Japan’s fiscal policy will remain loose, which increases risks to debt sustainabilit

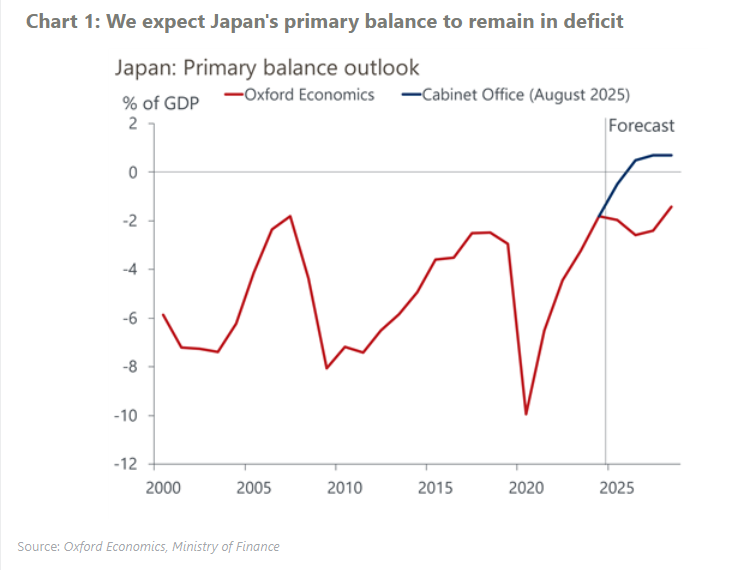

We’ve changed our fiscal outlook for Japan in our December forecast round. We now expect the new government to set a primary deficit close to that of 2024, at 2%-3% of GDP for 2025-2027, instead of restoring a balanced budget by taking advantage of strong tax revenue. We assume higher bond yields will force the government to take measures to reduce the deficit from 2028.

The government recently submitted a supplementary budget plan to parliament for approval. Despite the plan’s unusually large size, the primary deficit for fiscal year 2025 will stay at 2% of GDP, almost the same as last year, thanks to strong tax revenue driven by inflation. The budget’s impact on growth will likely be limited, constrained by the economy’s supply capacity and households’ cautious consumption attitudes.

We expect the government to reduce the deficit from 2028 after loose fiscal policy in 2026 and 2027, forced to do so by higher bond yields. We now expect the 10-year government bond yield to gradually rise to 2.1% at end-2026 and 2.3% at end-2027, instead of our previous assumption of around 1.8% in both years.

Concerns about fiscal sustainability will likely limit the yen’s gains in the coming years, despite our expectation of a tighter US-Japan yield gap. The yen could even depreciate if fiscal concerns and the perception of a too-dovish BoJ prevail over the yield gap’s impact. A combination of skyrocketing bond yields and a sharp fall in the yen would unleash severe financial disruption.