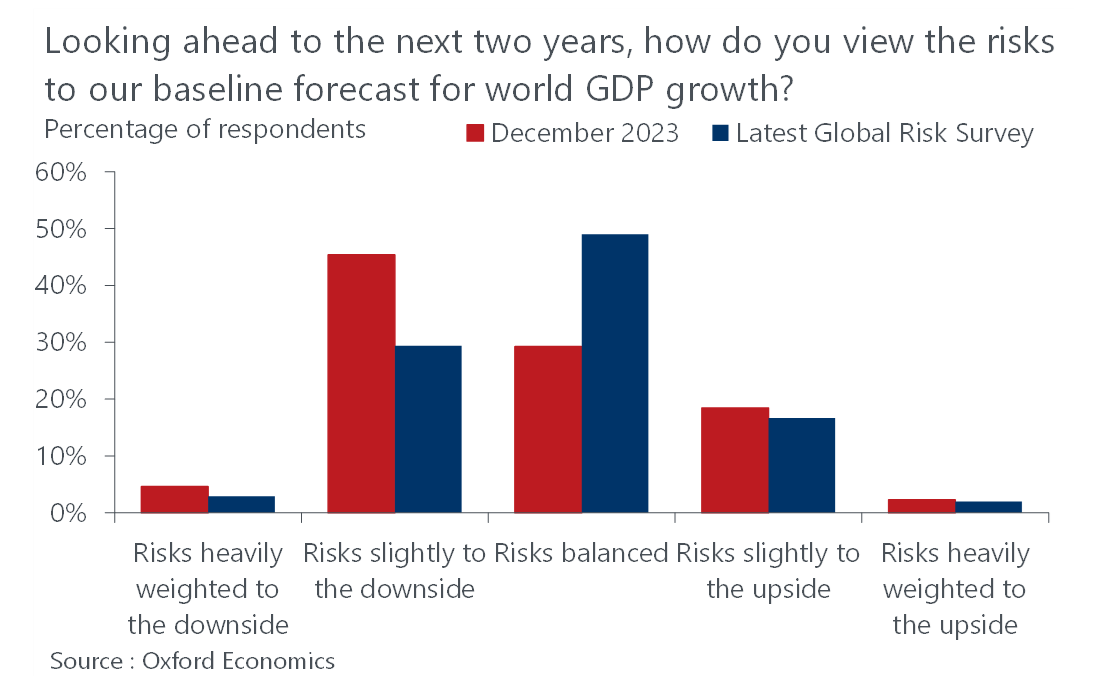

Despite the upgrade to our global economic outlook since December 2023, the Q1 update of our IFRS 9 and CECL scenarios services sees a more balanced assessment of the risks to the global economy over the next two years. More respondents to our Global Risk Survey now see risks as balanced than at any time since this question was first asked in 2017. The reduction in negativity comes as inflation has fallen significantly from its recent peak, and as monetary policy easing is on the horizon. So it is perhaps no surprise that around two-fifths of respondents view early policy rate cuts as their top upside risk over the next two years.

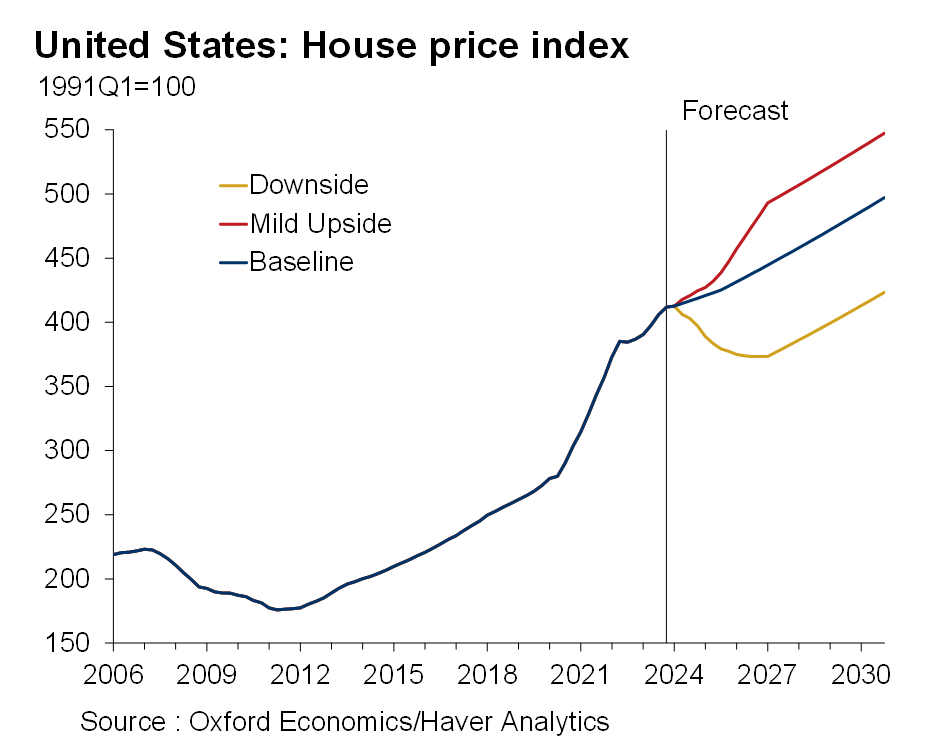

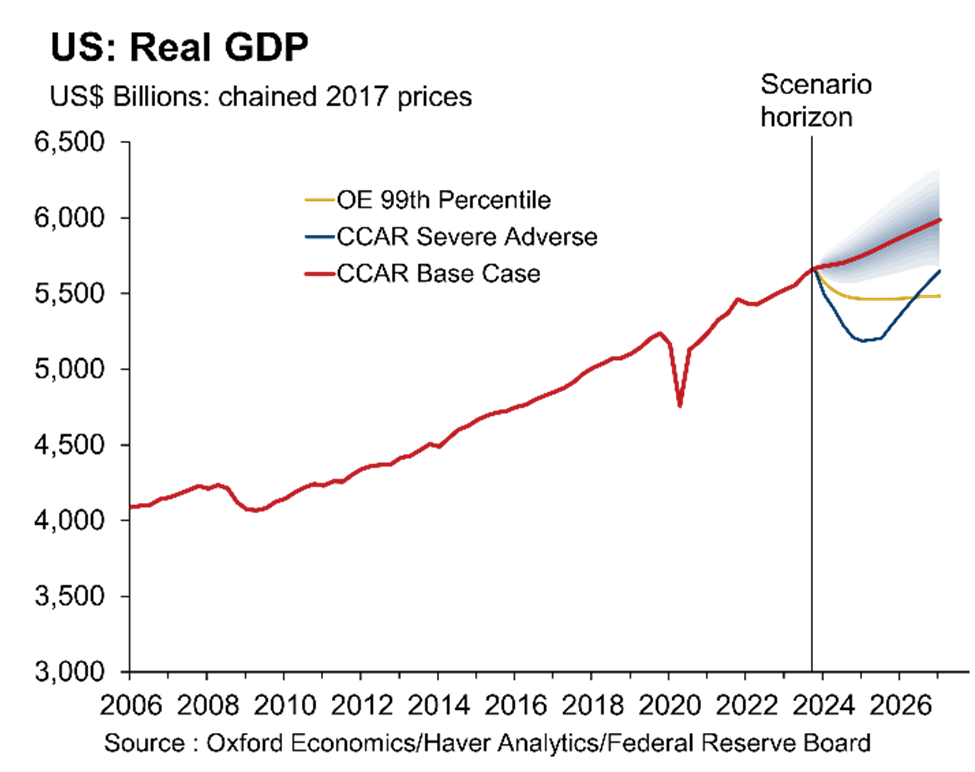

Despite this, recession risks remain and are examined in our alternative scenarios which enable our clients to calculate their expected credit losses. Our downside scenario results in a pronounced global recession in the near-term with a subdued recovery thereafter. A combination of increased risk aversion, lower real incomes, and long-term scarring weigh heavily on the global economy. By the end of the decade the global economy remains 4.7% smaller than in the base case. To counter the downturn, the Fed and other central banks start lowering rates much faster than expected in our base case. Despite the reduced pressure from currently elevated borrowing costs, the pronounced fall in asset prices still leads to a sharp tightening in financial conditions. Lower incomes and increased unemployment force sellers into property markets, with US commercial property falling over 15% below our baseline forecast and house prices down 10% from peak to trough.

However, this is by no means as severe as the Federal Reserve’s recently released Severe Adverse scenario. The scenario is characterized by a severe global recession, including prolonged declines in both residential and commercial real estate prices, which spill over into the corporate sector and affect investment sentiment. While our IFRS 9/CECL downside scenario is modelled at the 85th percentile of our forecast error distributions, the fall in US GDP seen in this scenario would be more in line with the 99th percentile a couple of years after the start of the scenario, and is far more severe in the first few quarters. This short-term severity, and the strong cyclicality of the Fed’s Severe Adverse scenario, make this scenario less suitable for calculating expected credit losses.

Our quarterly IFRS 9 and CECL products combine nearly three decades of forecast errors with our quantitative assessment of the current risks facing the global and domestic economy to produce robust forward-looking distributions for the economy. Using specific percentile points in the distributions of several key metrics such as GDP, unemployment, interest rates, house prices and equity prices we construct five alternative scenarios at a globally consistent level to help clients assess local and global risk and cover the expected lifetime of assets.

Click here if you want to learn more about our IFRS 9 service and here for our CECL service.

Author

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

+44 (0) 203 910 8138

Private: Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

Oxford, United Kingdom

Tags:

You may be interested in

Post

US Recession Monitor – Revisions reduce recession risks

Our probability of recession models showed marked improvement in September, reversing much of the recent rise. Against this backdrop, our conviction in our above-consensus GDP growth forecast for 2025 increased.

Find Out More

Post

Toss-up US elections increase downside risks again for our Q3 IFRS 9 and CECL scenarios

While our short-term outlook for the global economy has largely remained steady over the past quarter, the balance of risks around the base case has become more negative. This is evidenced by the number of clients expressing increased pessimism in their expectations around global growth in our latest Global Risk Survey.

Find Out More

Post

Infographic: Measuring risk exposure to China-Taiwan tensions

We have developed a globally consistent framework showing cross-country GDP vulnerabilities to an escalation in China-Taiwan tensions, factoring in three key channels of risks: trade exposure to Taiwan and mainland China, wider economic and industry reliance on semiconductors for producing output and price ramifications of shortages and disrupted shipping.

Find Out More