Saudi Arabia’s PIF: Driving diversification through strategic investments

Saudi Aramco’s 20-year, $11bn lease deal with Global Infrastructure Partner (GIP), a firm under BlackRock’s umbrella, for Jafurah Field Gas Plant underscores the growing international confidence in Saudi Arabia’s ongoing economic transformation. The agreement provides Aramco with upfront cash for further investment, while it retains control of production and revenues. In return, GIP receives a steady cash flow from Aramco’s fee payments each year.

The deal is symptomatic of the developments funded by Saudi Arabia’s Public Investment Fund (PIF), as part of the Vision 2030 programme’s aim to attract foreign capital to the Kingdom. The pressure on oil prices has weighed on investment activity recently and limited the fiscal space available for capital expenditure. However, foreign investment remains crucial to diversifying Saudi Arabia’s economy and improving the stability of its revenues. The recent reaffirmation of the Kingdom’s A+ credit rating by Fitch underscores the progress towards the Vision 2030 goals, which will help enhance the country’s attractiveness to investors.

Unlock exclusive economic and business insights—sign up for our newsletter today

SubscribePIF’s annual report showcases the sheer scale of the fund’s diversification drive

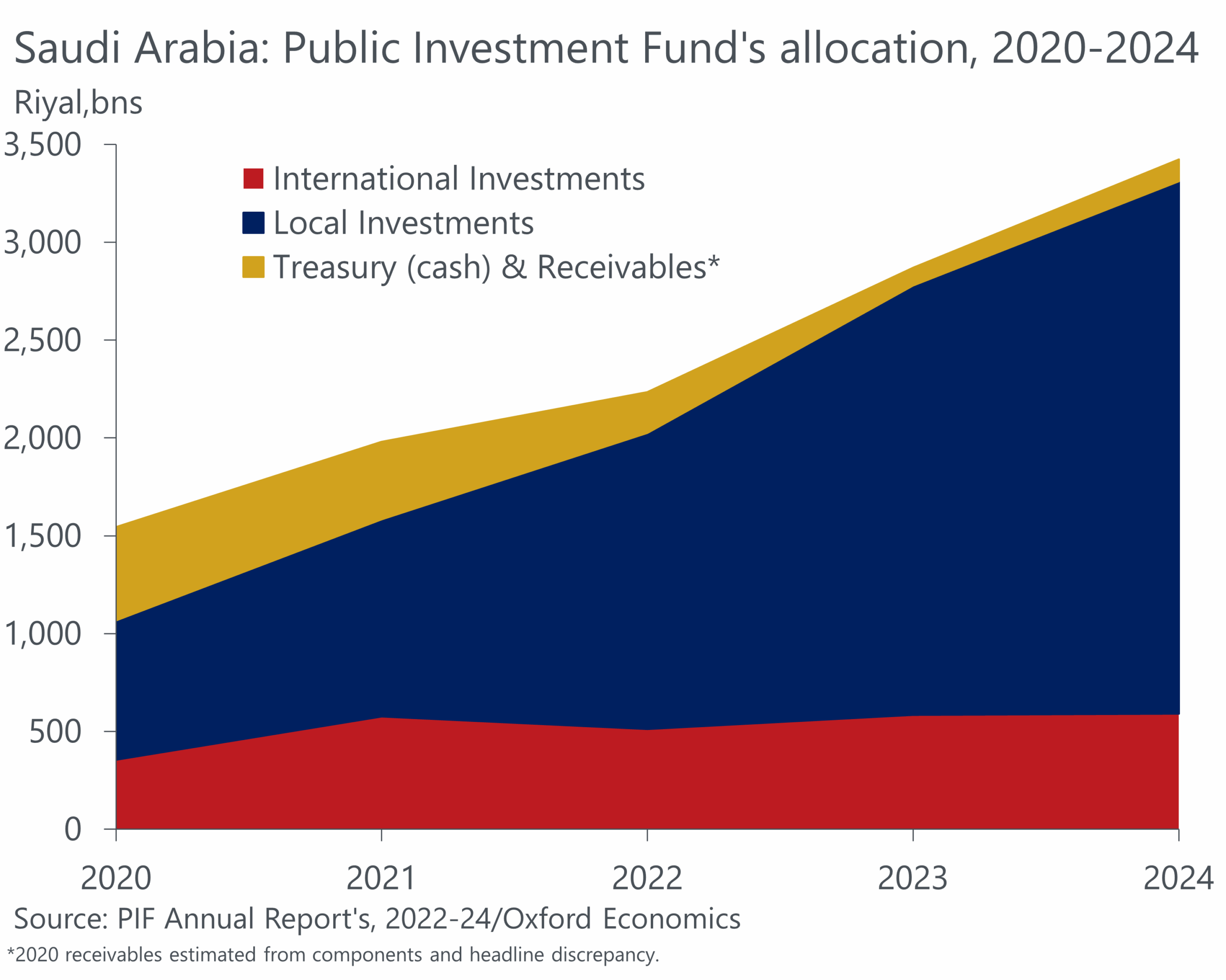

PIF’s recent annual report shows where the Kingdom’s wealth fund, one of the world’s largest, is allocating nearly one trillion dollars of capital in pursuit of this diversification. There were two key pieces of information in its 2024 report: first, PIF increased its stake in Saudi Aramco; second, the fund’s giga-project holdings were written down by $8bn, which could be for several reasons, such as cost overruns, delays, or revised estimates of future returns. Together, these developments could be taken to reflect a shift away from diversification efforts, but we disagree.

PIF’s decision to take an increased stake in Saudi Aramco was the result of share transfers from the company itself, rather than a cash injection from PIF, and doesn’t reflect a deliberate move away from investment in non-oil sectors. The transfer increases PIF’s claim on Aramco dividends, providing it with an increased cash flow that it can reinvest into diversification efforts. Additionally, although PIF has recorded an impairment against its giga-projects, its annual report shows it isn’t retreating from funding diversification efforts across the economy. Instead, the fund is rapidly increasing the scale of its local investments, particularly in sectors with the potential to further the Vision 2030 goal of diversification.

The fund has continuously increased its portfolio’s share of domestic investments

This is exemplified by PIF’s Saudi Sector Development (SSD), a dedicated collection of capital within PIF focused on investing in economic diversification and industrial advancement. From 2020 to 2024, the growth of this investment pool outstripped PIF’s total portfolio growth, rising from 4% of the portfolio to 30%. In riyal terms, this means each year billions were invested in the non-oil industries that have the most potential to attract foreign capital, creating jobs for Saudis, and increasing the Kingdom’s overall competitiveness.

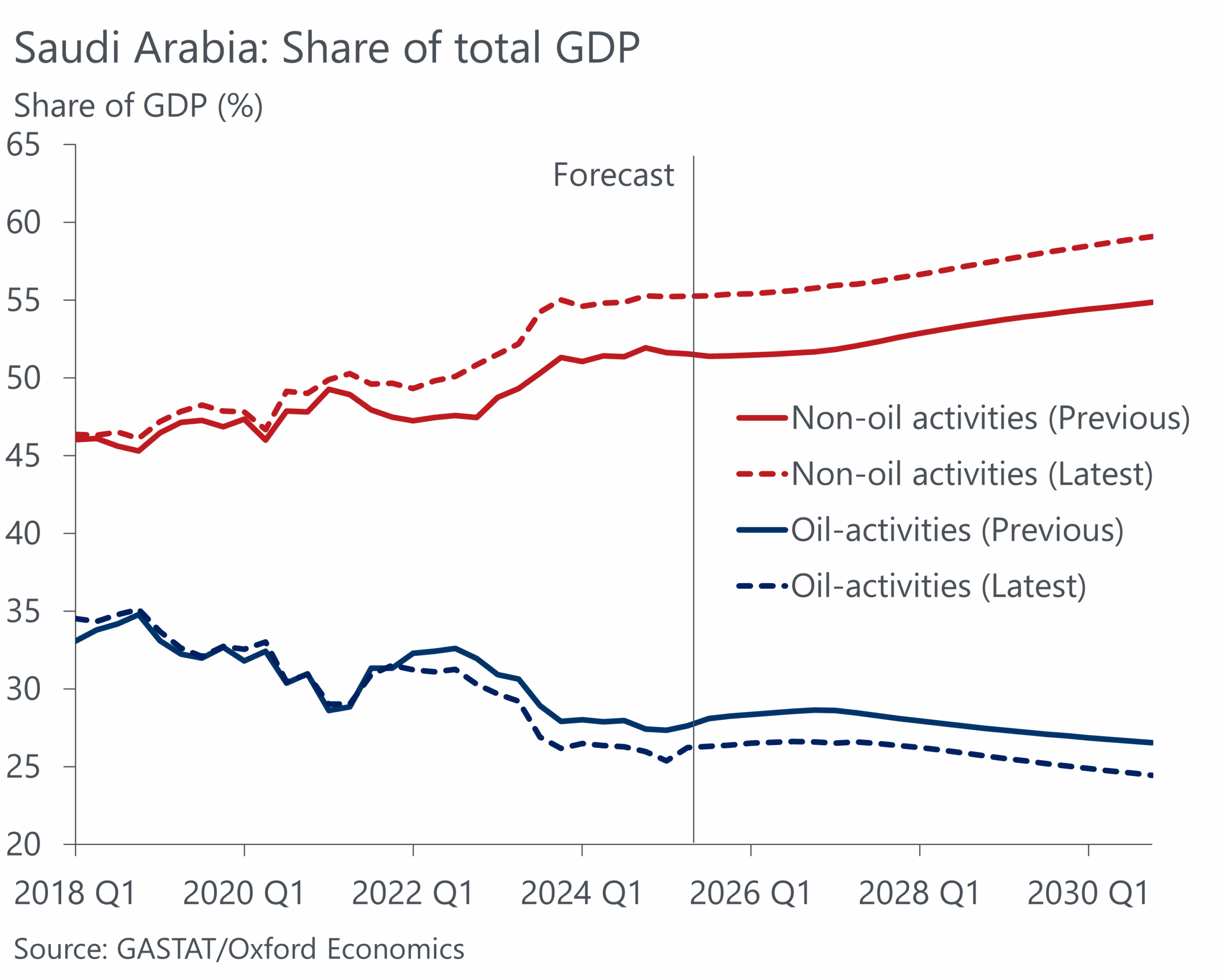

We expect non-oil activities will be 59% of the economy by the Vision 2030 deadline

Together with the nuances of PIF’s increased stake in Aramco, the fund’s annual report shows that, far from shifting away from diversification efforts, the Kingdom is increasing its investment in non-oil sectoral development. We expect non-oil activities to continue to outpace headline GDP, increasing to 59% of the economy by 2030, supported by PIF’s investments. This is higher than our forecast a couple of months ago, albeit primarily due to revisions by the Saudi Arabian General Authority for Statistics, which we discussed in a recent research briefing.

Speak to us

If you would like to find out more about our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

Related content

Trump talks business on GCC tour, with a sprinkle of diplomacy

The Gulf Cooperation Council (GCC) region concluded an eventful week as Saudi Arabia, Qatar, and the UAE hosted President Trump on his first major foreign trip since re-assuming office, underscoring an enduring strategic partnership.

Find Out More

MENA Forecasting Service

Monitor the implications of economic and market developments in the MENA region.

Find Out More

African and Middle Eastern Cities Forecasts

Comprehensive data and forecasts for major cities in Africa and the Middle East.

Find Out More

Middle East tensions could severely hurt the economy in Japan

Our scenario analysis reveals a partial shutdown of the Strait of Hormuz by Iran would push the Japanese economy into a near-stagflation situation in H2 2025, given Japan's structural vulnerability to terms of trade shocks.

Find Out MoreTags: