Blog | 14 Apr 2021

The API economy vs. the forces of chaos

Graeme Harrison

Director of EMEA, Macro Consulting

Software developers celebrated in early April when the US Supreme Court shot down a high-profile copyright case after a decade of litigation, making it easier for coders to use a critical bit of digital plumbing called an application programming interface, or API, which allows applications to interoperate with each other.

APIs don’t usually make headlines, but they are part of a big story that is remaking businesses far beyond the technology sector: Data-sharing and analysis tools are breaking down traditional barriers between corporate functions, business units, suppliers, customers, regulators, even competitors.

The old adage is you can’t manage what you can’t measure. The new reality is you can measure how changes in one area create risks and opportunities—and how those might cascade and feed back across multiple nodes on a network, or, to use a popular metaphor, an ecosystem.

Say you want to introduce a new product. Or a giant freighter gets stuck in a canal and chokes global commerce for several days. How well are you prepared to gauge the impact on your procurement, production, and customer service functions? Can you route around the problems in real time, and beat your competitors to market? It’s like the Butterfly Effect, but with a lot of butterflies and many possible outcomes.

This API economy is maturing fast, according to a survey of 1,000 chief information officers we conducted last year as part of a research program with Google Cloud. Respondents, spread across eight countries and seven industries, came from companies with at least $2 billion in revenue, including a meaningful sample of companies with more than $20 billion.

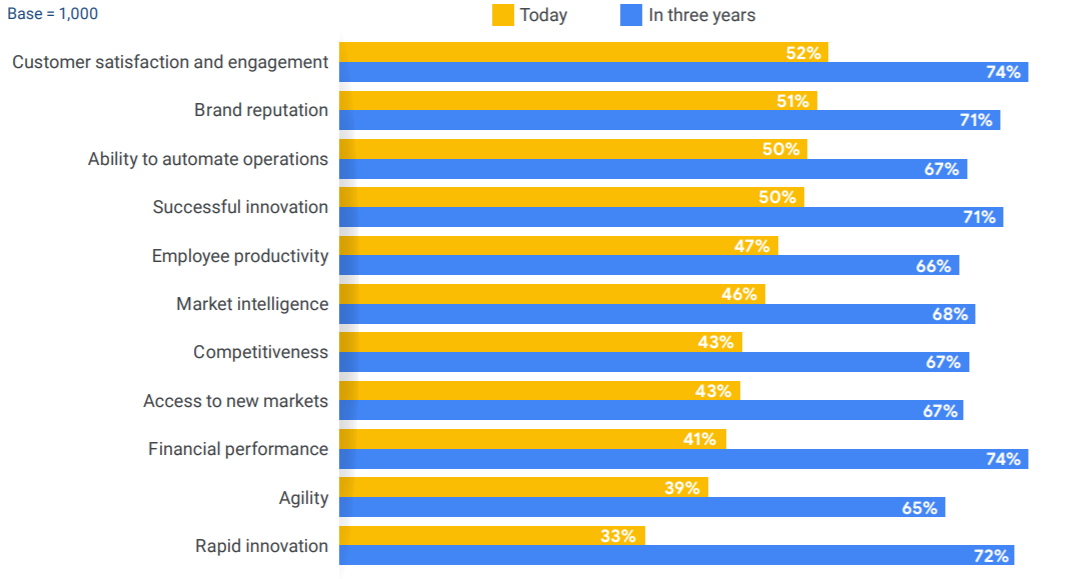

These executives told us that the positive impact of tighter next-generation relationships is already widespread and expected to be pervasive by 2023. Companies that are furthest along in building out their ecosystems rate themselves higher than industry peers in areas ranging from risk management to innovation, productivity, and revenue growth.

Q: To what extent do your business relationships and ecosystems support the following business goals today? In three years? “Substantially” and “Highly important” responses

Q: To what extent do your business relationships and ecosystems support the following business goals today? In three years? “Substantially” and “Highly important” responses

It takes more than software and tons of high-quality data to create and sustain competitive advantage in this hyperconnected world. Management must think holistically about an entire system of systems to understand how changes ripple and rebound across a web of interdependent relationships.

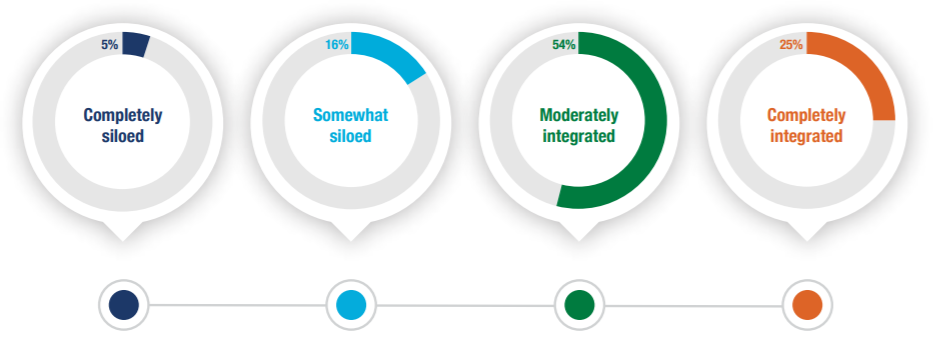

We looked at this emerging management discipline, sometimes called systems thinking, in another recent research program with SAP. While only a handful of the 3,000 companies surveyed (about 6%) demonstrated superior visibility across their digital ecosystems, this group tends to outperform rivals on several important business performance metrics, including innovation. Integrated relationships are more developed within companies than across broader business networks.

Q: Which best describes your organization’s operations across functions, in terms of their communication, data-sharing, and process management? Select one. Base = 3,000

Q: Which best describes your organization’s operations across functions, in terms of their communication, data-sharing, and process management? Select one. Base = 3,000

The last year has been a challenging one for the complex systems that define our global economy, from shipping and logistics to travel and public health. Meeting those challenges and empowering organizations with greater resilience, flexibility, and foresight is the promise of the ecosystem mindset and the technologies and data-sharing practices that enable it.

Tags:

You may be interested in

Post

KPMG M&A Outlook 2026: Between Uncertainty, Resilience, and Seizing Opportunities

Discover how Germany’s M&A landscape is evolving – with a focus on growth, AI and post-merger value creation.

Find Out More

Post

Powering the UK Data Boom: The Nuclear Solution to the UK’s Data Centre Energy Crunch

The UK’s data centre sector is expanding rapidly as digitalisation, cloud computing, and artificial intelligence (AI) drive surging demand for high-performance computing infrastructure.

Find Out More

Post

Are humanoid robots creepy?

Some very smart people are betting that machines shaped like humans will do much of our household and factory work for us in the near-ish future. But hurdles remain.

Find Out More