What is driving European cities’ housing affordability challenge?

Housing affordability has emerged as a central challenge across Europe, particularly in major cities and tourist hotspots.

Housing affordability has emerged as a central challenge across Europe, particularly in major cities and tourist hotspots. The issue has rapidly risen to the top of the political agenda: European Commission President Ursula von der Leyen has named it as one of her key priorities, while the UK government has made it a central mission to deliver 1.5 million new homes over the course of the current parliament. With the EU appointing its first-ever Housing Commissioner, attention is now turning to the forthcoming Affordable Housing Plan, a landmark initiative set to be published in December.

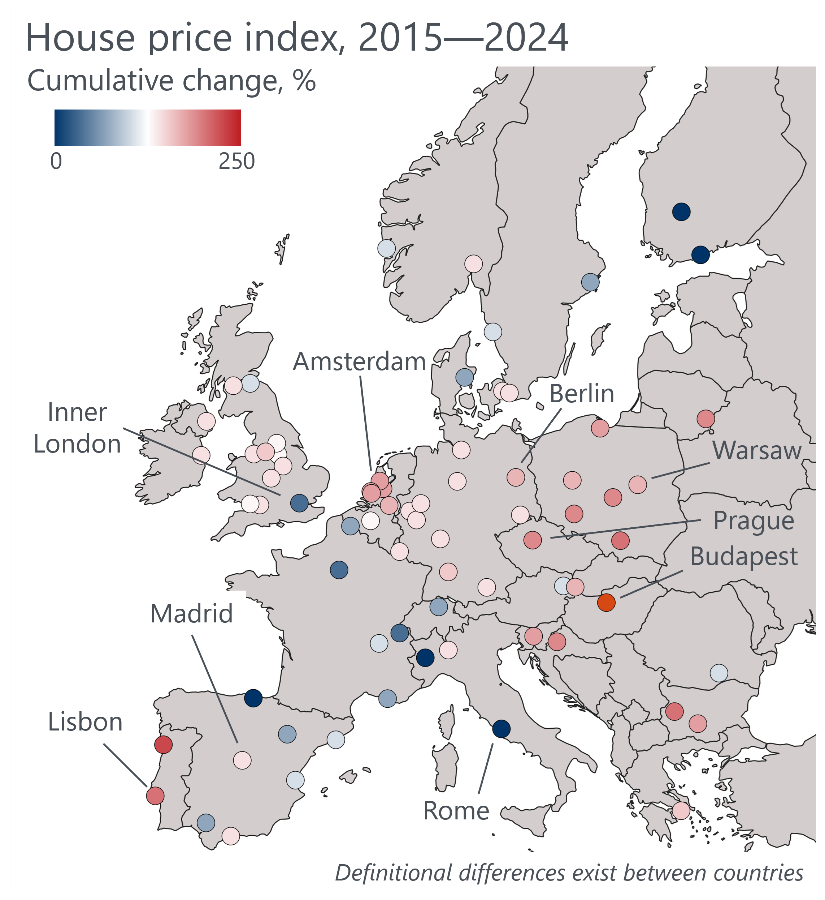

Given the rising political tide, how significant have price changes been? In many areas, very. Major cities in Central and Eastern Europe (CEE), Portugal, and the Netherlands have seen the steepest increases, with house price indices more than doubling in these regions between 2015 and 2024. Prices have continued to climb in these markets even after 2022, defying the broader European correction brought about by rising living costs, higher interest rates, and subdued economic growth. Yet, it’s not only these handful of cities experiencing growth. Across almost 80 major European cities for which we produce house price index forecasts, average values have risen significantly since

Map 1 – Cities across Europe have seen large increases in house prices

Unlock exclusive climate and business insights—sign up for our newsletter today

Perhaps contrary to expectations, some of the most limited increases in house prices have been in Europe’s most affluent cities. London, Paris, Geneva, Zurich, and Stockholm have all had relatively low price growth, while some of the lowest-income cities have seen huge gains. Part of this can be explained by the already sky-high housing costs in these wealthy cities limiting the scope for further price moves at a time when real incomes are under pressure. It can also partly be explained by a growing price convergence across major European cities, with investors looking for returns in emerging and fast-growing areas where prices are still relatively low by international standards, even if high relative to local wages.

This points to a broader issue: across all these cities, housing prices have risen significantly faster than incomes. As a result, affordability pressures have deepened, particularly in cities with lower average income levels. The economic consequences are large, including reduced labour mobility, lower disposable incomes, and weaker business investment. Together, these factors make cities less competitive, as firms face higher operating costs and a less prosperous local environment. The political consequences are equally serious, reflected in growing inequality and rising poverty, which keeps people in parental or rental accommodation for much longer.

And it’s not just house prices that have increased. Rental costs have also increased much faster than wages across many major cities, with the European Investment Bank finding that average rents doubled in some major cities over the last ten years. Lisbon, Dublin, Budapest, Berlin and Luxembourg saw some of the largest increases. While many European cities have rent controls, which will benefit existing renters, such controls may be exacerbating price increases for those entering the rental market as landlords either leave the market (reducing supply) or lock new entrants into high rents knowing there is limited scope for increasing returns in future years.

What has driven the increase in housing costs? Unfortunately, there is not a single answer, but rather a multitude of factors. On the demand side, years of ultra-cheap credit enabled investors and individuals to access the funds required to purchase property, while booming urban labour markets, particularly in the advanced services and university sectors, fuelled population and income growth. This explains why the strongest house price growth can be seen in CEE cities, given their much stronger economic performance over the last decade.

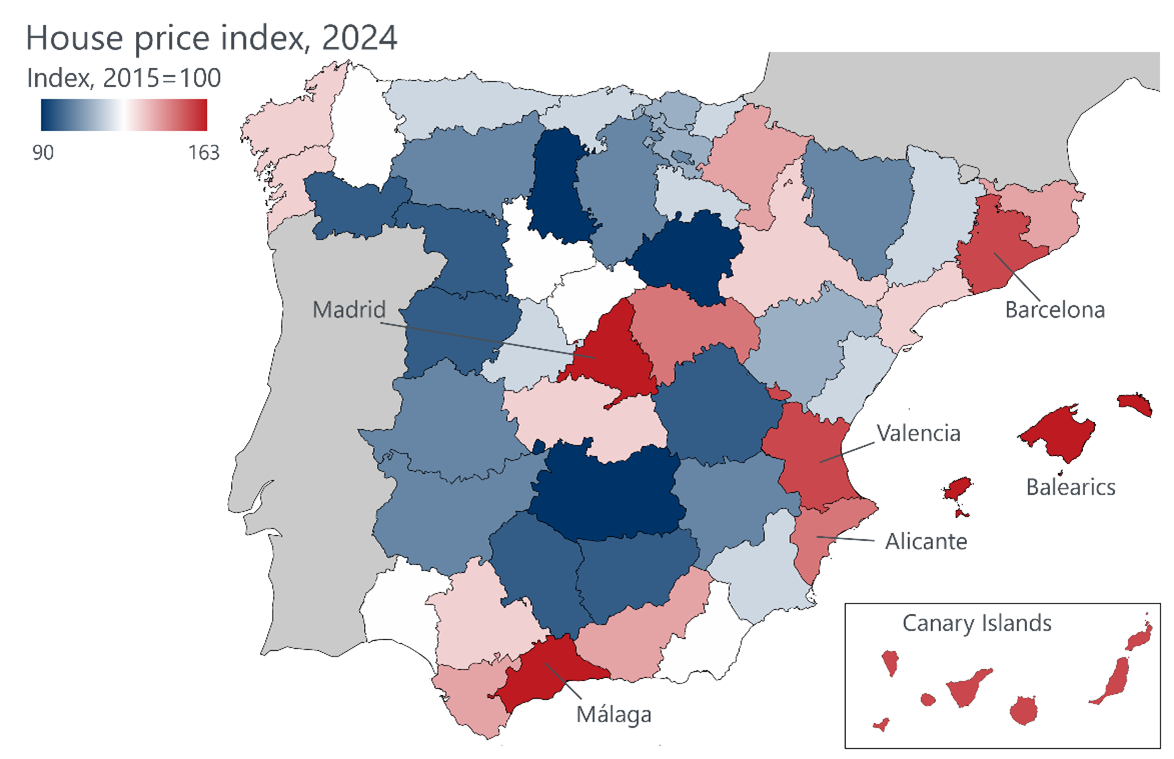

Population effects are also highly visible in Spain, a country with a significant and increasing housing affordability challenge. Indeed, regions with the strongest population growth, such as Madrid, Malaga, and the Balearic Islands, have seen the largest price increases. Notably, much of this population growth has been driven by international migration, particularly from Latin America. Spain also highlights the importance of looking beyond the national picture of housing trends to examine the issue at a local level, given that the bulk of house price activity is being driven by a small subset of cities and key tourism hubs (Map 2).

Map 2 – Spain’s house price growth is centred on a small group of regions

Source: INE, Oxford Economics

As well as urban population growth, the number of households has grown as a result of more people living alone or in smaller family units. This has increased demand for housing simply by increasing the numbers requiring housing. Moreover, some cities and regions, particularly those most reliant on the tourism industry, have found themselves confronting a significant increase in short-term rental units, often converted from local rental or housing stock. While this is a very localised issue, it has the dual impact of increasing demand for housing stocking and reducing supply. However, it is also worth noting that short-term rentals may lead to more efficient land-use, particularly where second homes, that would otherwise sit empty, are leveraged.

On the supply side more broadly, weak housing delivery, exacerbated by the post-2008 construction slump and the Covid-19 pandemic, have led to a clear supply and demand mismatch. Over the last 15 years, many developers went bankrupt, workers left the sector, and housing construction fell, with many cities never fully returning to pre-2008 housing delivery levels. Land-use, environmental, and planning constraints have added to the difficulties of boosting housing supply by raising costs for developers and creating delays while projects await approval. Furthermore, costs in the construction sector have increased significantly over recent years; EU-wide data from Eurostat suggests that the cost of inputs for residential buildings have risen around 20% over the period 2021–23, the strongest price inflation for decades and with particularly large increases in CEE countries. These higher input costs reduce returns on investment, make sites less viable, and limit new housing supply.

Overall, cities across Europe are facing significant housing affordability challenges, but the root causes are diverse. In the most prosperous cities, including those in the Nordics, London, Paris, Amsterdam and Munich, strong labour markets are colliding with limited supply. In Southern Europe, weak local incomes, pockets of strong population growth, and booming tourism sectors are coming together to disproportionately raise housing costs relative to wages. In CEE, strong economic growth, increasing urbanisation, high investment returns, and rising residential construction costs are coinciding to drive wide affordability gaps.

Our forecasts indicate that European house prices are likely to continue rising strongly, leaving policymakers with little room to avoid action. The UK’s upcoming Budget and the EU’s Affordable Housing Plan will shed some light on how governments intend to respond, but policymakers underestimate the scale of the challenge at their peril.

Tags:

Related Reports

Residential property market analysis

Residential property outlook for Australian houses and real estate

Find Out More

Unlocking the Potential: Exploring the Commercial Real Estate Market in Australia

Detailed analysis and forecasts for Australian office markets

Find Out More

Global Cities Service

Make decisions about market and investment strategies with historical data and forecasts for 1,000 of the world’s most important cities.

Find Out More

European Cities and Regions Service

Regularly updated data and forecasts for 2,000 locations across Europe.

Find Out More