Industrial recession still expected due to global tariff chaos

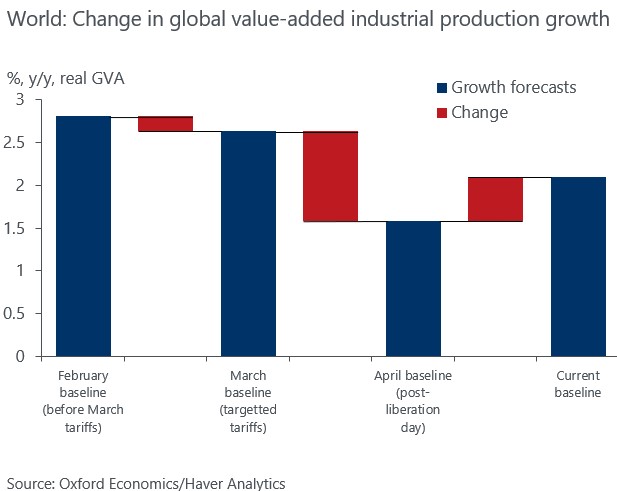

For the first time this year, we have raised our forecast for global industrial output in 2025. But this upgrade comes against the backdrop of turmoil and confusion on the global economic stage.

President Trump has imposed, withdrawn, and reinstated tariffs against both friendly and rival economies. We continue to expect a global industrial recession later this year, presenting a challenge that will force manufacturers to reassess their strategies.

Tariff reprieve does little to quash uncertainty

While the recent easing of tensions between the US and China is certainly a welcome sign, we don’t see it as a game changer for global industry. Indeed, much of the upgrade to our industrial production outlook is due to firms frontloading orders in Q1 to get ahead of anticipated tariffs. But as we move through the year, we expect to see an unwinding of this activity, leading to a weaker industrial performance.

Importantly for industry, the temporary reprieve in tariffs has done little to quell high levels of uncertainty. Developments regarding the future of the US China 90-day agreement, potential increases in tariffs against the EU or specific industries, and the final result of the court ruling to block President Trump’s tariffs all underpin an environment of extreme uncertainty. Indeed, we still expect an industrial recession in Q2 and Q3 of this year, and our industrial forecast in 2026 remains little changed from our previous update.

US industrial weakness is not uniform

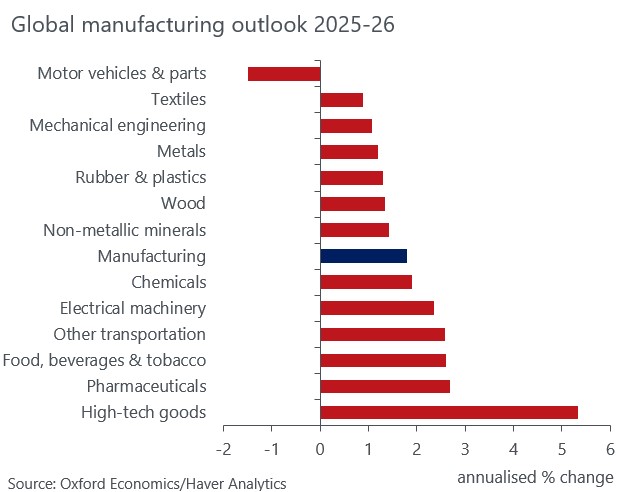

The US itself is at heart of the weakness in global industry. Uncertainty remains a major constraint and will continue to dampen business and household sentiment until there is more clarity on the direction of fiscal and trade policy. This will weigh on firms’ willingness to invest in expensive outlays, disproportionally impacting activity in investment-driven industries including construction and machinery, as well as in big-ticket durable goods such as motor vehicles.

In addition, tariffs will increase the cost of imported inputs to production. US industries that are more reliant on these imported inputs are especially exposed to the increase in costs. Automotive supply chains are highly integrated in North America, with parts often crossing borders multiple times, although exemptions for USMCA compliant parts lower the burden somewhat. We expect that automotive prices will rise significantly under the current tariff regime.

Despite the weak industrial picture, some elements of US industry remain resilient with solid demand for electronics, driven by demand for computing power from AI and data centres. The fact that semiconductors and are exempt from tariffs—at least for now—will help curb the inflationary pressure on imported inputs. Recent investments—driven by the CHIPS Act—have raised the sector’s domestic productive capacity. More domestic-oriented sectors, such as food and beverage, will also be among the strongest growing sectors in the US.

Tariffs will lead to winners and losers across countries and sectors

Lower US imports will weigh on industrial production in the US’s key trade partners, but the impact is not uniform. For Canada and Mexico, their close trade relationship to the US leaves their industrial sectors extremely vulnerable to any US-imposed tariffs. The fact that USMCA-compliant goods are exempt from most of the tariffs—and that energy is tariffed at a lower rate—partially shields their industries from the worst impacts of the tariffs. However, both countries are subject to the global steel and aluminium tariffs, particularly important for Canada. In addition, US industrial weakness will hit demand for their exports.

We remain cautious about the outlook for China as it has the highest effective tariff rate among all of the US’s major trade partners. Trade-intensive sectors such as textiles, furniture, and other consumer goods will suffer as a result. Electronic goods are among the most heavily exported to the US, but several products, including smartphones and semiconductors, are exempt from the current round of tariffs.

Globally, the automotive industry is particularly vulnerable in the current environment due to a 25% tariff on all (non USCMA-compliant) autos and parts to the US. The sector is heavily reliant on cross-border supply chains and is also highly cyclical as it depends on both investment spending and consumer purchases of big-ticket items. Automotive, along with trade-intensive and investment-driven sectors, have among the weakest outlooks over the next two years.

Navigating the Great Industrial Recession

While the easing of US-China trade tensions is a positive development, the corporate environment has undergone a fundamental shift since the start of the year. Despite the partial reprieve on tariffs, the global industrial landscape is still in a state of flux, creating both challenges and opportunities for businesses. Companies must treat tariffs as long-term challenges to their strategies for growth, partnerships, and profits and react accordingly.

For latest reports on trade and tariffs, please visit our topic page.

Subscribe to our newsletters

Tags:

Related Reports

Navigating fundamental drags and policy drives for China’s manufacturing investment in 2026

Chinese manufacturing fixed investment shrank by 6.7% year-on-year in October, deepening the slump that began in July. We expect this decline to continue for most of H1 2026. The pace of recovery will depend on the policy support in the Fifteenth Five-Year Plan.

Find Out More

India’s GST reform benefits durables, but far from a game changer

Research Briefing Industrial recession still expected due to global tariff chaos

Find Out More

The Impact of Intelligent Operations

Our survey of 1,000 senior leaders from the manufacturing, retail, and transportation and logistics sectors shows that improving workflows translates to a range of benefits, from financial gains to improved customer satisfaction and employee productivity.

Find Out More

The Digital Frontier—can the AI hype go on forever?

We believe that the current AI hype in financial markets will only be justified if companies can adopt AI quickly and effectively. In The Digital Frontier series, we will evaluate the state of AI and data centre investment and explore implications for different countries, cities, and sectors.

Find Out More