The Future of Trade: Tariffs, Taxes, and Economic Trends

Three certainties amid global trade uncertainty

Uncertainty is the word de jour. For months, business leaders have lamented how difficult it is to plan, especially with unpredictable changes in trade tariffs. The latest US trade announcements don’t change that. Even with supposedly ‘locked-in’ import tariffs, past moves suggest little is permanent.

Many firms are now waiting for clarity before making any major moves. Why invest in expanding production or hiring new staff if you don’t know what the future trade outlook will look like or how import taxes might shift?

Against that turbulent backdrop, here are three truths you can hang your hat on:

1. Global trade is already falling.

There’s a narrative in the US and elsewhere that the global economy has withstood the test of trade tariffs-duties have been in place for months, and trade is still standing. But the reality is less rosy. After an initial rush by firms to beat tariffs, trade is tumbling.

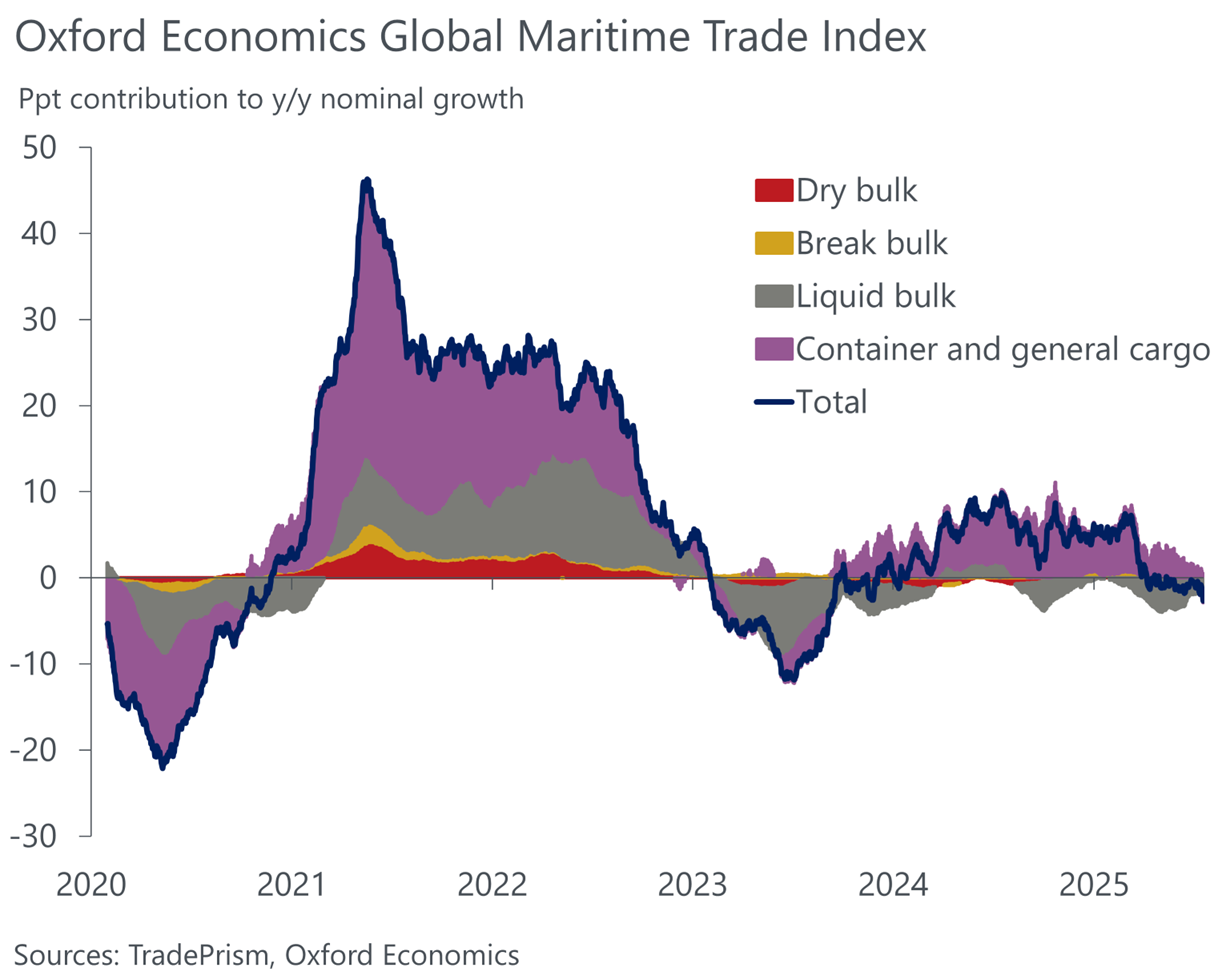

While it’s still too early to show up in most official sources, our Maritime Trade Index, a daily gauge of global shipping, shows trade volumes are more than 2% lower than a year ago. In the US, seaborne imports have fallen by around 8%.

2. Tariffs are here to stay.

President Trump has had multiple opportunities to unwind tariffs. He could have used the pause in April after the initial ‘Liberation Day’ tariffs were announced to reset policy. He could have done the same when the pause was extended in July. Or he could have left the base 10% import tax intact in early August rather than forge ahead with economy-specific levies of up to 40%.

The fact that he let each of these opportunities pass confirms that tariffs will be higher for longer. And not just during Trump’s term. Tariff revenue is now baked into the US budget, making it difficult for policymakers of any persuasion to wean themselves off the windfall. Remember, President Biden kept Trump-era tariffs in place during his term.

It’s time to stop waiting for tariffs to fade and acknowledge they’re part of the baseline.

See how Oxford Economics can help you navigate the tariff changes

Get in touch3. Tariffs and politics are inseparable

US trade policy is serving multiple, sometimes competing, objectives, from national security and geopolitics to domestic political gain. Tariffs targeting China, Canada, Mexico, and Brazil are as much about projecting influence or shoring up support at home as they are about rebalancing trade. This mix of motives means US trade policy will be more volatile going forward.

Given these three realities – a world where trade is falling, tariffs are business-as-usual, and politics shapes economics, what can firms do to mitigate risks and get ahead?

For the latest reports on trade and tariffs, please visit our topic page.

Join our upcoming webinar to stay updated on the evolving landscape of US trade policy and get your questions answered by industry experts.

Stay ahead of trade turmoil – read our latest blog on five lessons every business should know.

Related content

Tariffs take a toll despite easing trade hostilities

Global tradeflows remain under pressure despite easing tariff tensions. Recent US–China agreements reduce select import taxes and support China’s 2026 outlook, yet US imports continue to fall and supply chains pivot toward Asia and Europe. Containerised trade is set to expand, while bulk shipments soften alongside weaker industrial demand.

Find Out More

Global trade is losing momentum

Trade disruptions spread across autos and pharma sectors, with EU tariff exemptions giving Europe a competitive edge amid global slowdown.

Find Out More

Why have China’s exports held up so well under higher US tariffs?

China's exports have adapted, rather than retreated, under higher US tariffs. It will be difficult for businesses and consumers to decouple from Chinese exports or China-linked supply chains.

Find Out More

ASEAN growth opportunities following US-China Tariffs

Using sectoral production data from Oxford’s Global Industry Service, we have been able to quantify which countries and sectors have the greatest potential for production migration. Applying this framework across Asia reveals meaningful industrial depth in Vietnam, Thailand, and Malaysia in trade-intensive segments, and a distinctive, more resource-heavy footing in Indonesia and India.

Find Out More

Trends are reinforcing the strength of major cities

Leading cities like London, New York, and San Jose are thriving through technology, knowledge industries, and demographic advantages. As global shifts and AI reshape urban economies, which cities will stay ahead in the coming years?

Find Out More

Construction across sectors hitting record highs now and by decade’s end as economy slowly gains momentum

Australia’s construction sector is entering a defining decade. At the Australian Construction Outlook Conference 2025, Oxford Economics Australia explored the transformative trends shaping growth to 2030 – from AI-driven data centers and electrification projects to government-funded infrastructure and rising demand for social and retirement living.

Find Out More

Risk pendulum swings from inflation fight to trade tensions, economy to gradually gain momentum.

Economic Outlook Conference 2025 brought together business leaders and policymakers in Sydney & Melbourne where Oxford Economics Australia shared key insights on tariffs, investment, productivity, and sectoral trends shaping the nation’s economic outlook.

Find Out More

Eurozone outlook 2025-26: A clearer path for Eurozone growth but tariffs will still bite

The Eurozone economy has held up against geopolitical challenges but faces lacklustre growth in the near term, with global demand and uncertainty weighing on exports and investment. GDP growth is forecast at 0.8% in 2026, below consensus.

Find Out MoreTags: