Research Briefing

04 Dec 2025

Nordics: Key themes 2026 – Bright spots emerging

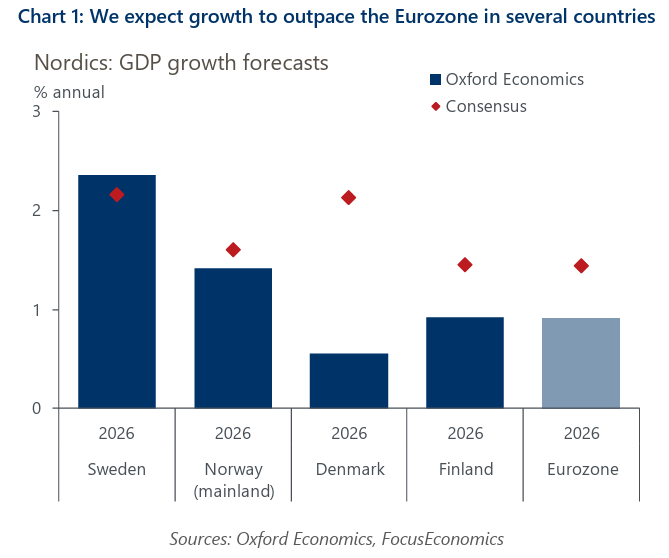

We forecast growth across the Nordic economies to diverge somewhat next year but share the same underlying drivers. Domestic demand-led upturns are being propelled by strong policy support, real income gains, and improving labour markets. The following themes will be key in shaping the outlook, in our view.

- Growth composition will shift to domestic demand. Improving labour markets, positive real income growth, and lower interest rates will boost consumption and investment, offsetting weaker external demand due to new US trade barriers and greater competition from China.

- Strong fiscal policy support. Sweden and Denmark plan large fiscal stimulus next year, mostly consisting of tax cuts. Loose fiscal policy is a key driver for Sweden’s growth outperformance. The fiscal impulse will decline in Norway but remain positive, while ongoing consolidation in Finland will weigh on growth.

- Another year of sub-2% inflation. The tax changes in Sweden and Denmark will have a material impact on headline inflation, dragging it below 2%. Headline inflation will also remain subdued in Finland amid weak demand. It will be stubbornly high but declining in Norway.

- Central banks in wait-and-see mode. The European Central Bank, Riksbank, and Norges Bank have policy options in both directions. We think the Riksbank will stay on hold until late 2026 and Norges Bank will only cut once given a much stickier inflation outlook. But past rate cuts will still be transmitted to the economy next year, reinforcing fiscal policy loosening and boosting domestic demand.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]