Mapping tariff risks and supply chain vulnerabilities across Asia

Helping a global energy technology company navigate supply chain and demand risks in Asia through scenario-based analysis

Heightened trade tensions and policy uncertainty have clouded the outlook for global economic growth and supply chain stability. Faced with some of the highest US tariffs and serving as a critical link in global production networks, Asia sits at the frontline of these trade disruptions.

A leading global energy technology company (hereafter referred to as the Client), with footprints and exposure across Asia, sought to understand how tariff shocks might influence its priority markets. The goal was to inform strategic planning by assessing where demand would be most vulnerable to tariff shocks, and where critical inputs could face disruption or cost volatility.

Details

Find out how we can help you

Connect with us todayThe Challenge

With trade tensions escalating and becoming increasingly unpredictable, multinational companies are finding it harder to plan with confidence.

Our Client, a leading global energy technology company, operates across multiple business lines, manages complex supply chains and serves a diverse customer base. Its Singapore-based strategy team, responsible for Asia-wide strategy and stakeholder engagement, needed to evaluate how tariff shocks could transmit through the macroeconomy, sector demand and complex procurement networks across their priority markets.

Our Client’s strategy team required a consistent and robust framework that allowed them to benchmark performance across countries and sectors and identify vulnerabilities and resilience points. They also needed clear, data-backed insights to guide strategic decisions and support effective communication with stakeholders.

The Solution

To address these needs, we delivered a suite of forward-looking, model-based trade war scenarios to 2030. We assessed impacts on GDP, trade, exchange rates and sector output under baseline, best- and worst-case scenarios.

To tailor the analysis to the Client’s operations, we integrated their internal sales and procurement data with Oxford Economics’ forecasts and developed two custom tools:

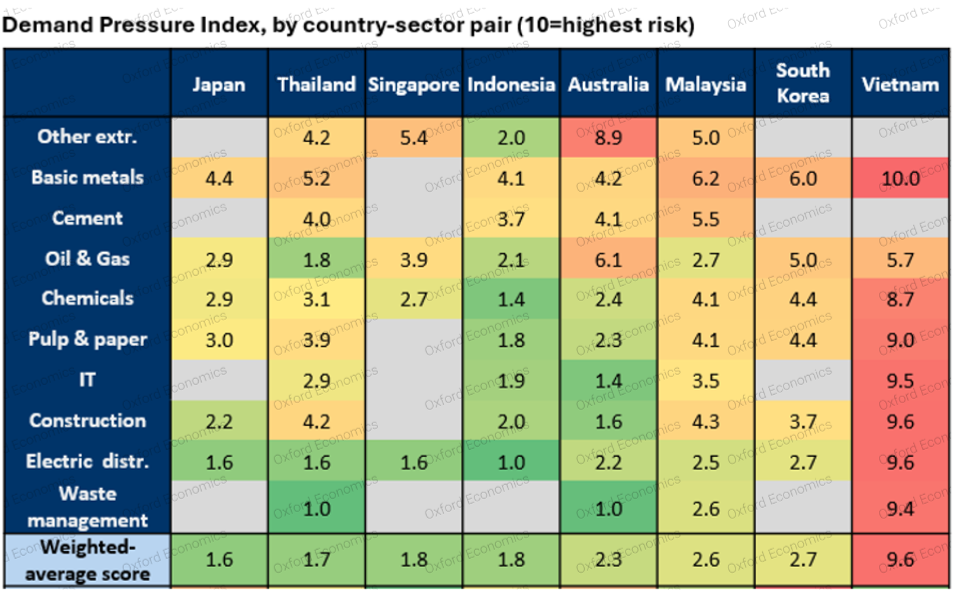

- Demand Pressure Index: Highlighted where end-market demand would be most sensitive to tariff shocks.

- Supply Pressure Index: Pinpointed inputs most vulnerable to disruption or cost volatility.

By combining macro, sectoral and supply chain perspectives in one framework, we provided the Client with a holistic and intuitive evidence base for decision-making.

Built on Oxford Economics’ Global Economic and Global Industry Model, the scenario forecasts provided robust and comparable insights across markets and sectors. Our consulting team then leveraged deep expertise in Asia’s trade and market dynamics to turn complex modelling outputs into practical, actionable guidance for the business.

The Result

The analysis revealed where tariff shocks would have the greatest impact by country, sector, and input, as well as where underlying resilience existed. These insights enabled the company to stress-test its Asia strategy against multiple potential trade war scenarios, prioritise risk mitigation efforts in the most vulnerable areas and engage stakeholders with clear, data-driven evidence to support strategic decisions.

The Oxford Economics difference

The robustness of the study stemmed from Oxford Economics’ unique strengths:

- Comprehensive coverage of countries and sectors to provide an encompassing and comparable analysis across client’s interested markets,

- Model-based scenarios that enable robust analysis despite ever-changing tariff announcements,

- Deep expertise in trade and supply chain analysis to translate findings into actionable implications.

Contact us to explore how we can help you

Related resources

Bespoke Forecasting and Scenarios

Global Economic Model

Global Industry Model