IFRS9 / CECL Update: Sentiment improves as trade policy uncertainty eases

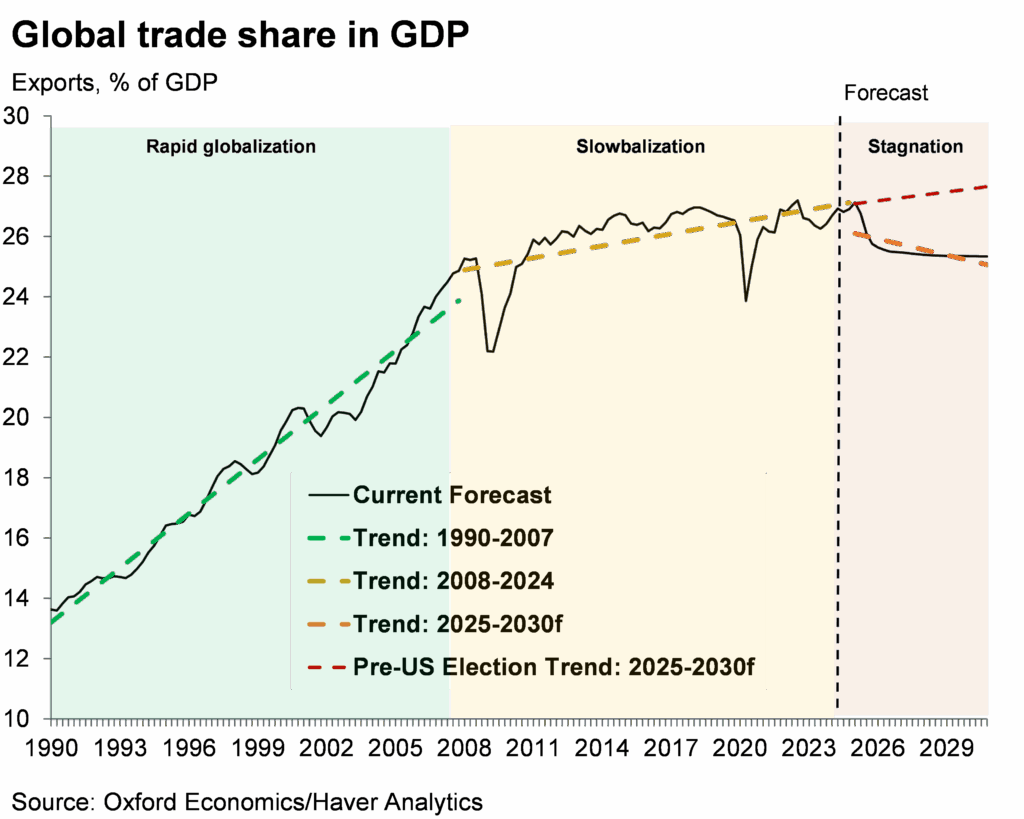

Over the past year, the effects of tariffs and other protectionist trade measures have re-emerged as a central risk to global GDP growth. The policies from President Donald Trump’s administration have injected heightened uncertainty into the previously established rules of global trade, having oscillated between tariff threats, deadline extensions and ad-hoc deals. This has had a significant impact on the trade outlook at a global level, especially when viewed in a historic context. Trade’s share of global GDP surged in the 1990s and early 2000s as supply chains expanded and trade liberalisation accelerated. But growing concerns over the vulnerabilities stemming from deep cross-country integration have since led many countries to reassess their reliance on foreign markets, slowing trade’s growth relative to economic output. Under the Trump administration that deceleration is expected to intensify, signalling a shift from the previous era of ‘slowbalization’ to a period of trade stagnation.

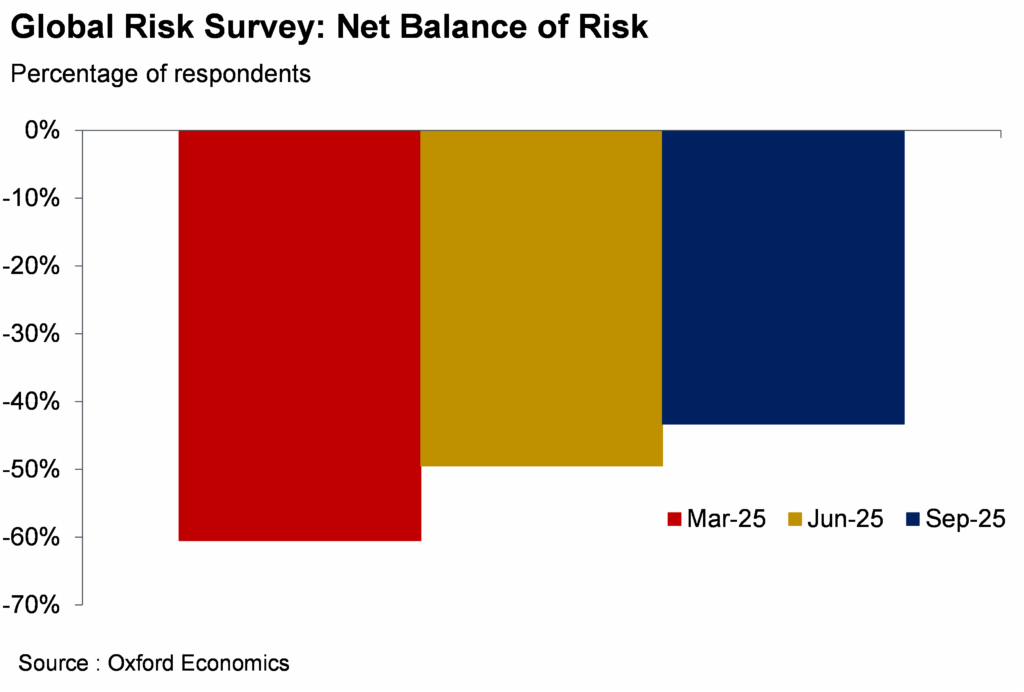

The protectionist measures that come with this trade agenda have cast a long shadow over business and investor sentiment this year. Businesses were especially anxious after Liberation Day, when the scale of impending tariffs and the resulting economic fallout remained deeply uncertain. As negotiations progressed over the year and deals took shape, increased clarity over policy outcomes and the extent of the resulting economic downturn has since helped steady executives’ nerves. We track our clients’ assessment of the risk outlook in our Global Risk Survey, which saw a steady improvement in the net balance of risk since the start of the year (see chart below).

Unlock exclusive economic and business insights—sign up for our newsletter today

Subscribe

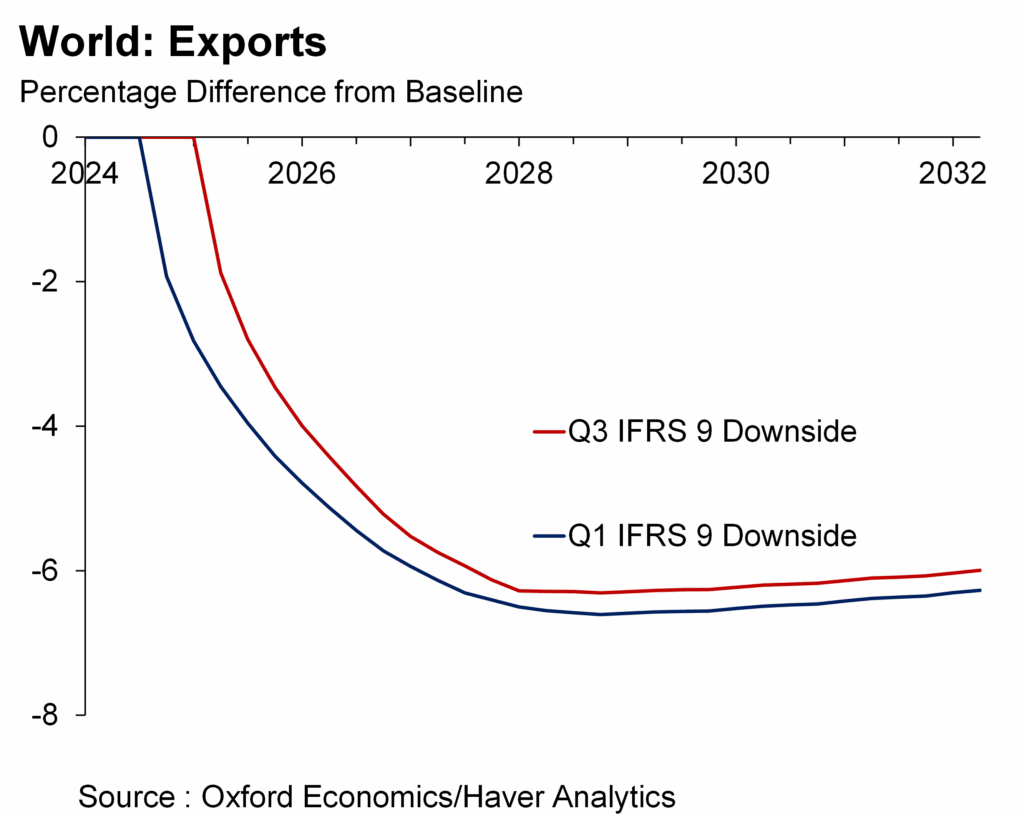

We reflect these developments in the balance of risk in our quarterly IFRS 9 and CECL scenarios, which are constructed using forward-looking probability distributions based on three decades of forecast errors. As our scenarios are statistical in nature, they do not make specific narrative assumptions about trade. However, the internally consistent structure of our Global Economic Model and the robust methodology used to generate our IFRS 9 and CECL scenarios, enable us to reflect changes to risk appetites on global trade in a rigorous framework. As seen in the chart below, our latest downside scenario reflects slightly less negative outturns for world exports relative to March when pessimism around trade was especially high. By embedding these evolving risks into our baseline forecasts and into our scenarios, we enable clients to better quantify and incorporate them into their expected credit loss (ECL) calculations.

Click here if you want to learn more about our IFRS 9 service and here for our CECL service.

Subscribe to our newsletters

Tags:

Related Reports

IFRS 9 and the BCST: How the Bank of England’s Latest Stress Test Measures Economic Shocks

The Bank of England’s new BCST stress test introduces a recalibrated approach to measuring financial resilience in reflecting IFRS 9 impacts and a softer, more realistic stress pathway. What does this mean for lenders and the wider economy? Discover how Oxford Economics extends the BoE’s guidance into a global scenario to help businesses stay prepared for the next downturn.

Find Out More

Toss-up US elections increase downside risks again for our Q3 IFRS 9 and CECL scenarios

While our short-term outlook for the global economy has largely remained steady over the past quarter, the balance of risks around the base case has become more negative. This is evidenced by the number of clients expressing increased pessimism in their expectations around global growth in our latest Global Risk Survey.

Find Out More

Downside risks remain amid a more balanced outlook in our Q1 IFRS 9 and CECL scenarios

Despite the upgrade to our global economic outlook since December 2023, the Q1 update of our IFRS 9 and CECL scenarios services sees a more balanced assessment of the risks to the global economy over the next two years.

Find Out More

Greater downside risks are explored in our Q4 IFRS9 and CECL scenarios

he Q4 update of our IFRS9 and CECL scenarios services paints a more pessimistic view of the balance of risks to the global economy, albeit with a lower peak in policy rates and higher terminal rates than we saw in Q3.

Find Out More