Research Briefing

04 Dec 2025

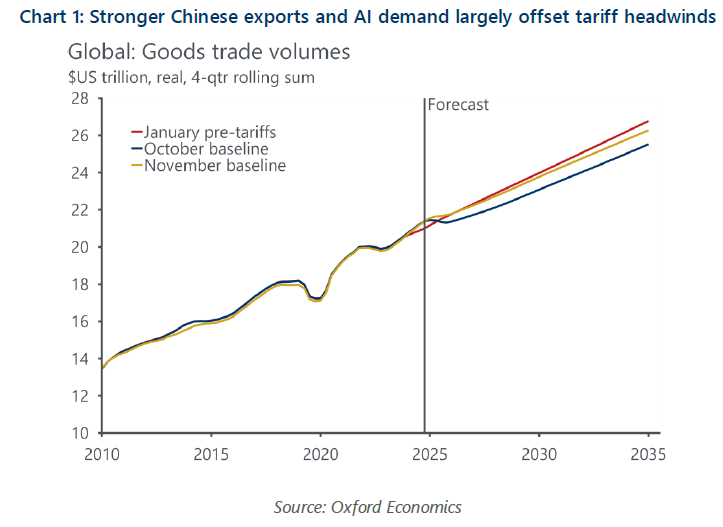

China and AI underpin stronger global trade outlook

Global trade outlook strengthens as tariff cuts, AI investment, and China’s export push reshape near-term growth.

We’ve upgraded our global trade forecasts on the back of lower tariffs, continued AI investment, and China’s doubling down on its export-led growth strategy. We now expect nominal trade to rise by 4.9% this year and only slow to 2.1% next year. In volume terms, global trade is set to grow 4.2% this year and 1.2% in 2026.

- The US and China reached a temporary trade truce in October, with Washington reducing its tariffs on Chinese imports to the US by 10ppts and Beijing pausing its restrictions on rare-earth exports. The lower tariffs have led us to upgrade our forecasts for the growth of Chinese exports to the US to a contraction of 8.2% in 2026, slightly less than the 10% decline we pencilled in just last month.

- The US also announced a series of (mainly incremental) trade deals across Asia and Latin America, and a more substantial agreement with Switzerland. Under pressure to reduce cost-of-living pressures, the US cut tariffs on a wide range of agricultural imports. The US effective tariff rate now sits at 12.8%.

- However, a Supreme Court ruling could invalidate a large share of country-specific tariffs. The US’s highest court heard oral arguments in November on the constitutionality of the IEEPA mechanism used to justify many of the US administration’s tariffs. If found to be unconstitutional, the administration will likely pivot to Sections 301, 122, or 232 to implement tariffs.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]