Economics for Asset Managers

Actionable, timely intelligence to sharpen your investment decisions.

Request a free trial

Latest Reports

Explore our latest reports to navigate the complexities of today’s economic landscape and gain a thorough understanding of how the macrocycle influences investment returns.

US Key Themes 2026: Exceptionalism amid fragmentation

US exceptionalism is alive and well, and that won’t change in 2026.

Read more: US Key Themes 2026: Exceptionalism amid fragmentation

US Bifurcated ꟷ Economic backdrop deepens racial disparities

Black and Hispanic households have experienced more inflation than other groups since the reopening of the economy from the pandemic lockdowns. Although there’ve been many phases of high inflation, some have disproportionately hurt these minority groups, such as the jump in energy prices following Russia’s invasion of Ukraine, with the ensuing surge in rental inflation further setting them back.

Read more: US Bifurcated ꟷ Economic backdrop deepens racial disparities

US economic outlook 2026: Four key calls for the year

US exceptionalism will continue in 2026—but so will the vulnerabilities beneath the surface.

Read more: US economic outlook 2026: Four key calls for the year

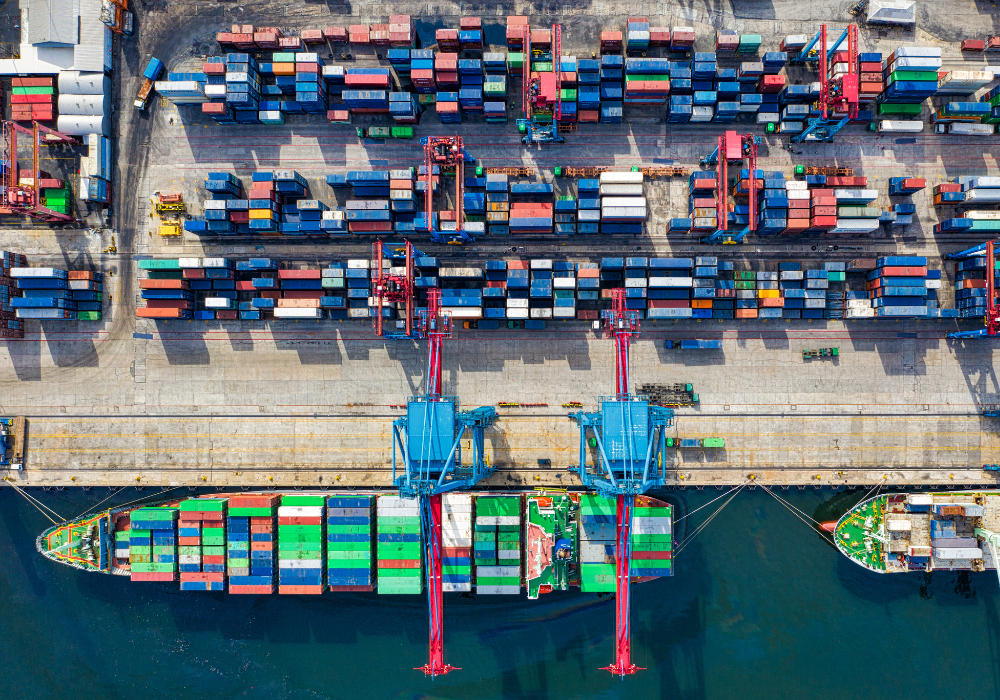

US Shipping freight rates on track to stay low in 2026

Our supply chain stress index moderated in September as import volumes continue to decline following front loading activity earlier this year. High frequency data shows that this trend has kept up in Q4, meaning port congestion is unlikely to become a concern.

Read more: US Shipping freight rates on track to stay low in 2026

Housing affordability remains strained across US metros

A household needed to earn an annual income of $110,100 to afford a single-family home and pay both property taxes and home insurance costs in Q3 2025, down 2.3% from the peak Q1 2025 ($112,700) but nearly twice that of Q3 2020.

Read more: Housing affordability remains strained across US metros

US Tariff Monitor – Going bananas over food prices

The US macroeconomic implications are minor, and the resulting reduction in inflation next year is no more than just a handful of basis points.

Read more: US Tariff Monitor – Going bananas over food pricesRead more →

Why Oxford Economics

Changing geopolitical, economic, and business conditions require a new approach to investment and asset management. Investment professionals need a new perspective on key challenges in order to capitalize on emerging opportunities. Oxford Economics offers independent, economics-based solutions that help you cut through the noise and get the necessary insights to outperform today’s market.

Track record

For over 40 years, our forecast model and award-winning team have withstood the test of time. We have helped clients worldwide define macro regimes, validate and inspire investment ideas.

Rigorous modelling

Underpinned by our Global Economic Model, we focus on delivering insights through a robust and analytical approach, going beyond opinions to help our clients achieve desirable results.

Global perspective and local expertise

With a team of over 350 economists and analysts spread across the globe, we possess a unique advantage in understanding local economies and market dynamics from a global perspective.

Unbiased forecasts

Our forecasts and analysis are truly independent, backed by data and our own modelling. Our operational independence ensures we can provide the best analysis without institutional bias.

Contact us

If you would like to find out more about our solutions for asset management, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Understand and Anticipate Interest Rate Changes with Trusted Oxford Economics Research

Over the past 12 months, the pace of disinflation has proceeded in line with our forecast and the outlook for monetary policy and yields has played out broadly in line with our expectations.

Trusted By