Global Construction Outlook

Global construction faces a near-term contraction as higher rates and tariffs bite, but growth returns in 2026.

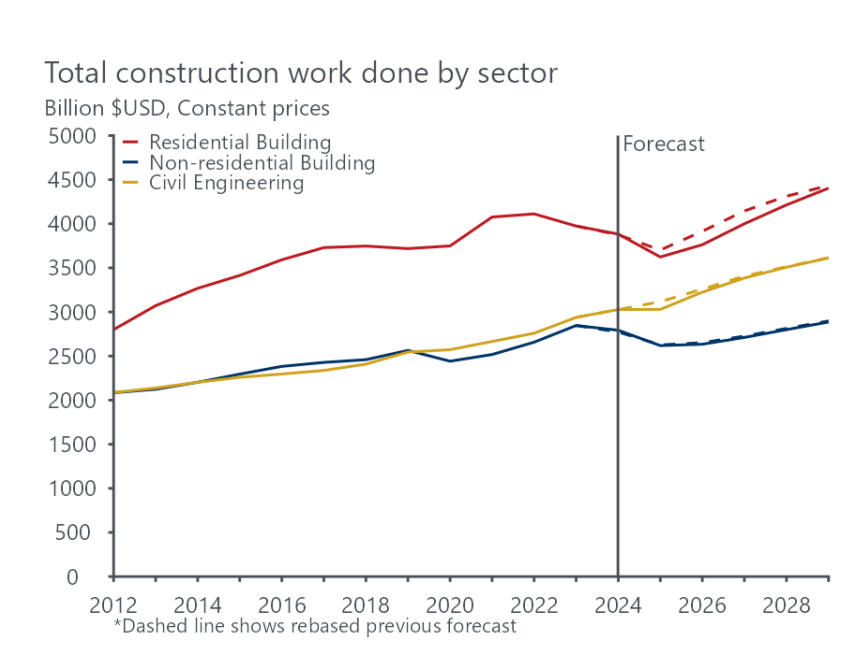

Global construction activity is forecast to fall 4.5% over 2025 to US$9.3tn and then grow 3.8% in 2026 to US$9.6tn (all values in constant currently 2023 prices). This is a downgrade from our Q2 forecast update to account for a weaker near -term outlook in China and the US.

Chinese real estate commencement surprised on the downside, and we have scaled back our outlook for Chinese government investment. In the US, mortgage rates have remain elevated despite Fed rate cuts over the past year, weighing on residential construction activity.

Residential building activity is forecast to fall 6.7% over 2025 to US$3.6tn, before rebounding 3.8% in 2026 to US$3.8tn. The Chinese real estate downturn continues to dominate the sector, with commencements taking another step down. Activity outside China is now expected to fall, pulled down by a weaker US outlook.

Non-residential building activity is forecast to fall 6.2% in 2025 to US$2.62tn and then grow 0.6% in 2026 to US$2.63tn. US tariffs continue to weigh on industrial building activity – particularly in Asia and the US. Industrial building activity in the US is also falling following the temporary recent boost from the CHIPS Act.

Civil engineering activity is forecast to grow 0.1% in 2025 to US$3.0tn and 6.5% in 2026 to US$3.2tn. We downgraded outlook for China to account for a weaker investment outlook as authorities focus on rebalancing towards becoming a consumer led economy. We have also downgraded our near-term US outlook following budget cuts made by the Trump administration.