Overview

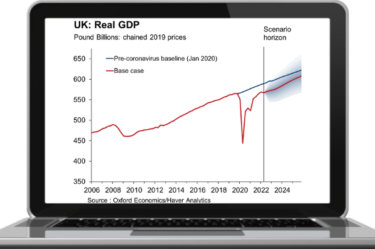

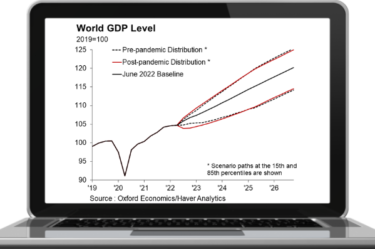

With our forecast track record, the high level of data granularity covered in our models, the in-depth analysis of our 300 in-house economists, and the world’s leading globally integrated macro model, Oxford Economics produces robust, forward-looking distributions and associated probabilities for the macroeconomic outlook. This comprehensive and flexible service includes up to six economic scenarios and their associated probabilities, spanning 85 countries.

What our service includes

Up to six macroeconomic scenarios

Our service includes two upside and three downside scenarios around our baseline to help you assess local and global risk and cover the expected lifetime of assets.

Detailed reports

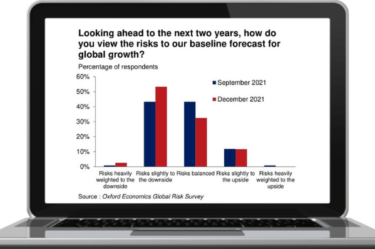

Comprehensive reports explicitly detail changes from the last set of scenarios based on our current trends and risks analysis, informed by proprietary global surveys of around 200 leading companies and external benchmarks.

Regular updates and in-house support

Scenarios are updated quarterly to reflect changes to the base case and emerging risks. We also provide full client support to answer questions about our data and forecasts.

Comprehensive variable coverage

Scenario outputs for all 85 countries included on the Global Economic Model cover the key drivers of impairment: property prices, financial asset prices, income gearing, interest and FX rates.

IFRS 9 Scenario Service

Discover more about our methodology, our approach and the clientele of our service.

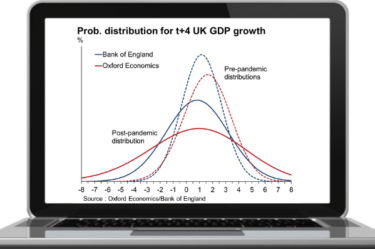

What's our methodology

The methodology used to construct these forward-looking distributions is similar to that used by the European Central Bank and Bank of England when assessing the risks around their central projections.

Based on these robust distributions, we derive coherent economic scenarios along with their probability. Crucially, our approach ensures that the only changes to scenarios from quarter to quarter are due to a transparent assessment of emerging or receding risks utilising external benchmarks and proprietary surveys on the nature and severity of risks to the economy.

What is our modelling approach?

At the centre of our approach is our renowned Global Economic Model, which integrates individual country models through global assumptions about trade volume and prices, competitiveness, interest and exchange rates, capital flows and commodity prices.

The model’s unique open-architecture framework enables us to assess the impacts of adverse scenarios on economic indicators and a range of asset classes. The model’s flexible software allows variables to be added to meet our clients’ needs when assessing the impact on portfolios of multiple economic scenarios.

What are our endorsements?

Our existing list of IFRS 9 clients spans major financial institutions in the UK, Eurozone, Asia, Middle East and Africa. In the US we also support financial institutions with our CECL service.

IFRS 9 Scenario Service

We offer a solution for IFRS 9 scenarios specifically designed to meet the requirements of the accountancy standard. The advantages of our methodology are that it minimises P&L volatility, it is highly robust and it is based on a validated economic model.

“Services provided are always delivered timely according to the agreed timetable. Output is solid and in discussions OE has shown to be very responsive and proactive. Turnaround time is quick.”

Resources and events

Research Briefing

Nowcast shows wage growth slowing sharply

Research Briefing

The euro and depreciation – shake, shake it off

Blog

MENA – Latest Trends

Blog

You don’t have to be an IT expert to lead on AI

Webinar

Frontier markets outlook: Looking for opportunities after the rally

Webinar

Economics of a second Trump presidency

Event

Tassi delle Banche Centrali in discesa, ma quando e con quale ritmo?

Webinar

Rebalancing of city tourism demand around the world

Global Key themes 2022: Supply chains to begin normalising

Featured

Contact us

If you would like to find out more about our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Talk to us about how you can benefit from our IFRS 9 Scenario Service

Talk to us

Trusted By