Blog | 11 Apr 2023

Weaker financial sector hurts US spending on technology

Mark Killion

Director of US Industry Services

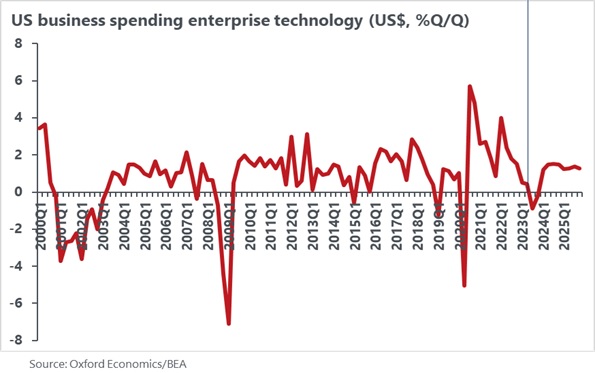

Oxford Economics has introduced its new Tech Spend Monitor that provides forecasts of US spending on enterprise technology by industry. Our baseline forecast shows that business tech spending will fall -1.2% in the second half of 2023, after rising over 10% on average during 2021-2022. Leading the downturn will be spending from the manufacturing, information, and financial sectors.

We are forecasting a modest economic recovery will take hold by the second half of 2024 and extend through 2025, with technology spending led by services sectors such as transportation, distribution, health care and entertainment.

The slowdown in technology spend began in 2022 with a post-Covid pullback in purchase of electronics and computers, also telecommunication services, while rising interest rates weighed on housing and related manufacturing. That slowdown was followed by a rolling series of employee layoffs from the information sector, a partial correction to the over-hiring that followed the pandemic. Now, the recent onset of weaker banking sector will further depress business spending.

Among products purchased, electronic devices and telecommunications are proving to be the most challenged. Also, business purchase of enterprise software is sensitive to changes in number of employees, so the decline in employment by technology and financial firms have become a strong headwind.

Faring better is spending for software and IT systems, also use of cloud and data processing services. These categories will retain a higher priority within business investment budgets, supported by the drive to develop and use AI systems, and the need for greater Cyber security.

After the downturn, products related to IT and cloud services will benefit from a modest economic recovery forecast over 2024-2025, also joined over the medium term by rebound in communication devices and services. The post-recession expansion of electronics will be driven by several secular trends, such as:

- roll out of 5G communication services

- greater use of connectivity for Internet of Things

- rising competition among internet/cloud and communications service providers

- new semiconductor manufacturing facilities results in higher US output, but also leads to overcapacity, which hurts industry pricing power

Despite the near-term downturn, the subsequent recovery and longer-term expansion of spending on technology will underpin the sector’s role in leading economic growth and fostering innovation. For example:

- US business spending on enterprise technology will increase share of GDP from 7.2% to 8.3% by 2030

- The investment portion of tech spend will increase share of overall US private sector fixed investment from 15% to 20%

- Nevertheless, both shares leave ample room for continued outperformance

Author

Mark Killion

Director of US Industry Services

Mark Killion

Director of US Industry Services

Philadelphia, United States

Mark Killion, CFA, is Director of Director of US Industry Services at Oxford Economics, with extensive experience in research and modelling for economics and finance, also skilled in the presentation of insightful conclusions and strategies. Killion brings value to companies and governments by developing state-of-the-art products that use innovative metrics to reliably forecast market conditions, and benchmark business performances.

Tags:

You may be interested in

Post

The rise of Southern India’s business service hubs

Over the next five years, India is set to be one of the fastest-growing major economies across Asia Pacific, lead by the performance of its IT and business services. The Southern states of Karnataka and Telangana are at the forefront of this success as they are home to two of India’s most rapidly growing cities and productive cities—Bengaluru and Hyderabad.

Find Out More

Post

Asia Chip Export Index

Asia chip export index (CEI) showed a remarkable rise of 27.3% in value and 26.2% in volume year-on-year.

Find Out More

Post

Japan’s software investment reduces the tariff shock to capex

Software investment in Japan has risen sharply since the late 2010s, outpacing investment overall. We expect this high rate of growth to continue as the economy undergoes a digital transformation and the acute shortage of labour continues, driven by adverse demographics.

Find Out More