Blog | 08 Mar 2024

Understand and Anticipate Interest Rate Changes with Trusted Oxford Economics Research

– Request a Free Trial

In mid-2023, markets began pricing in a series of US interest rate cuts, which some investors expected to begin as early as March 2024. These views depended largely on a faster deceleration of inflation than we forecast. With the pace of disinflation proving more gradual, fixed income markets have moved to reprice the rate outlook – causing some trepidation among investors.

Not everyone is surprised by this outcome, however. With a team of award-winning economists and proprietary forecasting models, Oxford Economics has been analysing and writing extensively about these market trends as well as their broader implications for asset allocation. Over the past 12 months, the pace of disinflation has proceeded in line with our forecast and the outlook for monetary policy and yields has played out broadly in line with our expectations.

Here we summarise some of these best-in-class research reports, which offered investors and asset managers detailed insights to support data-driven decision-making throughout the year.

Mid-2023 research identified the risk of higher rates for asset allocation

In March 2023, turmoil in the banking sector precipitated a shift in which markets began pricing in rate cuts. We viewed this turmoil as a short-term problem that was not likely to develop into a crisis. Accordingly, in May 2023 our economists perceived that hopes for US market rate cut were still too aggressive and that with the Fed solely focussed on inflation, rate cuts would not come until 2024.

By June 2023, greater near-term economic resilience and some upside inflation surprises made it clear that policy loosening in 2024 would unfold at a slower pace than previously assumed. As the risk of higher rates for longer began to crystalise, Oxford Economics reduced its projected number of 2024 rate cuts by the US Federal Reserve and the European Central Bank.

In our report, We need to talk about inflation targets, we also discussed the need for modern approaches to inflation targeting by policymakers and central banks as well as updated strategies for investors.

In H2 2023, economic fundamentals changed our 2024 rate-cut forecast

By September 2023, Oxford Economics recognized the need for a prolonged pause in interest rate setting by the US Federal Reserve, based on projections from the Federal Open Market Committee (FOMC) and communications from Fed Chair Jerome Powell. As we updated our financial market forecasts to reflect a slower decline in interest rates, our analysts also reminded investors and asset managers that higher US rates might last longer, but will not be forever.

Throughout 2023, labour market strength played a large role in supporting the resilience of the global economy. An Oxford Economics report, Labour markets unlikely to prompt faster policy pivots, summarized the impact of weaker-than-expected productivity in the eurozone and UK, unemployment rates in those markets and the US and potential policy pivots by central banks.

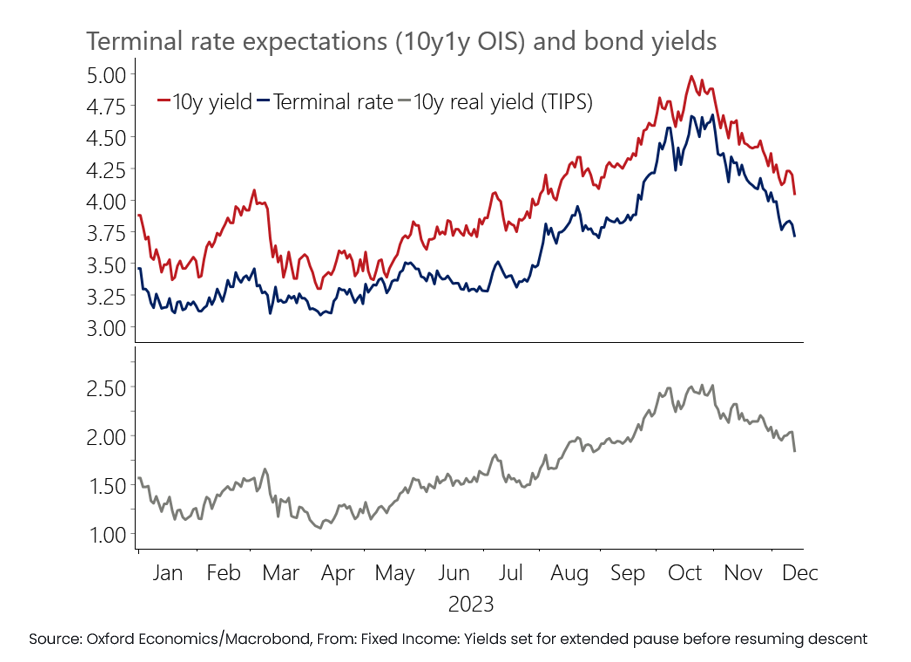

The end of the year brought slightly less hawkish FOMC communications, reinforcing Oxford Economics’ expectations for moderate rate cuts in 2024. After reaching our 4% target for US 10-year yields, our strategists expected a reversal in yields as markets had gone too far in expecting 150bps of cuts.

Our current forecast cautions against excessive easing expectations

Despite the continued fall in global inflation, we assessed that markets were too optimistic in their rate-cut expectations. An Oxford Economics report published in January 2024 upgraded our baseline forecast for growth due to a noticeable deceleration in inflation, a loosening in financial market conditions, and the anticipated acceleration in real disposable income.

But even with falling global inflation, Oxford Economics anticipated a measured response by central banks against a backdrop of improving demand. In February 2024, our analysts stressed that uncertainty over the cause of lingering inflation would encourage policymakers to hold firm on current interest rates for some time yet.

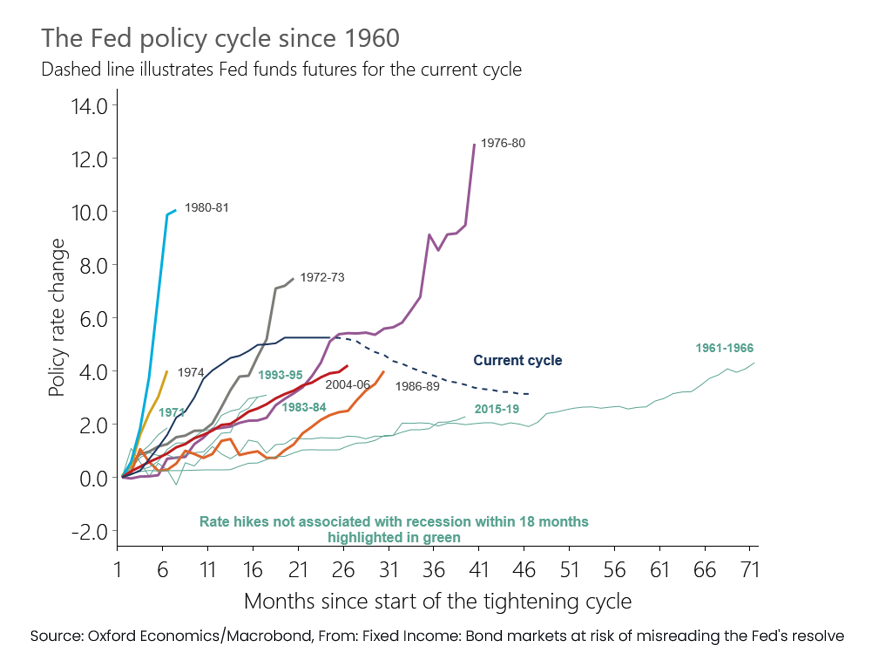

As of March 2024, we believe that the bond market may be misreading the Fed’s resolve on inflation management. We doubt the Fed will cut rates swiftly in an effort to ensure a soft landing. What’s more, the risk of inflation stabilising above the Fed’s target in the second half of 2024 is still underpriced by bond markets.

Our accurate forecasts and detailed research reports help you unlock the power of economics to sharpen your investment decisions.

To better understand market forces on interest rates for 2024 and beyond and optimise your asset management strategy, turn to Oxford Economics for actionable, timely insights.

Request a free trial

Please complete the form below to see how our expert forecasts and research can benefit your business.

You’ll also receive a bundle of eleven best-in-class research reports from the past year, which offered investors and asset managers detailed insights to support data-driven decision-making.

Author

Innes McFee

Managing Director of Macro and Investor Services

+44 (0) 203 910 8028

Innes McFee

Managing Director of Macro and Investor Services

London, United Kingdom

Innes McFee is the Managing Director of Macro and Investor Services, based in London. Innes oversees the activities of the Macro & Investor Services teams globally, including the Global Macro Forecast and Global Macro Service.

Innes joined Oxford Economics in 2017 after 6 years at Lloyds Banking Group as a Senior Economist. At Lloyds Innes was responsible for the economic scenarios underpinning the Group’s internal planning and stress testing; analysis of key risks; and developing Lloyds’ approach to multiple economic scenarios for IFRS9. In addition, Innes’ role included developing the Group’s capability in modelling macroeconomic fundamentals and UK banking markets and advising the Group Corporate Treasury on financial market developments.

Prior to joining Lloyds Innes was an Economic Advisor at HM Treasury where his roles included management of the UK’s foreign currency reserves; US economist; and G20 macroeconomic policy advisor. Innes has a first class undergraduate degree in Economics from the University of Durham and a MSc in Economics from Warwick University.

Tags:

You may be interested in

Post

Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

The 2024 US Presidential Election is less than seven months away. In this week’s Beyond the Headlines, Bernard Yaros, Lead Economist, outlines two scenarios for the US economy if former President Donald Trump returns to the White House and Republicans sweep Congress.

Find Out More

Post

Cross Asset: Closing our tactical long on gold, but we’re still bullish

The strength of the recent gold price rally has defied even our already bullish expectations and we think prices are vulnerable to a price consolidation in the short term. As a result, we close out our tactical long position on gold that we opened in October last year.

Find Out More

Post

How Inflation eroded governments’ debts and why it matters | Beyond the Headlines

The supply-shocks era (2020-23) represented the first time in a generation where inflation significantly eroded the real value of global public debt. In this week’s video, Gabriel Sterne, Head of Global Emerging Markets, focuses on the extent to which governments seized that opportunity.

Find Out More