Sanctions tighten: US targets the financial lifelines of Russian oil exports

The US has taken its most aggressive step yet against Russia’s oil sector, sanctioning the financial arms of Rosneft and Lukoil, companies that together account for nearly half of Russia’s seaborne crude exports. The move immediately pushed Brent prices up by $3 per barrel, though this reaction is unlikely to last as the global market remains well supplied and history suggests sanctions will be learned and evaded over time. The impact, instead, will fall mainly on Russian revenues rather than global oil supply.

Financial sanctions are unlikely to cause significant physical disruption

Rosneft’s trading arm alone handles around 2 million barrels per day (mbpd) of crude exports, while Lukoil adds another 0.8–1 mbpd. By targeting the financial infrastructure behind these flows, Washington is warning international banks against facilitating payments linked to Russian crude, a shift that increases compliance risks but stops short of directly curbing physical trade.

The UK imposed similar measures a week earlier, widening the discount on Russian crude from about $3 to $8 per barrel. Yet Brent barely moved, underscoring that sanctions have so far weakened Russian pricing power and diverted trade flows to Asia rather than shrinking supply. The latest US action builds on that pattern, tightening the financial screws rather than the physical ones.

The timing of the move appears calculated. Oil prices had fallen by $5 over the past week into the low $60s as the market priced in a growing surplus and rising inventories. The Trump administration, keen to maintain low energy prices while containing inflation risks, has taken advantage of that softness to increase pressure on Moscow without triggering a price spike.

Following the announcement, Brent briefly returned to the mid-$60s range, roughly where it has traded for most of 2025. This reinforces the view that the market’s structural surplus is the dominant force, keeping price rallies short-lived even as sanctions headlines intensify.

Unlock exclusive climate and business insights—sign up for our newsletter today

Short term friction may arise, but the market has been adjusting with improved evasion tactics

Unlike earlier sanctions focused on shipping and insurance, these measures heighten risk for the financial sector. Refiners in Asia, notably India’s Reliance Industries, are reassessing exposure, while banks tread carefully to avoid secondary sanctions. Still, Russia’s extensive “shadow fleet,” non-Western insurers, and alternative payment systems mean export volumes are unlikely to drop significantly.

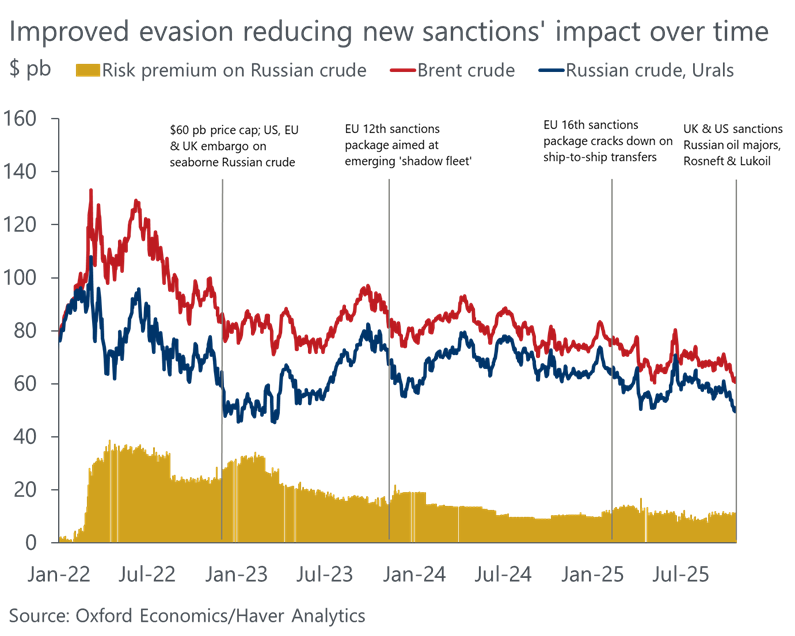

The result will likely be pricing friction, not physical disruption. Russian exporters will have to offer deeper discounts to offset higher legal and logistical risk, eroding net revenues. Over time, those discounts typically narrow again as markets adjust to new compliance rules, a pattern seen after previous rounds of sanctions.

Fig 1. Improvements in evasion have been blunting the impact of new sanctions

Pressure play unlikely to result in lasting price shock

For now, the sanctions signal a political and financial escalation rather than a shift in oil fundamentals. A temporary “sanctions premium” may persist as traders gauge compliance risk, but with the market still moving into surplus, we expect any price strength to fade. Brent is likely to close the year around $65 per barrel, consistent with our baseline forecast.

The message from Washington is clear: the US is tightening economic pressure on the Kremlin at a moment when it can do so without triggering an inflationary oil shock. A reminder that, for now, geopolitics remains a secondary force to supply-demand dynamics in global energy markets. We discuss these impacts and more in our latest commodity price forecasts.

Tags:

Related Reports

COP30 in focus: How to bridge the implementation gap?

Ten years since Paris, can COP30 deliver real change? We review the progress of countries, industries and cities on the path to decarbonisation.

Find Out More

How Russia shapes the outlook for global oil prices

The fate of global oil prices hangs on Russia. Sanctions, rerouted exports, and a potential ceasefire could drive Brent and Urals in unexpected directions. What will happen next?

Find Out More

What a fragile peace means for Central and Eastern Europe

Countries in Central and Eastern Europe (CEE) have been among the most exposed to Russia's war in Ukraine and will also be impacted by the nature of any ceasefire. Our baseline assumption is for 'fragile peace' this year, with a high likelihood of renewed hostilities.

Find Out More

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More