Blog | 27 May 2021

Will GCC countries be economies of the future or old oil ghost countries?

The sustainability of hydrocarbon revenues among Gulf Cooperation Council (GCC) economies has been a major concern for decades, prompting a plethora of policies, visions and reforms focused on economic diversification. Undoubtedly, oil will continue to play an important role in the foreseeable future, even as demand for hydrocarbons is set to run out of steam and weaken from current levels, consistent with the gradual transition towards renewable energy, in line with the Paris Agreement to achieve net carbon zero by 2040.

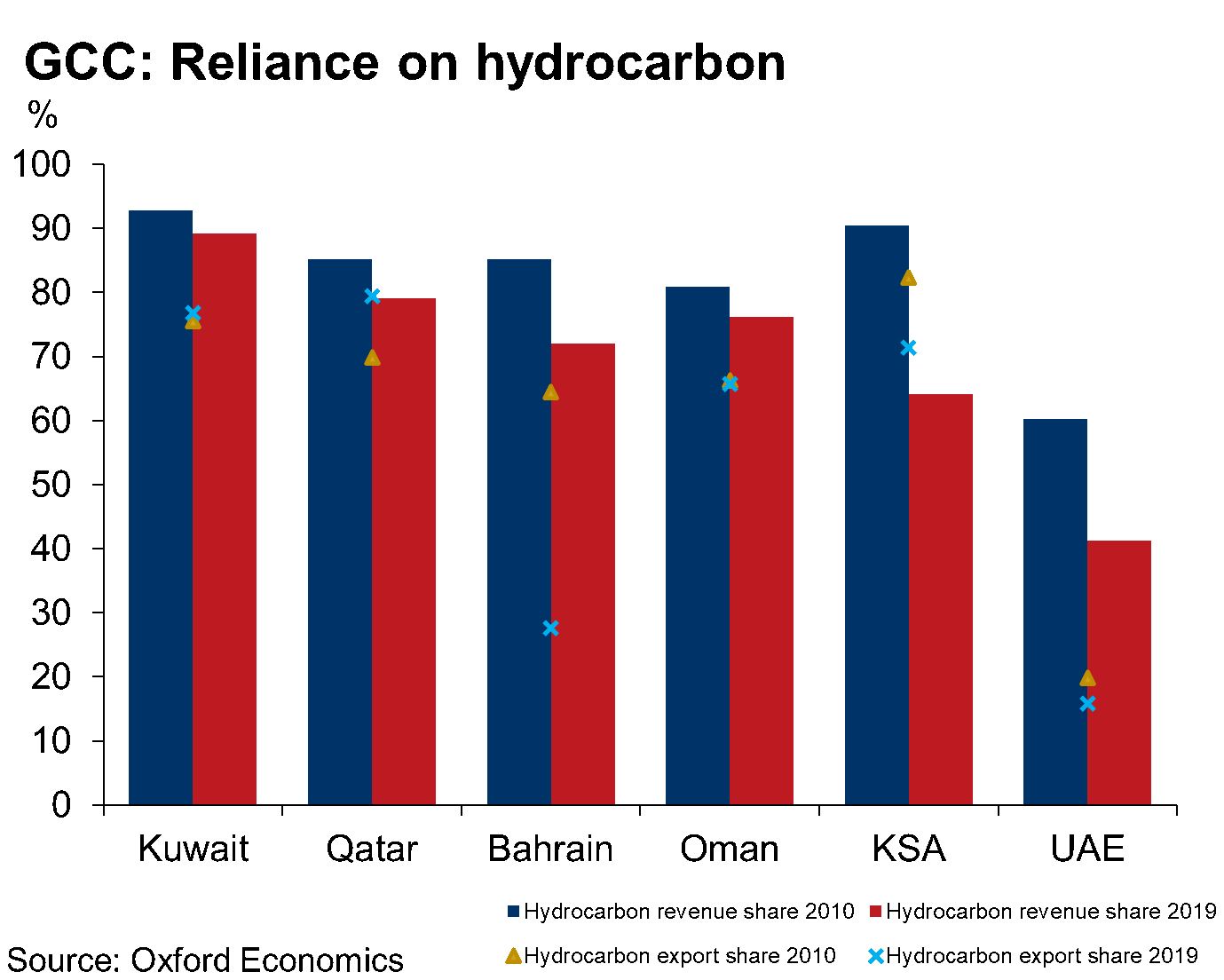

Oil extraction remains vital given its direct contribution to GDP. Oil and gas production represent over 40% of GDP in GCC countries with the exception of the UAE and Bahrain. More alarmingly, transfers of hydrocarbon revenues indirectly support the region’s non-oil activity, which accounts for over 70% of total revenues in GCC countries except Saudi Arabia and the UAE. Sectors such as refining, chemicals, food and metals and power generation capacity are designed to take advantage of access to cheap oil and gas, while the ever-expanding tourism sector, reliant on long-haul visitors, is also relatively oil-intensive.

Oil extraction remains vital given its direct contribution to GDP. Oil and gas production represent over 40% of GDP in GCC countries with the exception of the UAE and Bahrain. More alarmingly, transfers of hydrocarbon revenues indirectly support the region’s non-oil activity, which accounts for over 70% of total revenues in GCC countries except Saudi Arabia and the UAE. Sectors such as refining, chemicals, food and metals and power generation capacity are designed to take advantage of access to cheap oil and gas, while the ever-expanding tourism sector, reliant on long-haul visitors, is also relatively oil-intensive.

The Covid-19 pandemic highlighted the pitfalls of over-reliance on oil for growth. A global economic slowdown induced by the pandemic pushed Brent crude prices down from $64 pb at the start of 2020 to a low of $23 pb in April 2020, amplifying the need for sustainable diversification. The IMF estimated that unless GCC countries undertake substantial fiscal and economic reforms, their foreign reserves will be depleted by 2034 with the pandemic likely to have shortened this timeline.

The GCC region is yet to escape this turbulent phase with both the fiscal balance and current account balance shifting from surplus to deficit. Even with oil prices at $70 pb, several GCC economies will struggle to meet fiscal break-even levels, sharpening the urgency of the search for new sources of revenue. Further oil price volatility will limit diversification efforts.

The decline of the US Rust Belt serves as a reminder of the consequences of failing to diversify and adapt adequately. The region’s failure to implement the right-to-work state policy until 2012, while most of the south-eastern states had the laws in place since the 1950s, highlights its complacency. Oil booms in towns like Williston, North Dakota in 2012 swiftly vanished when oil prices plummeted in 2015, causing the industry and the regional population to disappear. The GCC isn’t there yet, but complacency in capitalising on the latest oil price surge risks a similar outcome for the Gulf.

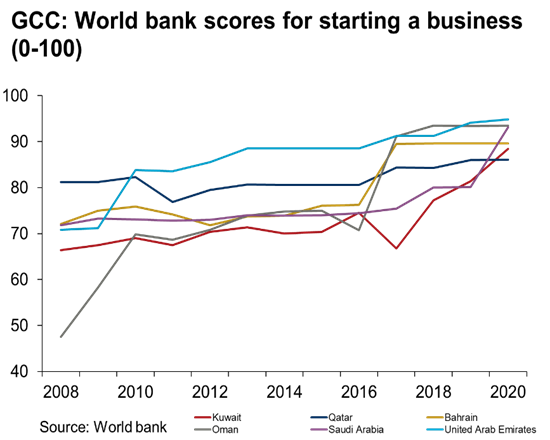

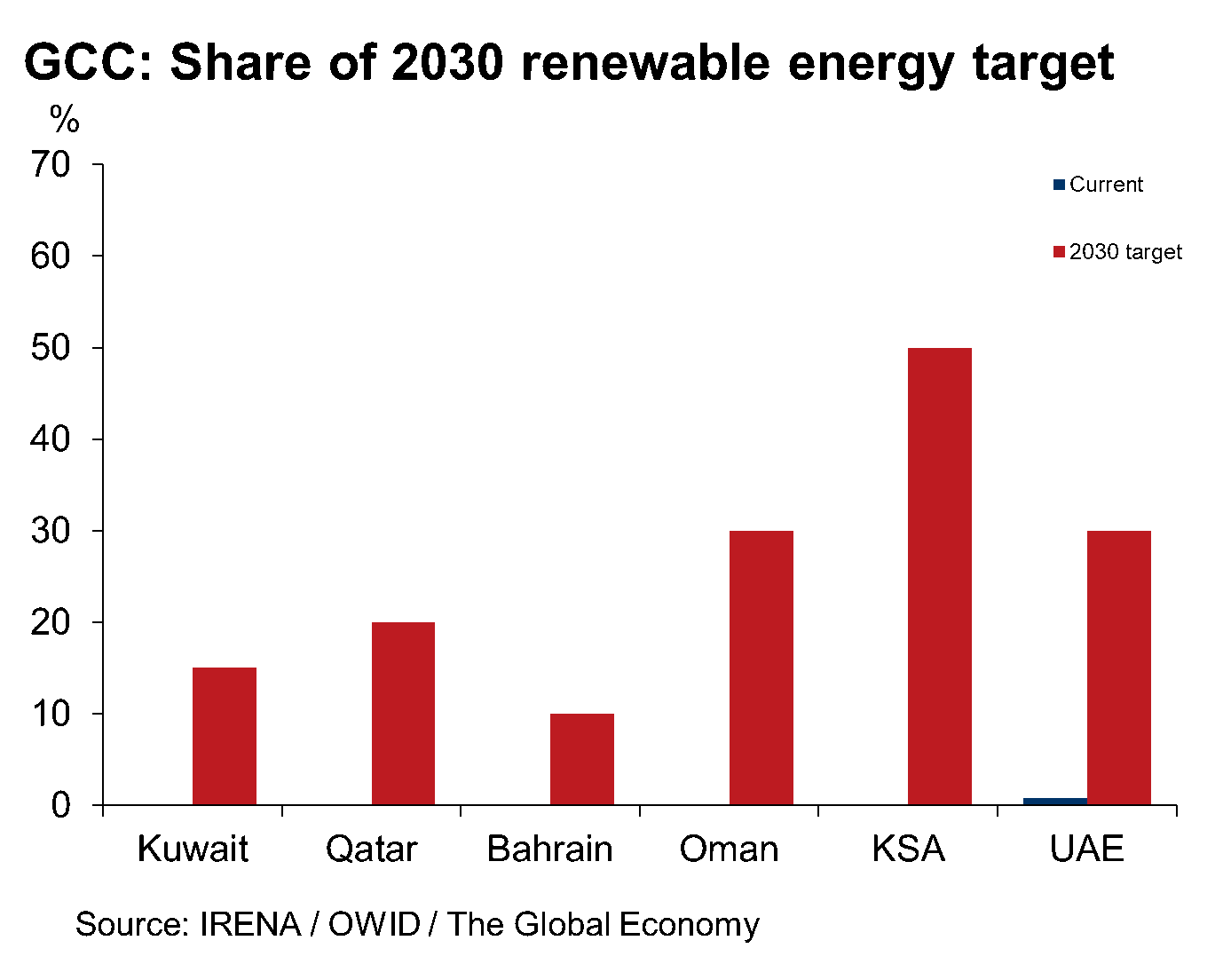

Policy makers have recognised the impending issue and have acted decisively by introducing ambitious diversification policies. Saudi Arabia has already made a bold effort to capitalise on the green hydrogen market. A $5bn energy plant powered by sun and wind is set to supply the planned futuristic city of Neom in 2025. Saudi Electricity Co. raised $1.3bn by selling 5- and 10-year dollar denominated bonds to finance green capital projects last year. Similarly, Qatar National Bank issued its first green bond worth $600m in 5-year senior unsecured notes. The UAE commissioned its first green hydrogen plant this year, which will supply fuel to certain vehicles during the anticipated Expo 2020. Installed solar photovoltaic (PV) capacity is expected to increase four-fold from its current 2.1GW level by the end of 2025. Meanwhile, agencies to support SME development and financing such as Saudi Arabia’s SME Authority, Qatar Development Bank and Oman’s Riyada have been established in recent years and have had a notable impact on the ease of starting a business in those economies.

Policy makers have recognised the impending issue and have acted decisively by introducing ambitious diversification policies. Saudi Arabia has already made a bold effort to capitalise on the green hydrogen market. A $5bn energy plant powered by sun and wind is set to supply the planned futuristic city of Neom in 2025. Saudi Electricity Co. raised $1.3bn by selling 5- and 10-year dollar denominated bonds to finance green capital projects last year. Similarly, Qatar National Bank issued its first green bond worth $600m in 5-year senior unsecured notes. The UAE commissioned its first green hydrogen plant this year, which will supply fuel to certain vehicles during the anticipated Expo 2020. Installed solar photovoltaic (PV) capacity is expected to increase four-fold from its current 2.1GW level by the end of 2025. Meanwhile, agencies to support SME development and financing such as Saudi Arabia’s SME Authority, Qatar Development Bank and Oman’s Riyada have been established in recent years and have had a notable impact on the ease of starting a business in those economies.

Despite encouraging diversification efforts, it remains more challenging for centrally planned economies to achieve the desired change. As oil price surges begin to fade, the GCC will need to reinvest strategically in a post-oil future, resist pressure from citizens for further financial support, align public sector wages and benefits with the private sector, and allocate additional government spending to support job creation. Vision targets are moving GCC countries in the right direction in the transition away from oil and successful implementation may provide the blueprint for other countries striving to diversify from oil.

Despite encouraging diversification efforts, it remains more challenging for centrally planned economies to achieve the desired change. As oil price surges begin to fade, the GCC will need to reinvest strategically in a post-oil future, resist pressure from citizens for further financial support, align public sector wages and benefits with the private sector, and allocate additional government spending to support job creation. Vision targets are moving GCC countries in the right direction in the transition away from oil and successful implementation may provide the blueprint for other countries striving to diversify from oil.

Tags:

You may be interested in

Post

Inside the UK’s Data Centre Boom: Why London Still Dominates—and what comes next

As AI accelerates and global tech companies commit billions to new cloud and data-centre projects in the UK, the country is cementing its role as a leading AI hub.

Find Out More

Post

The UK’s data centre boom: growth trends, drivers, and the rising power challenge

The UK is experiencing a remarkable growth in its digital infrastructure. Data centres—the facilities that house the servers and computing equipment powering everything from cloud storage to artificial intelligence (AI)—are expanding at an unprecedented rate and fuelling energy demand.

Find Out More

Post

Australia’s Infrastructure Outlook: Big Shifts, Bigger Challenges

Australia’s infrastructure landscape is shifting fast, driven by new investment trends, emerging asset classes and growing capacity constraints. This outlook explores the major changes ahead and what industry and government must do to navigate the decade effectively.

Find Out More