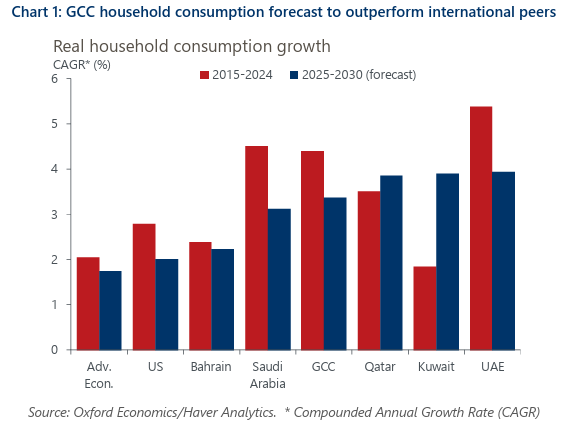

Why GCC consumers are set to continue to outperform

As GCC governments focus on diversifying economic activity and revenue sources away from oil and gas, our analysis suggests that household spending in the region will outperform that of international peers. This should create strong opportunities for companies operating in consumer sectors.

We project consumption will increase 3.4% per annum across the GCC in the next five years, compared to 1.7% in advanced economies. We also expect inflation to remain low and steady, safeguarding the purchasing power of households while also limiting cost pressures for firms.

Meanwhile, unemployment is low and should fall further for a number of countries in the region, supporting consumer confidence. We forecast employment growth to grow at roughly 10x that of advanced economies.

Still, the key risk to GCC economies remains the reliance to hydrocarbons. Using our Global Economic Model, we estimate that a 10% fall in oil prices would reduce the level of real consumption by 0.74% by the fifth year, subtracting about 0.15 ppts from annual growth. However, unless a fall in oil prices is deep and sustained, it’s unlikely to change the overall picture for household spending.