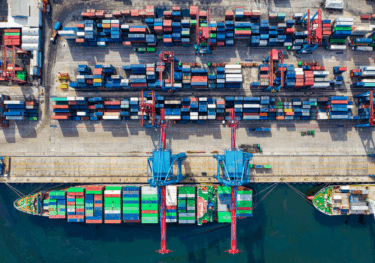

The Deglobalisation Myth: How Asia’s supply chains are changing

Global supply chains have continued to expand, despite talk of deglobalisation and nearshoring. Analysing bilateral flows of trade in intermediate goods (IG), we find that global IG exports have grown by 6% a year between 2018 and 2022. Outside of some specific cases such as US-Mexico, regional-shoring is not yet present at the global level.

Asia’s supply chains are changing rapidly. We also find evidence of China’s decoupling – but only with US and Japan. In contrast, China has actually became more important for international supply chain in major Group of 7 economies. Outside the top 3 regional players (China, Japan and Korea), several Asian countries are emerging as “hotspots” of supply-chain trade growth. In particular, Vietnam and Indonesia registered double-digit growth in annual intermediate goods exports during this period.

There are more than one winning formula in this regional reconfiguration process. Economic offering matters and we found three archetypes of hotspot countries.

Also, economies don’t have to choose in this China-US decoupling. In fact, Vietnam and Taiwan became a lot more important for supply chains of both the US and China during this period.

The experts behind the research

Our Macro Consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques. Lead consultant on this project was:

Thang Nguyen-Quoc

Lead Economist, Macro Consulting

Tags:

Recent reports on supply chains

Industry key themes 2026: Industry will grow if you know where to look

Prospects appear solid for global industry in 2026, but activity is set to remain regionally and sectorally divergent.

Find Out More

US Bifurcated ꟷ Economic backdrop deepens racial disparities

Black and Hispanic households have experienced more inflation than other groups since the reopening of the economy from the pandemic lockdowns. Although there've been many phases of high inflation, some have disproportionately hurt these minority groups, such as the jump in energy prices following Russia's invasion of Ukraine, with the ensuing surge in rental inflation further setting them back.

Find Out More

Global Valve and Actuator Market Report 2025

We expect the global valves market to register an increase of 3.0% in 2025 and 3.1% in 2026. The downgrade is largely due to a weaker outlook for growth as a result of the impact of tariffs.

Find Out More

US Shipping freight rates on track to stay low in 2026

Our supply chain stress index moderated in September as import volumes continue to decline following front loading activity earlier this year. High frequency data shows that this trend has kept up in Q4, meaning port congestion is unlikely to become a concern.

Find Out More