Research Briefing

12 Nov 2025

Shrinking development pipeline supports CRE rental growth in Europe

Detailed forecasts show which markets will see the strongest stock gains.

A shrinking development pipeline is supporting vacancy rates and rental growth, generating a sense of optimism across European commercial real estate markets.

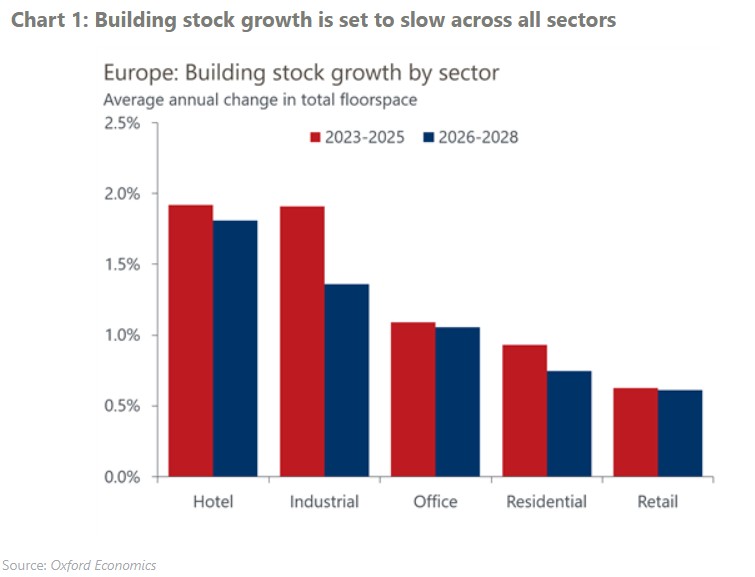

Our development pipeline data suggest European building stock growth will slow across all five of the major property sectors over the next three years.

- The hotel and industrial sectors are still set for the fastest stock growth despite the pace slowing, consistent with the past three years. We think office, residential, and retail stock will grow at a more modest pace.

- Markets in Central and Eastern Europe are expecting a faster pace of stock growth in the office and industrial sectors. Southern Europe leads the way for retail, while Germany and the Nordics dominate hotels.

- Among cities, Budapest comes in first for industrial development over 2026-2028 and second for office development, outshined only by Dublin, where strong demographics tend to drive higher construction rates compared to other Western European markets. Southern European capitals including Madrid, Lisbon, and Milan rank in the top five for retail stock growth.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]