BoJ announces cautious plan to sell ETF and J-REIT holdings

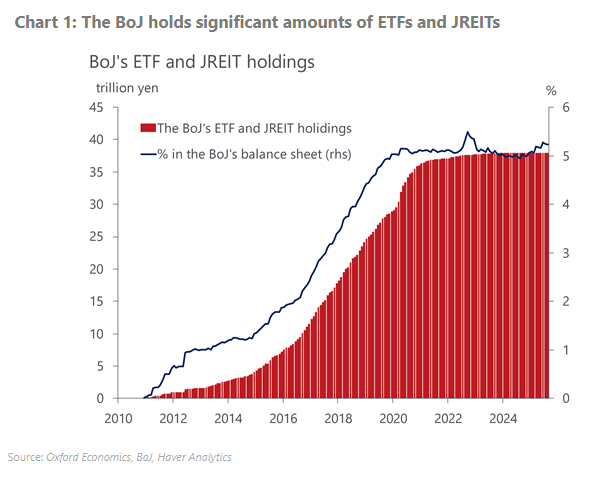

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

The Bank will sell ETFs and J-REITs at a very cautious pace of JPY330bn and JPY5bn per year on a book-value basis, respectively. Based on market value, these amounts equate to JPY620bn and JPY5.5bn, respectively, as of end-March 2025, or about 0.05% of the trading value in the market.

The plan is flexible to avoid market disruption. The BoJ could adjust the pace of sales at future monetary policy meetings. And it will allow the trustees it has instructed to sell the assets to temporarily adjust or suspend sales, based on market conditions.

The BoJ will replicate its recent experience of selling the stocks it purchased in 2002-2010 from financial institutions to ensure financial stability. That sale took place at a rate of around 0.05% of the trading value, spanned nine years, and concluded in July 2025.