Australia’s Infrastructure Outlook: Big Shifts, Bigger Challenges

How shifting demand, emerging assets, and resource pressures are reshaping the decade ahead.

Australia’s infrastructure landscape is undergoing one of the most significant transitions in decades. As I outlined in my recent address to industry leaders, the nation’s construction and infrastructure outlook is being reshaped by new investment drivers, new asset classes, and intensifying capacity constraints. Understanding these shifts – and planning for them now – will be essential for businesses, policymakers and project owners through the remainder of the decade.

Investment is the Engine of Economic Growth

A core message of the presentation was simple: economic growth relies on sustained, efficient investment. Over time, Australia’s growth cycles have mirrored booms in housing, resources, transport and now energy and data infrastructure. As investment patterns evolve, so too does the distribution of construction activity – and ultimately, economic opportunity.

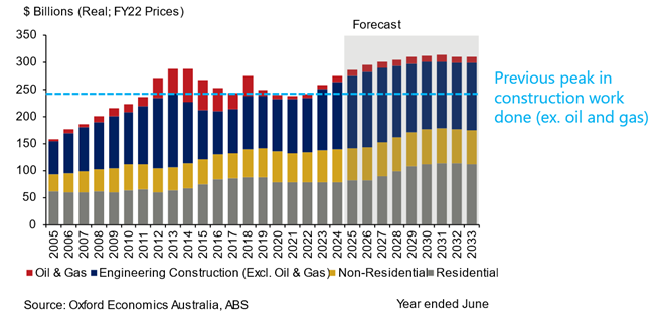

A Major Reallocation of Investment Activity

The composition of Australia’s infrastructure pipeline is changing rapidly. Public spending on major transport projects is peaking and beginning to taper, diversifying into defence, water, energy transmission, education and health. Private capital is accelerating into energy generation, resources and digital infrastructure. Data centres are emerging as a standout sector. Housing construction is also expected to become a much larger share of total building activity in the coming years, even as the national housing target remains well out of reach.

This shift will redefine what we build, where we build it, and how much capacity the industry must deliver.

Booms, busts and bulk water – a familiar infrastructure challenge is unfolding now

New Risks for Industry and Government

These transitions introduce a series of new challenges:

• New asset types requiring different skills, technologies and delivery approaches.

• New project owners and clients with distinct procurement expectations and risk appetites.

• New supply-chain partners, many specialising in emerging sectors like renewables and digital infrastructure.

• New geographies, with more activity shifting to regional Australia – where labour, accommodation and logistical constraints are more acute.

Growth Continues – but So Do Constraints

The Construction activity is expected to remain on an upward trajectory. Yet this growth comes with persistent – and worsening – constraints:

- Workforce shortages across key trades and professions.

- Intensifying wage pressures and rising real construction costs.

- Significant regional variation in demand complicates resource allocation for contractors and suppliers.

- Limited project visibility in some sectors which can distort workforce planning and investment decisions.

Without meaningful productivity improvements, these pressures will drag on project delivery, budgets and timelines throughout the 2020s.

What Industry and Policymakers Must Do Next

To navigate this next phase successfully, stakeholders should focus on four priorities:

- Stay informed about activity pipelines – by segment, state, region and asset type. The shifts underway are large and accelerating.

- Prioritise innovation and productivity in project proposals and procurement. Owners should reward it; the industry is ready to supply it.

- Plan realistically for capacity and cost pressures. With many 2030–2032 targets rapidly approaching, repeating past mistakes is a real risk.

- Recognise the enabling role of civil infrastructure, which remains essential for achieving Australia’s broader economic, housing and energy goals.

Tags:

You might be interested in

Estimating Data Centre ‘Phantom Demand’

To support Australia’s planning for cloud and AI growth, Oxford Economics worked with the market operator to assess future electricity demand from data centres. By combining industry data with insights from network providers, the analysis shows that current connection enquiries significantly overstate the grid demand likely to materialise.

Find Out More

Wage growth stable, but divergence under the hood in Australia

Wage growth held steady in Q3, reinforcing a still-tight labour market. But with conditions set to soften, we expect unemployment to rise and wage pressures to ease through next year.

Find Out More

Recent strength proves more enduring than expected

Australia’s outlook is improving as household spending strengthens and property prices surge, though inflation keeps the RBA cautious.

Find Out More

The Economic Impact of the Aura Network

This study demonstrates the economic importance of digital infrastructure by providing a comprehensive analysis of how high-capacity data connectivity underpins Australia’s future prosperity. We analyse how Telstra InfraCo’s Aura Network -a $1.6 billion nation-building fibre investment supports productivity, innovation, and competitiveness across Australia’s digital economy, while strengthening the nation’s position within the Asia-Pacific region.

Find Out More