Lower return on investment does not mean US tech is losing its edge

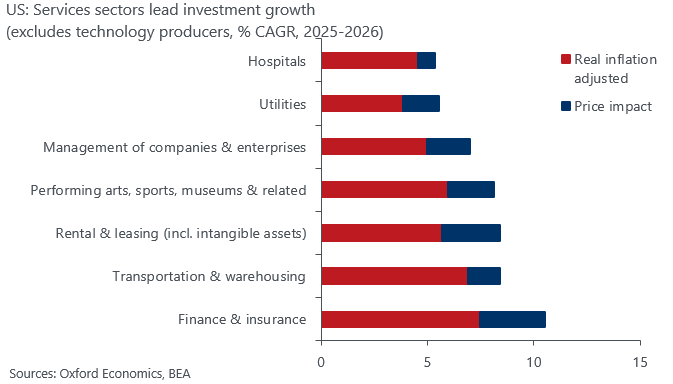

The surge in capital spending by U.S. technology providers is leading one of the largest investment cycles of the past half-century. Technology and other services sectors, such as in finance, transportation, and health care, are racing to upgrade their electronics and computer systems, develop new products that support adoption of artificial intelligence, construct new data centers, and expand power supply.

Services sectors increase their spending on technology

As the installed base of AI infrastructure expands, the pace of growth for additional capital spending will naturally moderate. We expect investment by technology providers to slow to a high single-digit rate over the next two years—still well above historical averages. This slowdown does not reflect structural weakness; it signals the transition from rapid buildout to consolidation and utilization of new capacity.

The capital-intensive phase of recent years will moderate, but the cumulative effect on productive capacity, efficiency, and competitiveness will be substantial. As the investment wave transitions into an operational one, the payoff will come through improved economic value added across multiple industries.

Unlock exclusive climate and business insights—sign up for our newsletter today

Follow the cash, not just the earnings

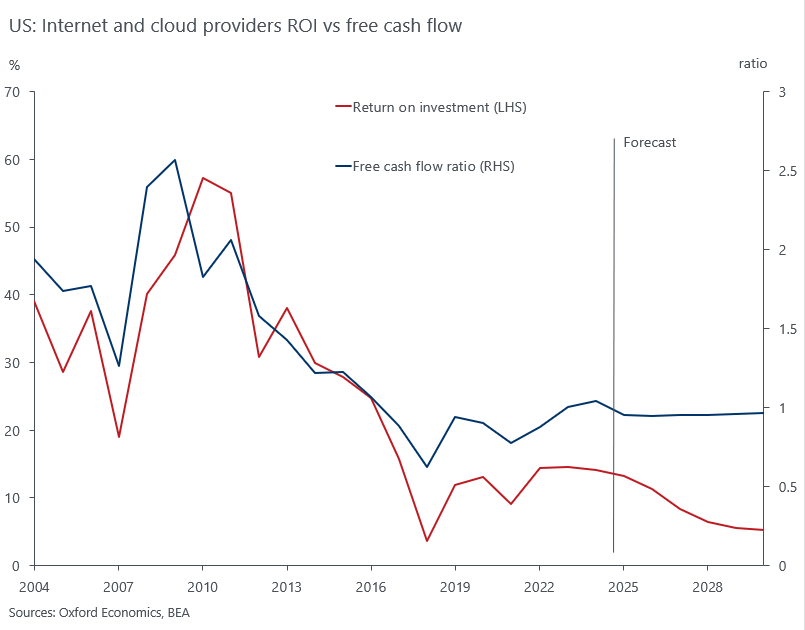

The extraordinary level of investment has led some to question whether returns from the spending are beginning to weaken, but a closer look at the evidence suggests the opposite. In our latest United States Industry Outlook, we find that this investment cycle is laying the foundations for sustained growth across multiple sectors of the economy.

A common measure of profitability from spending is the return on investment (ROI), which compares profits with the amount of capital invested. As a result, when investment rises sharply, a worry is that denominator will grow faster than the numerator, stalling a rise, or forcing a decline.

In addition, ROI has an upward bias from higher inflation, since prices impact profits (numerator) but not the book value of capital (denominator). Similarly, comparison of ROI over time and across sectors benefits from adjustment of net income to a cash flow basis, particularly for industries with high reinvestment rates or shorter asset lives, such as data infrastructure and software.

By adjusting for these biases, the free cash flow approach (FCF) comes into alignment with GDP conventions and, when compared to each sector’s own capital costs, provide a clearer lens on the comparative investment performance.

As capacity utilization rises and the initial wave of investment begins to pay off, the tech sector’s FCF will rebound, reinforcing the sector’s economic growth engine, despite an expected lowering of ROI from past spending.

Our analysis shows that while the surge in the tech sector’s capital expenditure has temporarily reduced their near-term cash flow, the underlying trajectory points toward sustainable cash generation and thus contribution to GDP growth. The focus on cash flow clarifies that the spending on technology will secure future gains in profits by laying down the digital infrastructure that will underpin the next decade of productivity growth.

Outlook: From Buildout to Payoff

In short, the expected decline in the tech sector’s reported ROI is not a symptom of weakness. It marks a healthy phase in the investment cycle: one where firms trade near-term returns for long-term strategic advantage. As capital spending normalizes and cash flow recovers, the sector’s true strength will become increasingly visible in profits and productivity gains that will ripple through the wider U.S. economy.

Tags:

Related Reports

COP30 in focus: How to bridge the implementation gap?

Ten years since Paris, can COP30 deliver real change? We review the progress of countries, industries and cities on the path to decarbonisation.

Find Out More

How Russia shapes the outlook for global oil prices

The fate of global oil prices hangs on Russia. Sanctions, rerouted exports, and a potential ceasefire could drive Brent and Urals in unexpected directions. What will happen next?

Find Out More

What a fragile peace means for Central and Eastern Europe

Countries in Central and Eastern Europe (CEE) have been among the most exposed to Russia's war in Ukraine and will also be impacted by the nature of any ceasefire. Our baseline assumption is for 'fragile peace' this year, with a high likelihood of renewed hostilities.

Find Out More

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More