GCC: Fed rate cut unlocks further boost for domestic demand

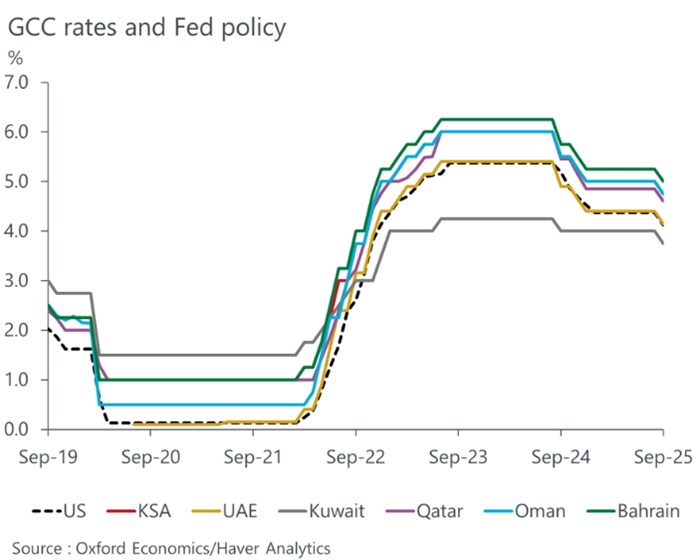

The resumption of the US Fed’s rate cutting cycle in September 2025 is set to create a more favourable credit environment across the economies of the Gulf Cooperation Council (GCC). With regional currencies closely pegged to the US dollar, moves by the Fed are swiftly mirrored by local central banks, leading to immediate shifts in borrowing costs for consumers and businesses alike, thereby setting the stage for a significant boost to regional consumption and credit growth that could reshape the economic landscape.

Lower borrowing costs drive consumer confidence

The US Federal Reserve lowered interest rates by 25 bps at its September policy meeting last Wednesday, and the median rate projection in the dot plot showed two more quarter-point cuts in 2025. Following the Fed’s interest rate decision, all six GCC central banks lowered their respective interest rates by 25 basis points last week, providing a further boost to domestic demand.

GCC central banks shadow the US fed’s monetary policy paths

Lower policy rates in the GCC mean reduced borrowing costs for mortgages, car loans, and personal credit, leaving households with more disposable income and encouraging higher levels of spending. Durable goods, real estate, automobiles, and consumer discretionary sectors are likely to be among the primary beneficiaries as consumer optimism rises and households find credit more accessible. We project consumption will increase by 3.4% per annum across the GCC over the next five years, double the pace of 1.7% expected in advanced economies.

Booming household credit expansion amid a resilient banking sector

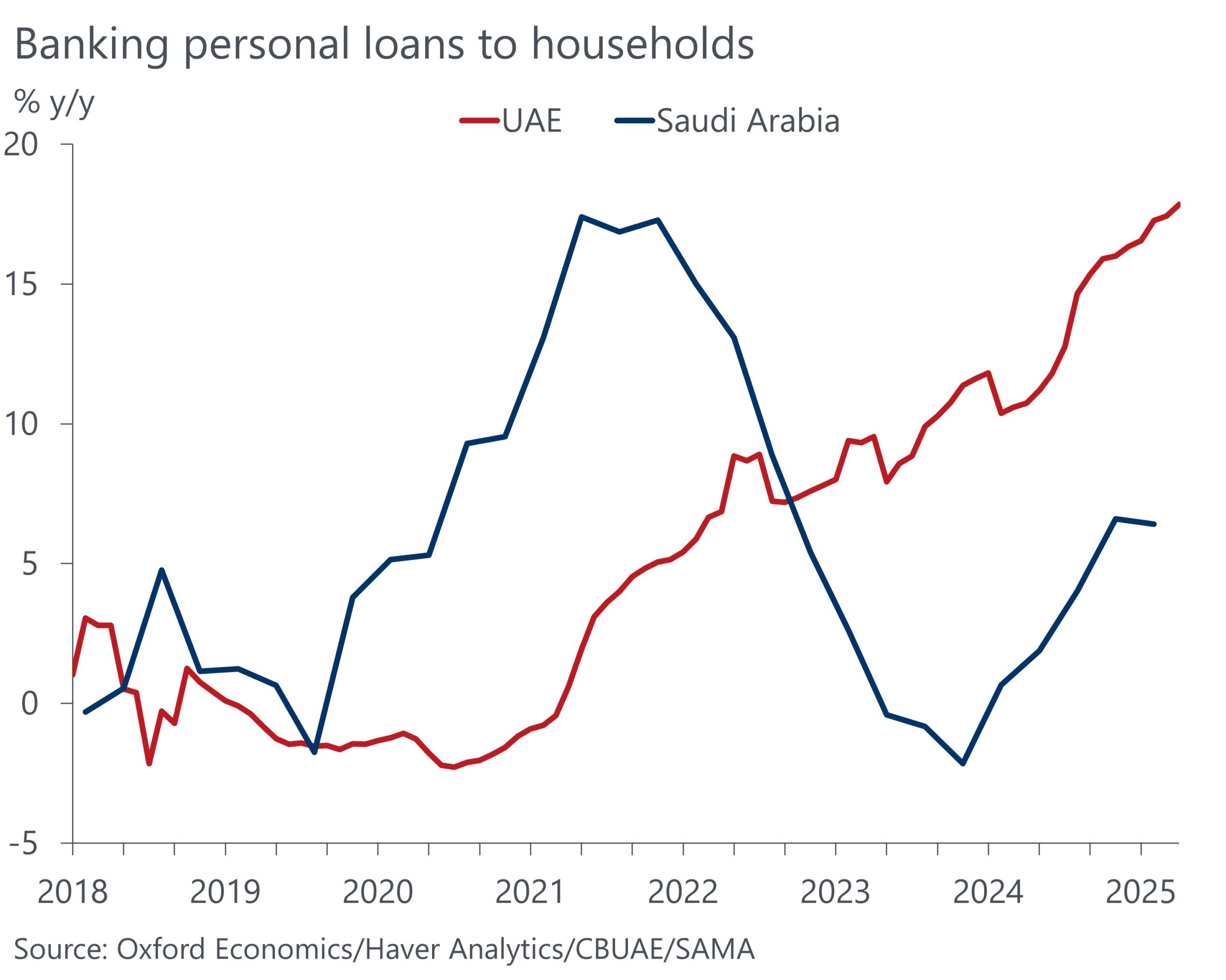

Lower borrowing costs, alongside favourable cyclical factors, are driving robust credit growth across the GCC. Expanding credit availability is a core component of regional development plans, with some countries extending access to non-national citizens, resulting in a significant surge in demand.

The UAE and Saudi Arabia exemplify this trend. Our recent research revealed that in Saudi Arabia, personal lending has rebounded following a dip in 2023 that succeeded pandemic-driven growth. Meanwhile, UAE private sector retail loans have surged over 50% since January 2022, sustaining double-digit growth since late 2023. This reflects a structural break from previous trends, propelled by relaxed lending standards for both nationals and expatriates.

Strong credit growth a key driver for spending

An increased supply of land and properties available to expatriates, coupled with steady migrant inflows, has energized the residential housing market. This buoyant housing sector signals both strong economic growth and elevated consumer confidence—more so than unsecured consumer credit, given the durable and high-value nature of property purchases and associated costs. Additionally, increased housing transactions stimulate demand for furniture, appliances, and other durable household goods, further benefiting the consumer sector.

Despite rising consumer debt, GCC banks remain highly resilient. The sector is underpinned by robust capital buffers, healthy loan-to-deposit ratios, and disciplined risk management practices. For example, UAE banks report a household debt-to-GDP ratio of just 30%, well below many developed markets, alongside steadily improving provisions for potential loan losses. Although recent rate cuts have slightly compressed net interest margins, these effects are expected to be offset by higher lending volumes and improved credit quality driven by lower borrowing costs and accelerated economic activity.

Regional diversification gets a boost

The Fed’s easing cycle arrives at an opportune moment for GCC economic diversification efforts. Lower borrowing costs reduce financing expenses for governments and corporates alike, providing crucial support for ambitious transformation projects from Saudi Vision 2030 to the UAE’s industrial strategy. This cheaper capital is particularly valuable for non-oil sectors, which are already driving growth momentum across the region.

We believe the combination of lower rates, strong employment growth, contained inflation, and robust fiscal positions creates an unusually favourable environment for sustained consumption growth and economic transformation. We forecast GDP growth in the GCC at 4.1% for this year and 4.6% in 2026, substantially outpacing the advanced economies’ projections of 1.6% and 1.4%, respectively. For a region already demonstrating remarkable dynamism, these tailwinds promise to amplify existing momentum and create new opportunities for businesses and consumers alike.

If you’re interested in speaking to our specialist regional team of economists to, feel free to drop us a line.

Contact us

If you would like to find out more about our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Tags: