Understanding climate-related implications on investment strategies

As global awareness of climate change continues to increase, investors are beginning to consider how climate risks and opportunities may affect long-term investment strategies and returns.

Download PDF

Background

As global awareness of climate change continues to increase, investors are beginning to consider how climate risks and opportunities may affect long-term investment strategies and returns. Our client, Schroders, a large asset manager, is no exception, which is why they switched to our Global Climate Service as the economic foundation for their long-run asset class publication.

The Challenge

The primary challenge for asset managers is to produce or acquire a set of long-run forecasts that can effectively inform investment decisions. Forecasts must be sufficiently detailed to capture key drivers of climate risk and opportunity. But also flexible enough to account for a range of potential scenarios and policy channels. Crucially, forecasts need to provide a clear connection between economic outputs and asset returns, achieved within a rigorous modelling framework.

The Solution

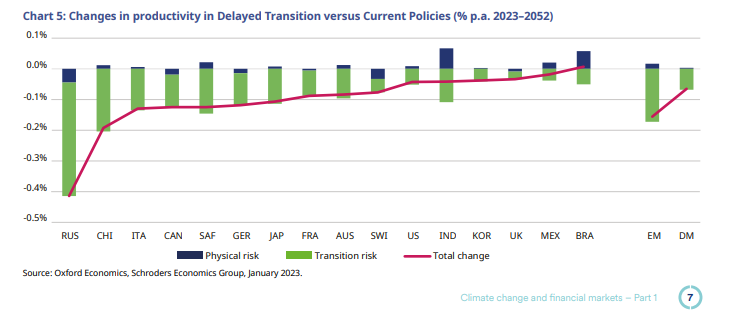

For Schroders, our Global Climate Service met this challenge. It provided the framework to assess the implications of climate-related risks and opportunities by exploring both physical risks from climate change and transition risks from climate mitigation through its modelling of various economic scenarios.

Net Zero, Net Zero Transformation and Delayed Transition scenarios:

- Explored the varying severity and timing of key mitigation policies such as carbon pricing and energy investment.

- Covered different assumptions on the nature of investment and, in particular, the role of innovation, a crucial determinant of long-run economic output and asset returns

Oxford Economics also provides physical risk scenarios (such as the Climate Catastrophe scenario), which provide estimates of the economic and financial damages from intensifying concentrations of greenhouse gases in the atmosphere and the associated physical damages from global warming.

Our rigorous modelling and detailed, clear reporting were key benefits for Schroders versus their previous provider. In addition, our matching of assumptions (such as carbon pricing) with those of key public policy organisations like the Network for Greening the Financial System (NGFS) and International Energy Agency (IEA) provide consistency with scenarios used by central banks in their climate stress testing analysis. Again, this was an important requirement for Schroders, as it is for our other financial institution clients.

Scenarios were generated using our Global Economic Model (GEM), which provides best-in-class economic forecasts through its ability to capture the diverse interactions between economies, energy systems and emissions, and the impacts of economy-wide decarbonisation. Moreover, the GEM’s direct modelling of linkages and passthrough to key assets such as bonds, equities and exchange rates provided a useful reference point for the client’s own proprietary financial modelling.

The Result

Schroders used our climate change forecasts to make a more informed investment analysis better aligned with potential climate-related risks and opportunities, providing the necessary focus on economic outputs and asset returns. This culminated in their long-run asset performance publication, which enabled them to share this value with their clients and investors by coupling it with their own more asset-specific analysis.

Climate related services

Climate Change and Sustainability Consulting

Quantifying the impact of global warming and abatement policies on your organisation and its overall environmental footprint

Find Out More

Country Climate Analysis

Assess the impact climate change will have on all facets of your business. Now and in the future.

Find Out More

Sectoral Climate Analysis

Assess the impacts of climate change and mitigation policies for more than 100 sectors

Find Out More

Global Sustainability Model

Accurately measure your organisation's global footprint through economic, environmental and social lenses, identify risks and develop strategies to become more sustainable.

Find Out More