Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank’s forecasts in its quarterly outlook. However, there’s a material chance of a delay.

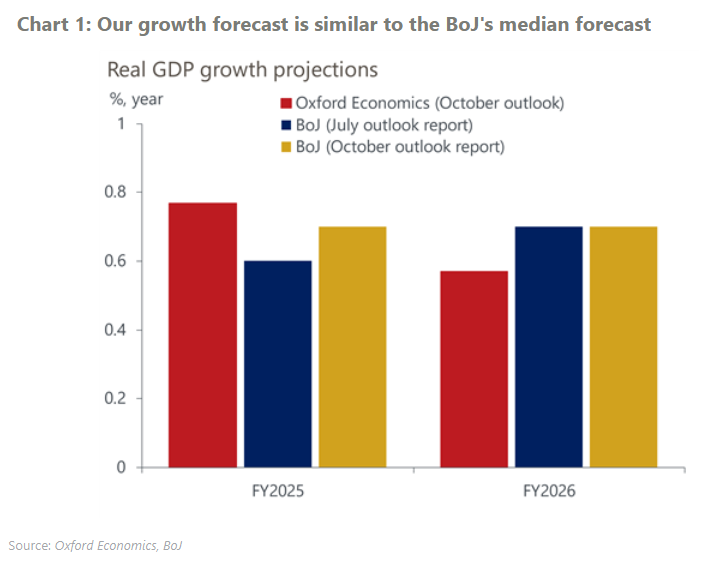

The BoJ largely maintained its growth projection for FY2025 and FY2026. Governor Kazuo Ueda noted an increased likelihood of achieving their outlook. He also highlighted the necessity for more data to assess downside risks from the US economy, US tariffs’ impact on corporate profits, and upcoming wage negotiations.

The BoJ’s price outlook is little changed as well, projecting core-core inflation will stabilise at around 2% in FY2026 as supply-driven food inflation gradually fades. Ueda downplayed the risk of the BoJ falling behind on rate hikes, stating that he doesn’t attach a high probability to a risk scenario of stubbornly high food prices pushing up inflation expectations.

But there’s a material risk of the BoJ delaying the next rate hike to January or later, depending on economic data and also if new Prime Minister Sanae Takaichi sticks to her cautious stance on monetary policy normalisation. That said, we believe that she has no choice but to accept some rate hikes to avoid market pressures, especially excessive yen weakening.