UAE’s 2026 federal budget signals stronger growth and investment

The UAE has set a balanced federal budget of AED92.4bn for 2026, a 29% jump in both revenue and spending, underpinned by new tax measures and an expected uplift from hydrocarbons. The plan channels funds towards social services and strategic investments aligned with the ‘We the UAE 2031’ vision.

Key takeaways

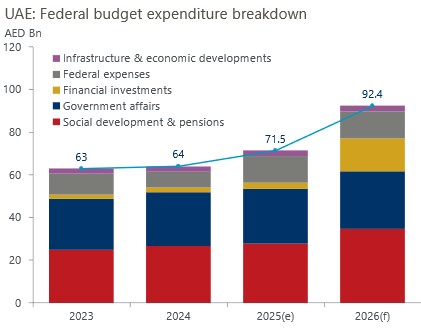

- Record scale: Revenue and spending rise to AED92.4bn (4.6% of GDP) from AED71.5bn (3.5%) in 2025.

- Investment push: ‘Financial Investments’ see the biggest increase, up AED12.5bn (0.6% of GDP), a 431% jump, supporting outward FDI ambitions.

- Broader revenues: The new domestic minimum top-up tax (aligned to the OECD’s 15% floor) should significantly lift receipts; social spending on education and healthcare is set to benefit.

Details of the 2026 federal budget are limited, but the direction is clear: the government is accelerating progress towards its long-term development plan, which targets a doubling of GDP and greater leadership in technology, human capital, and international engagement. Running the budget in balance underscores continued fiscal discipline even as activity expands.

As shown in the below chart, the largest increase by headline category is for ‘Financial Investments’, rising by AED12.5bn (0.6% of GDP), or 431%. This is consistent with the UAE’s outward FDI strategy: outward FDI rose 9% last year to AED1.1tn (54.2% of GDP), with the country ranking first in the Arab world and among the top 20 globally. The second largest increase, and the biggest allocation overall, is for ‘Social Development & Pensions’, up AED6.7bn (0.3% of GDP), signalling more resources for education and healthcare in line with national priorities. Administrative costs appear to be contained, easing as a share of total spending.

Chart 1: Huge increase in federal spending planned for 2026

Unlock exclusive climate and business insights—sign up for our newsletter today

The introduction of the domestic minimum top-up tax at the start of this year likely contributes to the jump in projected revenues for 2026. Alongside higher hydrocarbon production and exports as OPEC-led cuts unwind, this should support stronger domestic demand and investment.

What to watch next: confirmation of other local budgets and national budget plans; the pace of DMTT collections; and the path of oil output. Together, these will shape the near-term outlook for the UAE—and could herald a broader fiscal and growth upswing across the GCC.

Contact us

If you would like to find out more about our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Tags:

Related Reports

MENA Forecasting Service

Monitor the implications of economic and market developments in the MENA region.

Find Out More

African and Middle Eastern Cities Forecasts

Comprehensive data and forecasts for major cities in Africa and the Middle East.

Find Out More

Global Cities Service

Make decisions about market and investment strategies with historical data and forecasts for 1,000 of the world’s most important cities.

Find Out More

Middle East tensions could severely hurt the economy in Japan

Our scenario analysis reveals a partial shutdown of the Strait of Hormuz by Iran would push the Japanese economy into a near-stagflation situation in H2 2025, given Japan's structural vulnerability to terms of trade shocks.

Find Out More