Infographic

25 Sep 2025

2026 US real estate supply outlook

While we expect a slowdown in inventory growth for most metros over the next five years, not all markets will be affected equally.

Our new infographic explores how inventory growth trends are playing out across industrial, office, retail and residential sectors in 42 US markets. While we expect a slowdown in inventory growth for most metros over the next five years, not all markets will be affected equally.

Download this infographic to learn:

- How supply shifts are influencing industrial, office, retail and residential property fundamentals?

- Which metros are experiencing the strongest inventory growth?

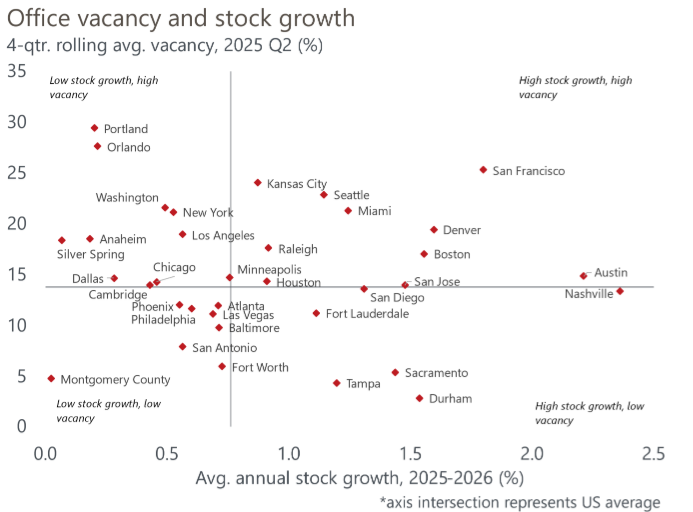

- Amid headwinds such as remote work, AI and excess supply, which metros’ office markets are best positioned?

- Will industrial supply growth continue, and in which markets?

- How will elevated multifamily supply affect the market, and which metros are under the greatest pressure?

- Are there signs of recovery in retail supply?

Register for our upcoming webinar on 15 Oct:

Navigating Disruption to Uncover Opportunity: CRE Outlook Varies by US Metro

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]