Blog | 21 Oct 2021

Supply chain pain: three key questions, answered

Alexandra Hermann

Lead Economist, Asia Macro

Not a day goes by without a fresh headline about the mix of supply-chain bottlenecks that continues to disrupt industrial production worldwide. And it seems as if any news about easing disruptions is immediately overshadowed by new problems emerging elsewhere. Power crunches in China hampering the production of export goods are only the latest chapter in the supply chain chaos saga. Here are three things you should know about the global issue.

1. Is there enough capacity to meet demand once bottlenecks begin to ease?

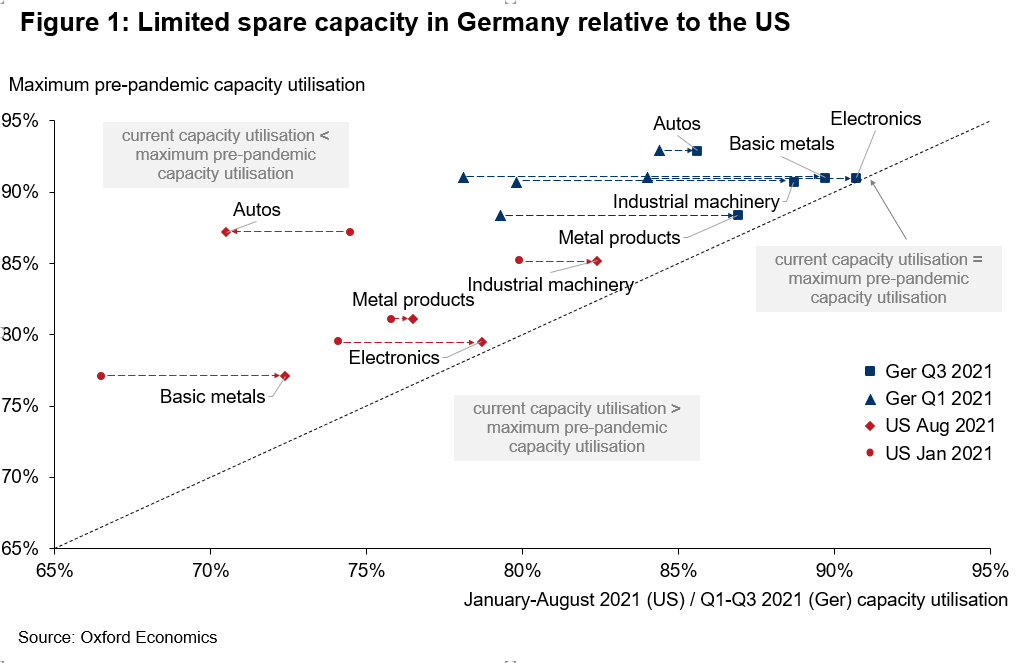

In most sectors, manufacturers have responded to surging goods demand by raising capacity utilisation rates. For instance, since the beginning of the year, US and German manufacturers of electronics have been able to raise their capacity utilisation rates by five and seven percentage points, respectively. The auto sector, by contrast, has not been able to keep up with other sectors’ improvements. When comparing current utilisation rates to pre-pandemic maximum rates (as shown by the 45-degree line in Figure 1), the data suggest that there is generally little room to boost capacity further, albeit somewhat more in the US than in Germany. A backlog of investment in industrial infrastructure is a likely explanation, but that would take a long time to deliver benefits even if that started now. Therefore, even when supply chain disruptions ease, we see considerable roadblocks to a quick clearing of order backlogs.

2. When will bottlenecks begin to ease?

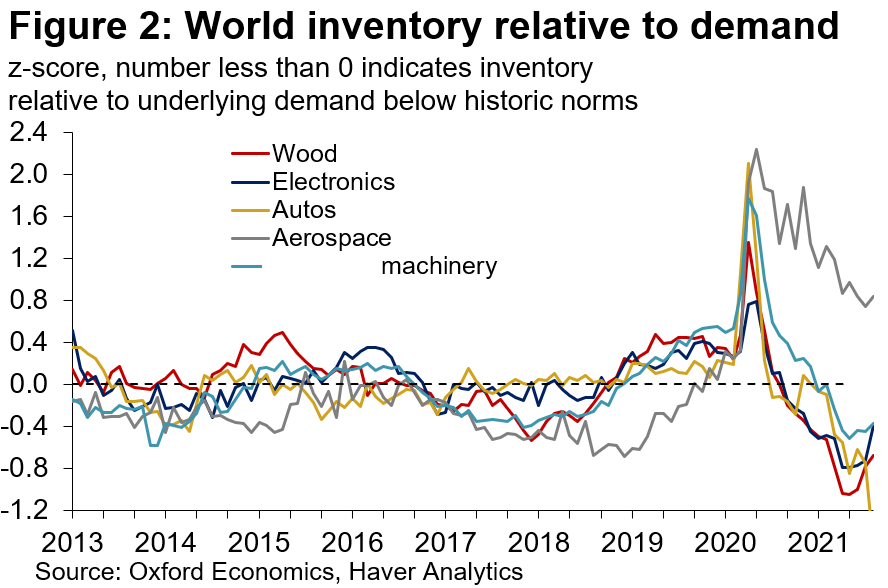

The severe supply chain disruptions have hindered global industrial production’s ability to accommodate strong consumer demand, leading to a drawdown in inventories relative to demand. However, the most recent data to August suggest that inventory tightness has begun to ease somewhat in several sectors. The notable exception is automotive, where the global shortage in semiconductors continues to hamper production. Our outlook generally remains cautious due to the time it takes to build chip factories (which have been planned by the likes of Intel and TMSC) or expand the fleet of container ships—another major source of bottlenecks. Indeed, respondents to the Global Risk Survey we conducted in September also anticipate supply chain issues to persist for longer. Around half of respondents expect disruption to their business to end only in the second half of 2022. Preliminary results from the October survey update suggest that the share of pessimistic respondents has grown even further over the past month.

3. Are there other potential supply headwinds to be mindful of?

The expectation so far has generally been that once intermediate goods supply issues ease, shipping pressures lift off, and capacity is built, industrial output will accelerate. However, it may not be completely smooth sailing even at that point. Labour shortages have emerged as another key risk for the recovery: In the US, for example, manufacturing employment in August 2021 was almost 3% below its level in December 2019. But recovery is under way and we expect labour supply shortages to unwind more rapidly as generous unemployment benefits expire. By contrast, in Germany, the manufacturing sector already employs 4% more people than in Q4 2019, pointing to issues of a more structural nature than in the US and hence limited quick fixes to alleviate labour shortages.

While the current challenges are significant enough that many businesses are still in a reactionary mode to ensure short-term survival, companies have started to rethink their supply chain management, and we expect some trends to become permanent post-pandemic. Our recent survey of executive perspectives and expectations regarding global supply chains finds that one major shift is a tweaking of the delivery model from “just-in-time” to “just-in-case,” which would reduce exposure to at least some bottlenecks that may re-emerge in the future.

Tags:

You may be interested in

Post

US Shipping freight rates on track to stay low in 2026

Our supply chain stress index moderated in September as import volumes continue to decline following front loading activity earlier this year. High frequency data shows that this trend has kept up in Q4, meaning port congestion is unlikely to become a concern.

Find Out More

Post

The economic footprint of railway transport in Europe

This study demonstrates the economic importance of railway transport by providing a comprehensive analysis of the economic footprint of railway transport in Europe. We analyse how the railway sector’s activities contributed to GDP and supported jobs across the EU27 in 2023.

Find Out More

Post

Why have China’s exports held up so well under higher US tariffs?

China's exports have adapted, rather than retreated, under higher US tariffs. It will be difficult for businesses and consumers to decouple from Chinese exports or China-linked supply chains.

Find Out More