Research Briefing

25 Nov 2025

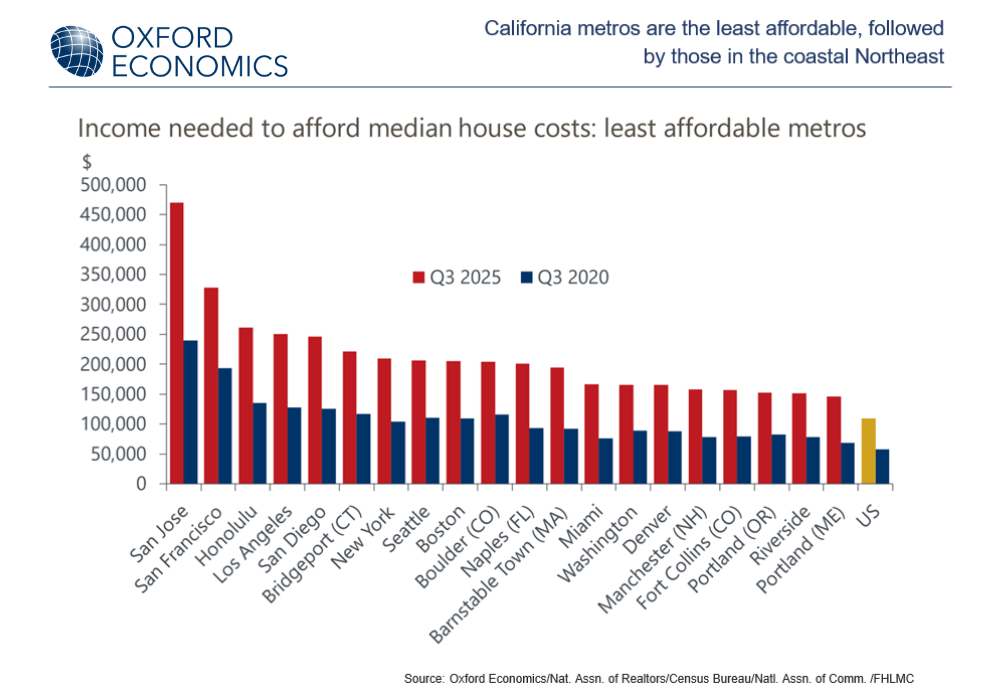

Housing affordability remains strained across US metros

While housing affordability improved marginally over the last few quarters in most metros, it remained considerably worse than five years ago.

A household needed to earn an annual income of $110,100 to afford a single-family home and pay both property taxes and home insurance costs in Q3 2025, down 2.3% from the peak Q1 2025 ($112,700) but nearly twice that of Q3 2020.

- The least affordable metros were San Jose, San Francisco, Honolulu, Los Angeles, and San Diego, where a maximum of 17% of households earned enough income to afford their respective housing costs in Q3 2025.

- Metros that saw the biggest drop in affordability include Port St. Lucie and Ocala (FL), Kansas City, and Fond du Lac and Green Bay (WI).

- Of the 50 major metros, the more affordable ones were generally located in the Midwest and Sun Belt—led by Pittsburgh, Cleveland, Oklahoma City, Louisville, and Memphis—where nearly half the households could afford the median housing costs.

- Elevated mortgage rates continue to cripple affordability more than other factors, especially since interest costs crowd out principal in mortgage payments in early years.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]