No Liberation from Uncertainty in our IFRS 9 and CECL scenarios

The implementation of the US “Liberation Day” tariff hikes will have significant impacts on individual sectors and firms, even in their latest, scaled back, coverage. Although our initial assessment suggests a global recession will likely be avoided, assessing the implications on downside risks around the baseline forecast has become increasingly important.

Following President Trump’s announcement, there was a sharp deterioration in sentiment, with our latest global risk survey highlighting that businesses have shifted their main concern from broader geopolitical tensions to trade-related uncertainty. This uncertainty is likely to persist, as governments enter negotiations on individual reciprocal tariffs. Questions also remain around how the US might respond to retaliation and whether talks may drag on over contentious issues such as non-tariff barriers.

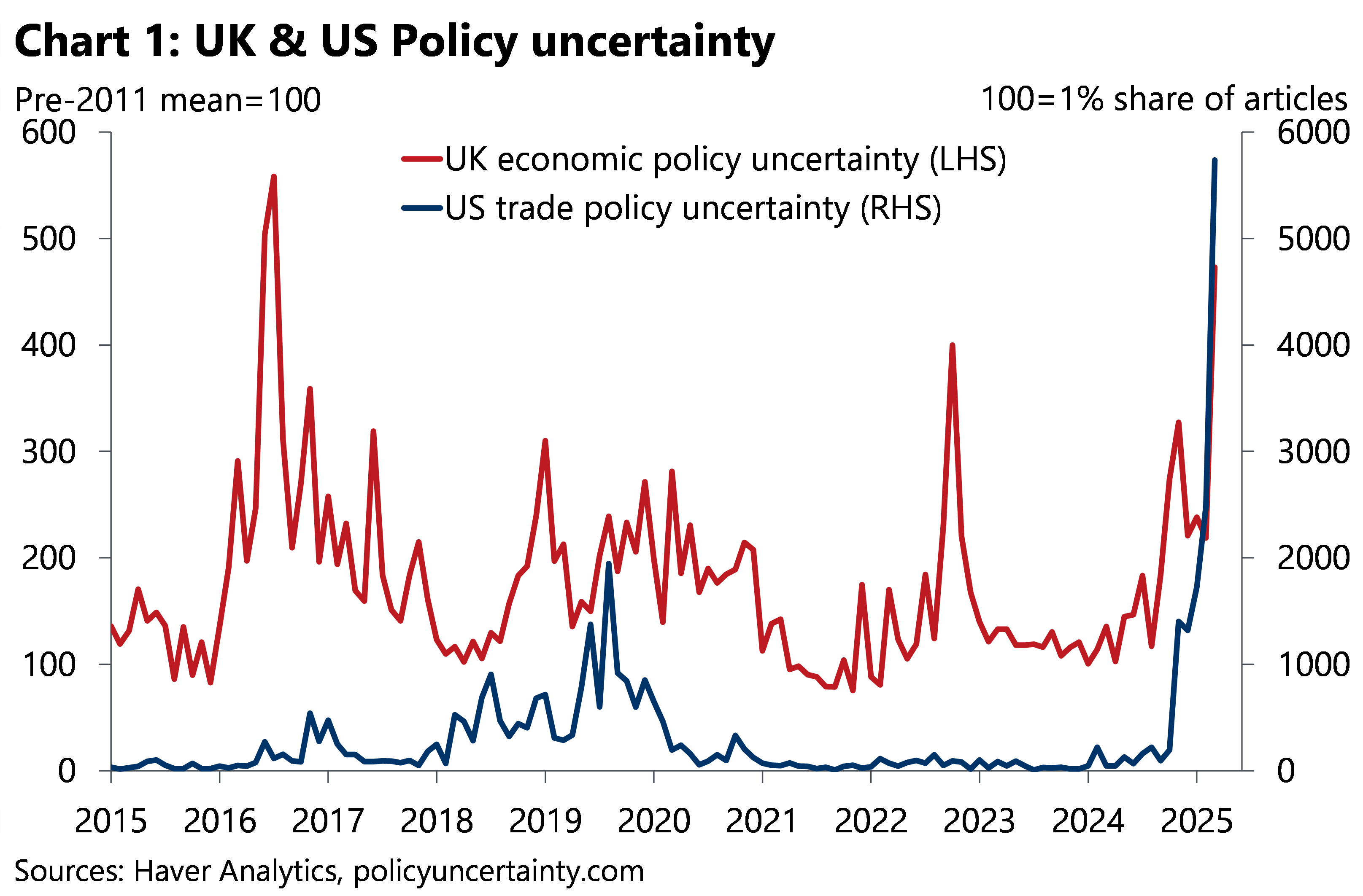

Chart 1 shows the surge in uncertainty in the lead up to the US “Liberation Day”. With trade-related uncertainty set to remain elevated, its impact on global growth prospects will be harmful, particularly for business investment.

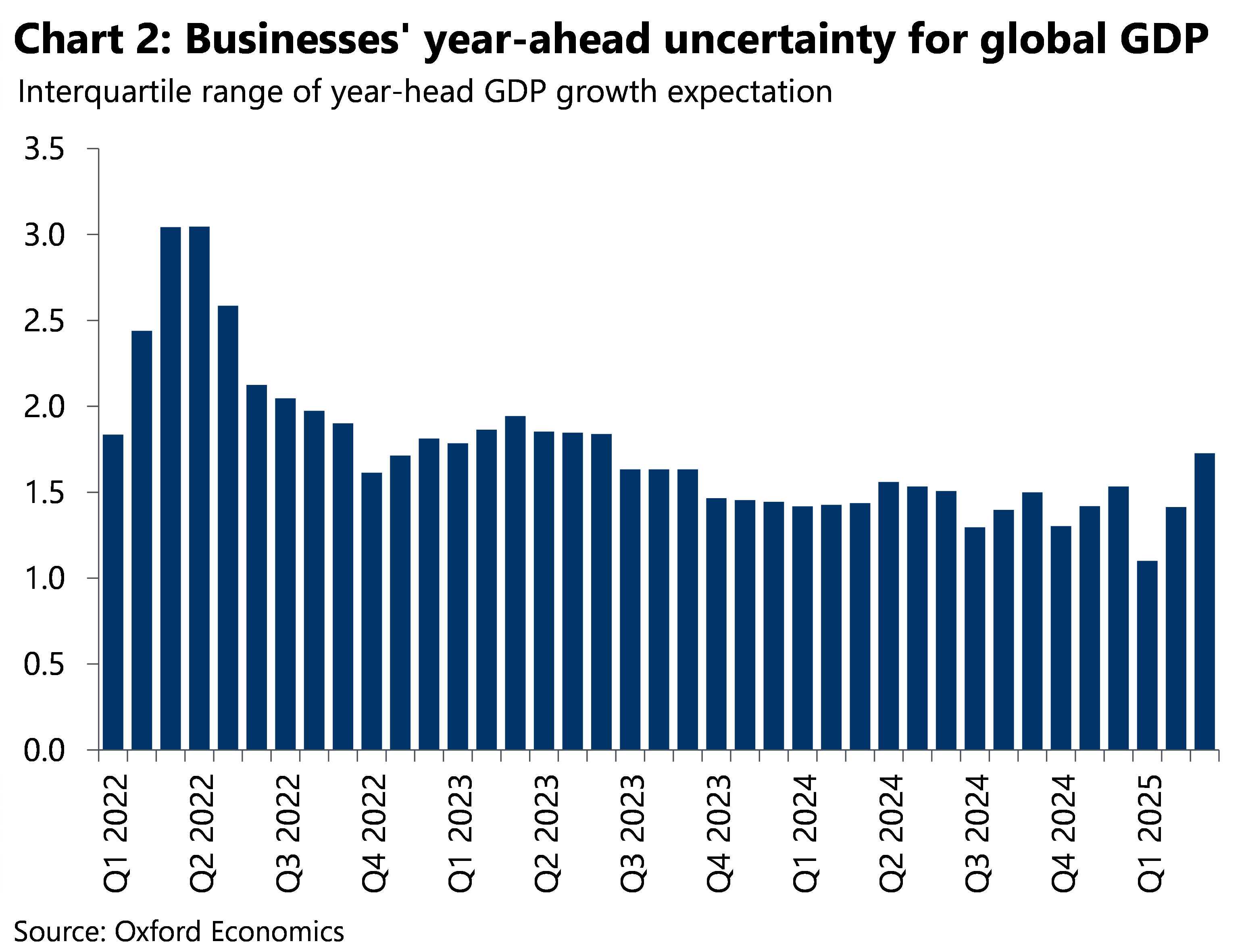

Despite escalating trade tensions, broader economic uncertainty remains relatively contained by historical standards across two key metrics we track. The first is based on our Global Business Sentiment Index, which captures the average year-ahead world GDP expectations from over 150 businesses completing our survey each month. We calculate the interquartile range of these responses to gauge how uncertain businesses are about future growth. As shown in Chart 2, intensifying trade tensions have driven a renewed uptick in uncertainty in February and March. Although levels remain within historical norms for now, recent developments suggest a further rise is likely in the months ahead.

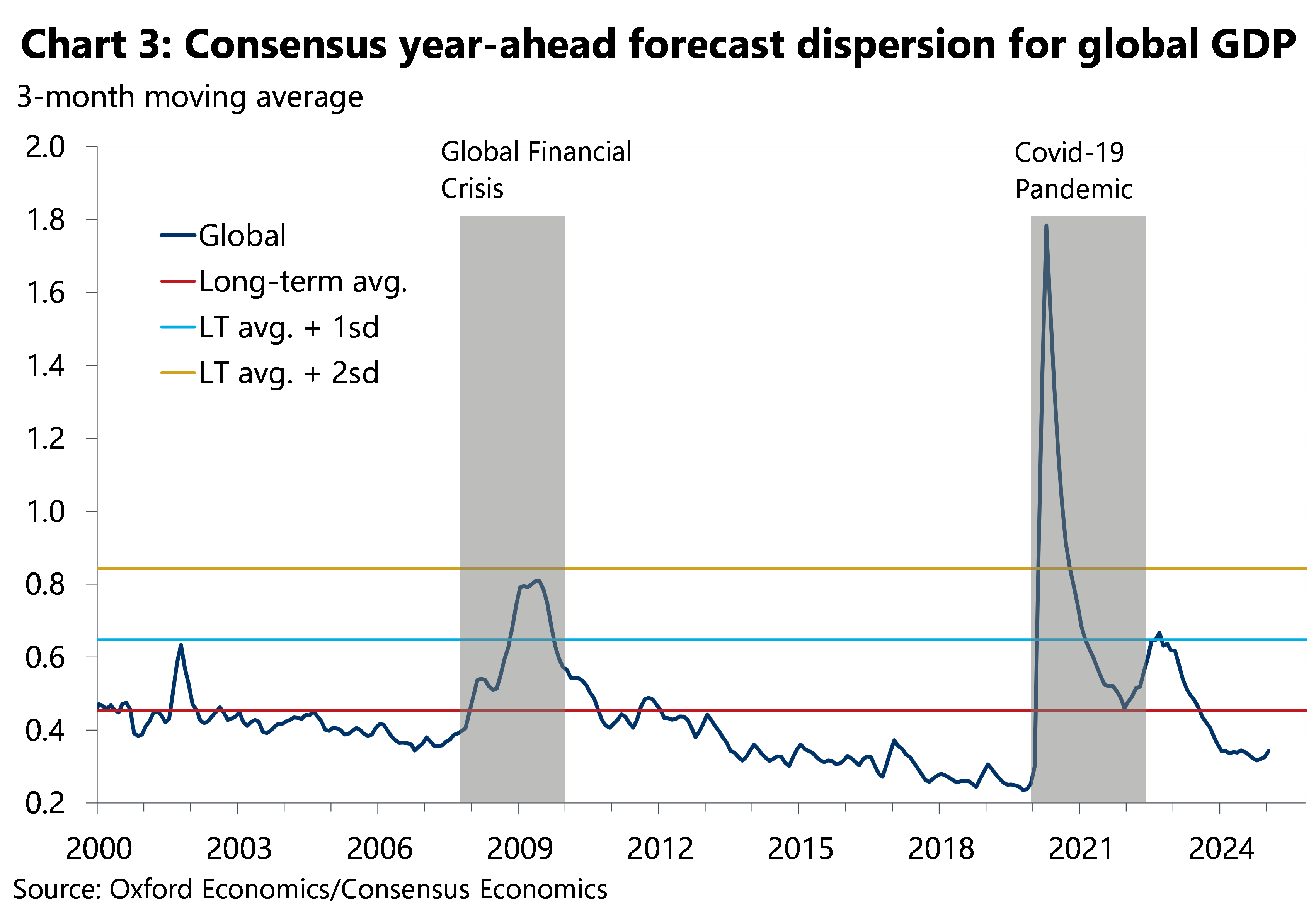

Our second metric draws on Consensus Economics’ monthly reports, which provides a measure for the dispersion of respondents’ year-ahead GDP growth forecasts. As shown in Chart 3, the forecast dispersion for implied global GDP growth ticked up in March but remained well below its long-term average. Recent US policy announcements are likely to trigger a renewed widening in forecast dispersion as economists diverge on their assumptions about the global growth outlook following the breakdown of a predictable trading system. We now expect global demand to be much weaker than our March baseline, by around 0.3ppts this year and 0.4ppts in 2026, with risk around the base case skewed to the downside.

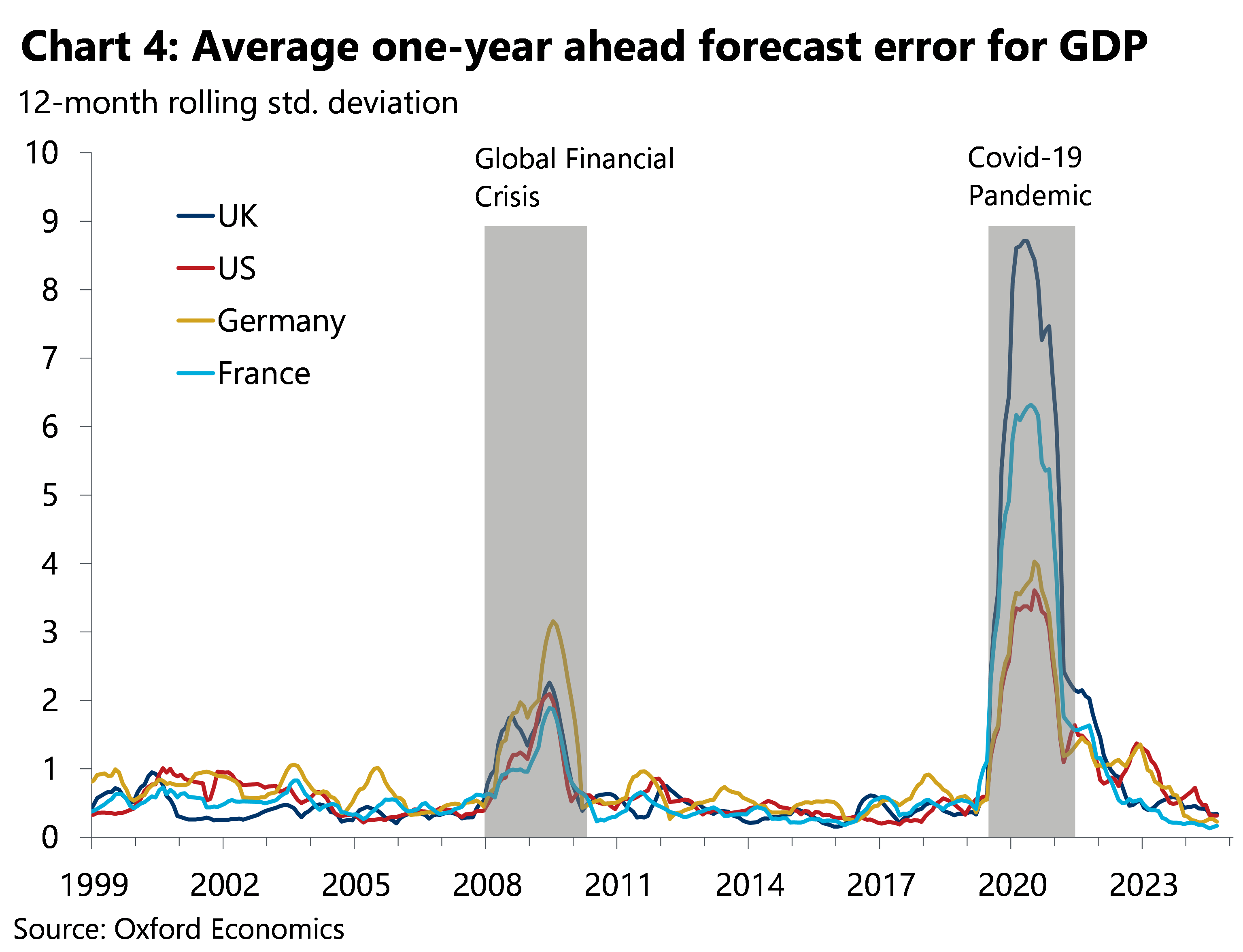

These high-frequency measures of uncertainty correlate well with our own forecast errors. Chart 4 plots the average one-year-ahead forecast error for GDP growth across key economies, highlighting that forecast errors typically increase during periods of elevated forecast dispersion (e.g., during the Global Financial Crisis and the Covid-19 pandemic), resulting in higher standard deviations. This pattern reinforces the idea that shifts in the distribution of expectations are informative at times when economic conditions are shifting markedly.

Combined, these measures therefore provide useful benchmarks to assess the wider ramifications from trade disruption, volatility in prices, and a new policy mix over the coming years. Should economic uncertainty exceed historical thresholds again we would be able to reflect that in our IFRS 9 and CECL scenarios by incorporating a heightened near-term dispersion in the scenarios. This is similar to the approach taken during the Covid-19 pandemic when we incorporated an overlay into our forecast-error distributions to capture the extreme macroeconomic uncertainty. As a result, our methodology remains well-suited during times of volatility, which allows us to help clients appropriately reflect risks in their expected credit loss (ECL) calculations.

Click here if you want to learn more about our IFRS 9 service and here for our CECL service.

Upcoming Webinars

マクロ経済から見る産業へのトランプ関税インパクト

今次セミナーでは、トランプ関税が経済に及ぼす影響について、マクロ経済学を用いた産業分析の観点から紐解いていきます。急速に変化する経済・政策環境の中では、目先の動きにとらわれるのではなく、経済構造に基づいた分析を通じて大局的な視点を持ちリスク管理を行うことが重要となります。マクロ経済調査会社である弊社の強みを活かしたトップダウンで一貫性のある分析手法により、ボトムアップ型の分析では捉えきれない要因まで包括的にカバーすることが可能になります。関税からくる直接的な影響だけではなく、複雑に絡み合う国際的なサプライチェーンを通じた間接的なインパクトを含め、様々な産業の中から脆弱性の高い産業からそうでない産業まで、波及経路も含めて仔細に説明します。

Find Out More

LatAm shows resilience to U.S. Tariffs

Economic growth across most of the region has been mostly undisturbed by the start of US tariffs. Resilient domestic demand and high commodity prices suggest economic stability will continue in most countries, except in Mexico, where the impact of trade uncertainty and fiscal consolidation have temporarily stalled the economy. Inflation shows relatively different dynamics due to domestic idiosyncrasies, but most countries are exposed to the same international shocks, which could justify greater caution in the monetary normalization process by central banks.

Find Out More

Could shifting US economic fissures turn into fault lines

The economy is being tested by higher tariffs, enormous policy uncertainty, geopolitical tensions and high interest rates. There are some fissures in the labor market, but layoffs remain low and nominal wage growth continues to outpace inflation. Consumers spending remains bifurcated as is the landscape for businesses. In this webinar we will discuss our latest economic outlook and how tariffs, immigration, fiscal policy and geopolitical events are expected impact growth, inflation, unemployment, interest rates and how these factors could steer the economy off course.

Find Out More

Through the TradePrism: Making Sense of Global Trade Disruptions

Powered by insights from our TradePrism forecasting platform, this webinar will explore recent developments, changes to the near- and long-term trade outlook and how businesses can navigate the increasingly fragmented world.

Find Out MoreTags: