What key cities are driving Asia’s semiconductor success?

From smartphones and gaming consoles to MRI scanners and electric vehicles, semiconductors power many aspects of our world. The Asia Pacific (APAC) region is at the heart of this billion-dollar industry, with it being home to some of the sector’s largest market players. Fortune Business Insights has estimated that APAC accounted for just over 50% of the global market share in 2024. With chip sales projected to soar to the heights of US $1 trillion sales of chips by 2030, the semiconductor industry will continue to be of great importance to APAC’s national, as well as, city-level economies.

Chart 1: Key semiconductor hubs across APAC

APAC’s biggest economies host major semiconductor cities

Several key hubs across the region’s largest economies anchor APAC’s dominance in the semiconductor supply chain (Chart 1). Hsinchu city in Taiwan is a primary base for the country’s flagship semiconductor manufacturer TSMC, a huge player in the market, which produces the world’s most advanced chips. South Korea’s Samsung, which specialises in memory chips—an area where it continues to hold global leadership— has major manufacturing locations within Seoul’s metropolitan area. Meanwhile, China has several fabrication plants and headquarters throughout the country, including in the major cities of Shanghai, Shenzhen, and Suzhou. Through state-backed initiatives such as the “Big Fund” and “Made in China 2025“, China is accelerating research and development in semiconductors, with Huawei’s HiSilicon (based in Shenzhen) making notable advances.

Semiconductor industry is also driving the development of cities in emerging economies

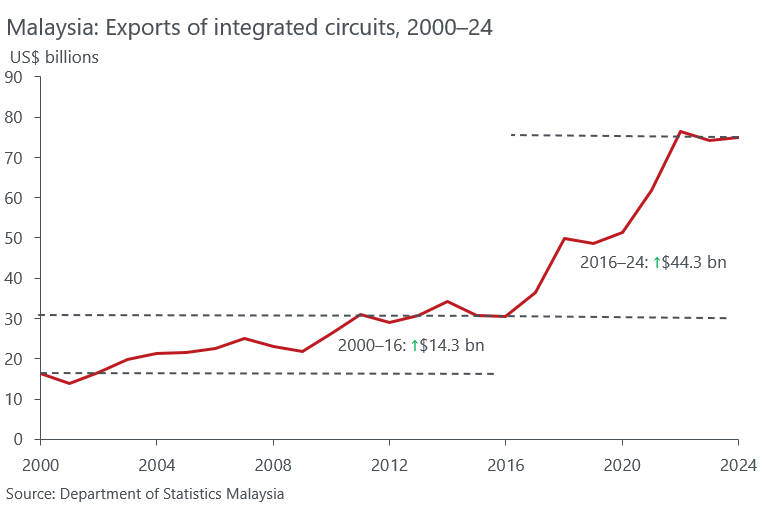

Emerging Asian economies have also become major players in the industry. Malaysia has rapidly grown into a key competitor in the industry, particularly in the lower end of the chip supply chain, with production and exports of integrated circuits growing rapidly over the past decade. Between 2016 and 2024, Malaysia’s exports of integrated circuits increased by 145% to reach US $75 billion. And according to ASEAN Briefing, the country now accounts for around 13% of the world’s output in semiconductor testing and packaging. The city of Penang in the northwest of the country and nicknamed the “Silicon Valley of the East” has been crucial to the country’s back-end assembly success, with its strong manufacturing base attracting international firms such as Intel and Bosch.

Chart 2: Malaysia’s exports of integrated circuits have rapidly increased over the past decade

Malaysia is certainly banking on semiconductors to be a strategic driver of the country’s economic progress. With fresh initiatives in place, such as its National Semiconductor Strategy, the nation is setting its sights further up the supply chain—namely, chip design. Progress in this area looks set to accelerate, following the recent investment of $250 million into the Malaysian chip industry by British chip giant ARM. This includes an agreement to train over 10,000 local engineers over the next 10 years and the establishment of ARM’s first Southeast Asian office in Kuala Lumpur. Not only will this enhance Malaysia’s technical capacity, but it will also create an array of high-skilled positions within the country’s expanding chip design sector. This could help stem the country’s persistent brain drain issue, with many of the country’s top talent looking for opportunities abroad.

Chips industry is driving jobs growth and local economic development

Indeed, across the region, the growth of semiconductor production is not only driving APAC’s national economies in terms of global trade, but it is also supporting city-level job creation, infrastructure development, and local incomes and prosperity.

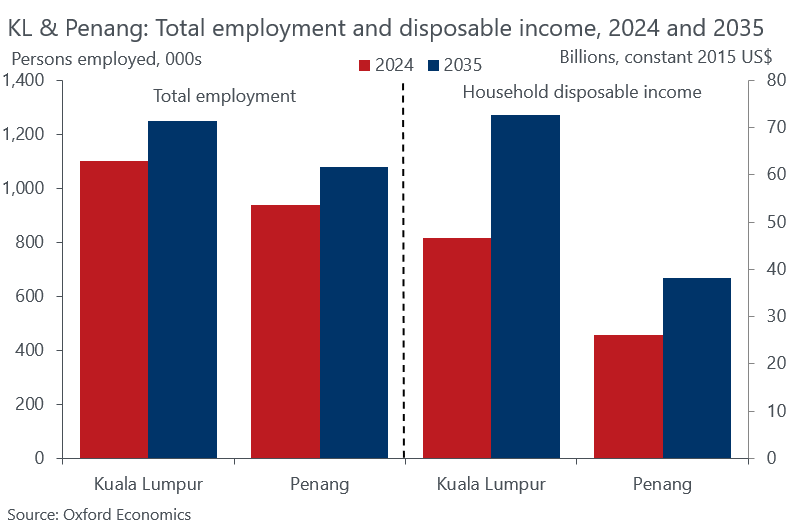

Forecasts from our Asian Cities and Regions Service point towards a strong uplift in total employment levels over the medium term in both Penang and Kuala Lumpur—growing by 15.1% and 13.5% between 2024 and 2035, respectively. Notably, this outperforms some of the other major semiconductor hubs highlighted in Chart 1, such as Hsinchu, Seoul, and Shenzhen. Alongside this, we also forecast a rise in real household disposable incomes by around 50% in Kuala Lumpur and Penang over the same period, which is well above the average growth rate of 36% of the other cities. This growth can partly be ascribed to the growing presence of the semiconductor industry in Malaysia, which is driving an increase in employment, in turn boosting average wages.

Chart 3: Our forecasts indicate strong employment and disposable income growth over the medium term for key semiconductor cities in Malaysia

Tariffs are a key risk to the outlook for cities in the semiconductor supply chain

APAC’s and Malaysia’s semiconductor ascent, however, is not without obstacles. Geopolitical tensions, particularly surrounding President Trump’s tariffs, continue to cast uncertainty over the region. In August, an announcement was made that firms not “building in the United States” would all be subject to a 100% tariff on their chips. While major players such as TSMC, Samsung, and SK Hynix would reportedly be exempt due to their manufacturing facilities in the US, the policy could still undermine the competitiveness of other Asian exporters.

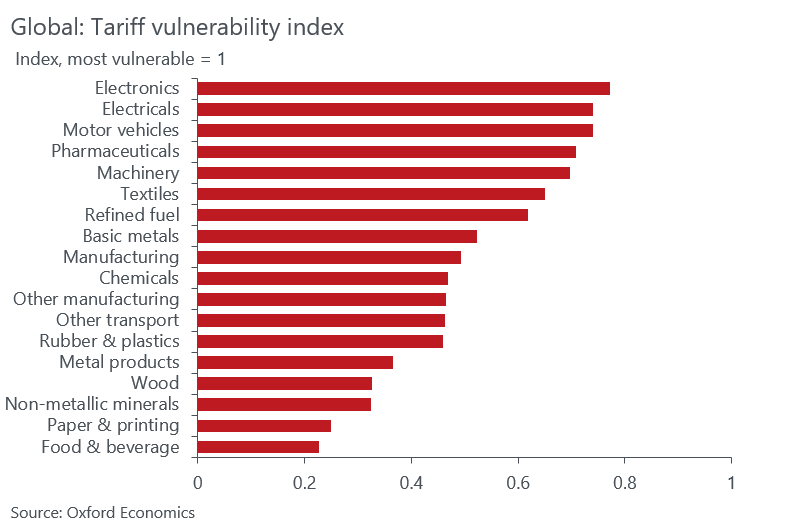

As Oxford Economics’ Industry team recently highlighted in its new tariff vulnerability index (Chart 4), the electronics and electricals sectors are the most vulnerable by trade shocks. These findings further emphasise the exposure of APAC’s semiconductor industry to external risks. Overall, the semiconductor industry remains a valuable, high-growth, high-skill industry for many cities in the region, but whether these cities will be able to weather the storm of the next few years will shed light on their long-term economic potential.

Chart 4: Globally, electronics and electricals are most vulnerable to tariffs

The Oxford Economics Global Cities Index ranks the largest 1,000 cities in the world based on five categories: Economics, Human Capital, Quality of Life, Environment and Governance. Underpinned by Oxford Economics’ Global Cities Service, the index provides a consistent framework for assessing the strengths and weaknesses of urban economies across a total of 27 indicators. To our knowledge, this is the largest and most detailed cities index in the industry. To download the full report, please fill out the form below.

Tags:

Related Reports

The rise of Southern India’s business service hubs

Over the next five years, India is set to be one of the fastest-growing major economies across Asia Pacific, lead by the performance of its IT and business services. The Southern states of Karnataka and Telangana are at the forefront of this success as they are home to two of India’s most rapidly growing cities and productive cities—Bengaluru and Hyderabad.

Find Out More

London’s productivity slump highlights Manchester’s momentum

The UK’s productivity performance has been lacklustre since the 2008 global financial crisis—both historically and relative to its international peers.

Find Out More

Amsterdam outlook 2025-2029

The European economy has endured a challenging year in 2025, but we expect Amsterdam to hold up relatively well.

Find Out More

Southern metros stand to lose the most from the government shutdown

The federal shutdown that started on October 1st is on course to be one of the longest in years and could have a significant impact in a handful of mostly southern metros.

Find Out More