Research Briefing

04 Dec 2025

UK: Key themes 2026 – Sluggish growth and fiscal worries

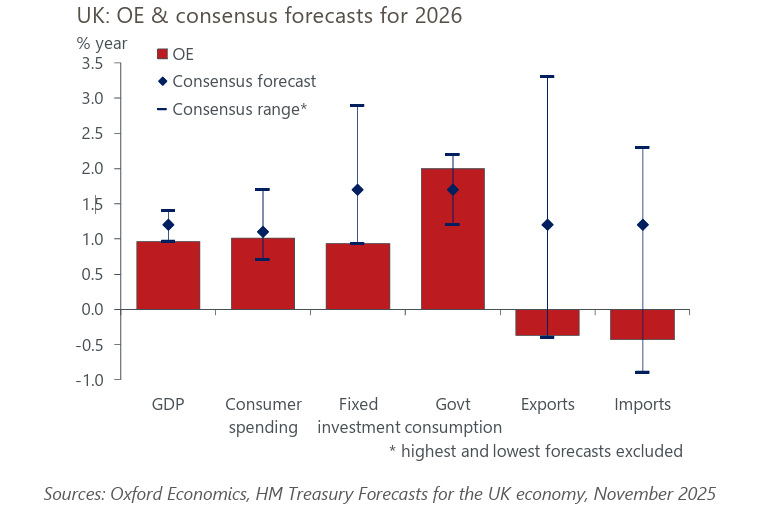

We think 2026 will be another challenging year for the UK economy – our GDP growth forecast of 1% is at the bottom of the consensus. Four themes will be key to the outlook, in our view.

Fiscal and political risks will remain elevated. We expect markets will increasingly question the fiscal credibility of the Budget and the survival of the Labour leadership. A slow burn of a steepening yield curve and weaker sterling could morph into a more serious confidence crisis.

- The UK lacks a sustainable growth driver. Government spending has played an outsized role in GDP growth in recent years and will do so again in 2026. Prospects for the private sector remain poor. Consumers face a sharp slowdown in real income growth in 2026, while a combination of weak profitability and low confidence will restrain business investment.

- Weak growth and sticky inflation will continue to divide the Monetary Policy Committee. Inflation should cool next year due to lower contributions from food and energy, plus slowing services inflation. But it will likely remain well above target. Alongside weak growth, this will stop the MPC from shifting decisively in one direction or the other. On balance, we expect Bank Rate to be cut to 3.25% by the end of 2026.

- Another year of pain for the labour market. Strong public sector job creation has mitigated the impact of falling private sector headcount, but the boost from the public sector will likely start to fade. Given weak private sector demand, we expect the jobless rate will rise further.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]