Inside the UK’s Data Centre Boom: Why London Still Dominates—and what comes next

As AI accelerates and global tech companies commit billions to new cloud and data-centre projects in the UK, the country is cementing its role as a leading AI hub. But this growth prompts a crucial question: where in the UK are these data centres located? Perhaps surprisingly, they are heavily located in urban areas, particularly London.

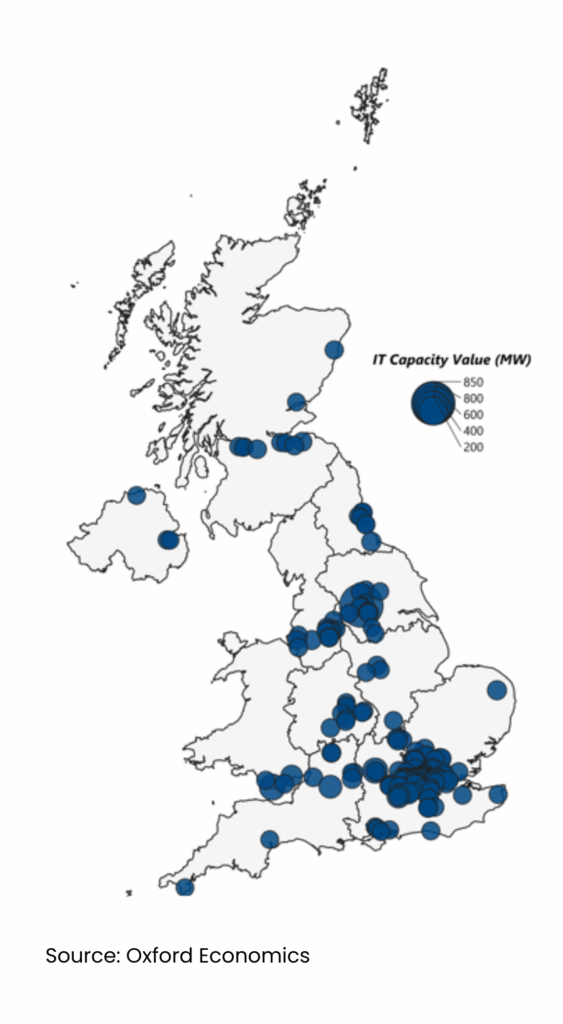

We have identified 266 operational data centres in the UK today. This number is set to increase over the next few years, with a further 52 facilities announced for completion between now and 2034. Around 27% of these new developments are expected to be located in Greater London. Map 1 highlights this urban centricity of the UK’s data centre infrastructure in greater detail.

Map 1: Data centre clusters in the UK, 2024

A core driver of the UK’s urban and specifically London-centric clustering of data centres has been the demand for low latency (high speed) applications, proximity to a high concentration of internet exchanges, and being close to key customers—professional business services, tech, and finance users—all of which are located in urban centres. This clustering also likely became self-fulfilling with providers being able to rely on an associated workforce, local infrastructure, and closer knowledge of the local planning process to deliver the infrastructure demanded.

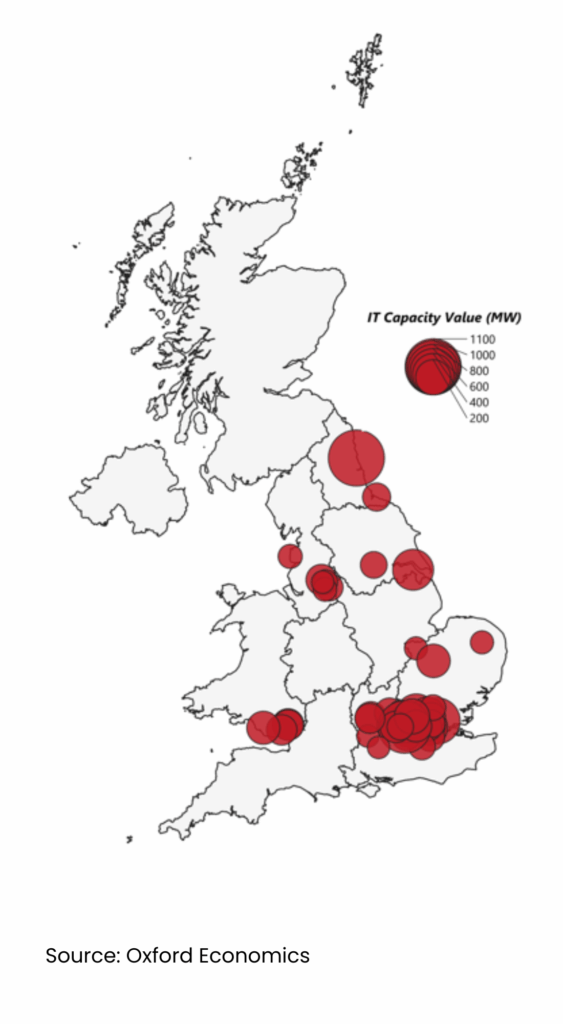

However, the UK’s highly urban infrastructure contrasts with the US, where the scale of land and electricity networks has enabled a growing share of new hyperscale and AI-focused data centres to be developed in rural or semi-rural locations. Rural locations offer advantages for data centre siting due to lower land constraints, readily available grid connections, and cheaper access to power. Issues with lower latency in rural locations are less prominent for emerging workloads, such as AI model training, that do not rely on proximity to end users. This explains why the UK’s data centre infrastructure is starting to broaden with one of the largest proposed data centres set to be in Cambois, Northumberland (Map 2).

Map 2: Announced data centres in the UK, 2025–2034

The UK is also taking further steps to remove barriers to data centre development, helping to unlock investment in more rural areas. Ongoing planning reforms, alongside the designation of critical national infrastructure and the introduction of AI Growth Zones in Northumberland and Oxfordshire, are expected to accelerate approvals.

Drivers of economic growth

Given the significant number of economic impact studies we have undertaken, we are well placed to identify and calculate the three ways in which data centres will deliver economic benefits to the UK. First, during the construction phase, there will be jobs created on the data centre site which will have their own respective GVA, wages, and tax impacts. Furthermore, this construction activity will have a supply chain which will bring about another round of impacts. Then, the workers on the construction site and within the supply chain will spend their salary in the local economy and create further impacts there. This total impact will be largely similar in the operational phase once the data centre is live. All of these impacts can be calculated at the local, regional, and national level.

Second, there are catalytic benefits, including through the higher local employment rates to run the data centres. These jobs typically span a range of skillsets, enabling people of differing skill levels to find employment. While there is criticism that the number of these jobs is low given the size of the investments, they still provide vital employment benefits across a range of occupations important to the local economy. This, in turn, can help boost spending in the local economy.

Third, data centres can drive clustering benefits. For example, the addition of a data centre to a local economy can create a clustering impact as companies who have elevated latency demands move close to this piece of digital infrastructure. Once they do, this can attract businesses from similar sectors and result in more high productivity jobs within a local economy. This can also bring about investment, particularly if the UK is seen to be a world leader in providing the best digital infrastructure and having a highly skilled workforce, thereby producing a virtuous cycle of increased investment and activity.

Tackling energy costs is crucial

Taken together, data centres can prove to be a vital piece of infrastructure to help councils meet their local plans. This is particularly true for employment, skills, and digital connectivity. But the wider economic benefits and clustering can help move a local area from being a growth laggard to a growth leader—helping councils meet a number of relevant objectives.

Yet, despite these clear benefits, concerns around data centres remain. The key one is around energy consumption and the high energy demand data centres can have on local energy prices and, hence, the competitiveness of local businesses. For example, in west London, data centres account for 18% of electricity consumption and, as a result, there are now constraints on further commercial and housing developments in the area due limits on the electricity grid. There has also been an uptick in reporting from the US on how data centres have been raising costs for local business, undermining their business models. Given the high cost of energy in the UK and the rising demand from data centres, similar impacts may occur.

AI Growth Zones and planning reforms may help, but the challenges are large and the government needs to go further to reduce energy costs—not just for data centre development, but for the economy more broadly given the UK’s lacklustre recent economic performance.

This blog post was produced by our Cities and Regions Consulting team. If you’d like to learn more, fill in your details below or click here to get in touch. We can help you understand how data centre expansion is affecting the geographies you operate in. Our capabilities include mapping and analysing data centre build-outs, as well forecasting the implications for future electricity demand.

For more detail on the methodology and data that underpins this blog post, read our report for the Nuclear Industry Association here.

Contact us

If you would like to learn more about our unique cities and regions consulting capabilities, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Tags:

You might be interested in

The UK’s data centre boom: growth trends, drivers, and the rising power challenge

The UK is experiencing a remarkable growth in its digital infrastructure. Data centres—the facilities that house the servers and computing equipment powering everything from cloud storage to artificial intelligence (AI)—are expanding at an unprecedented rate and fuelling energy demand.

Find Out More

Powering the UK Data Boom: The Nuclear Solution to the UK’s Data Centre Energy Crunch

The UK’s data centre sector is expanding rapidly as digitalisation, cloud computing, and artificial intelligence (AI) drive surging demand for high-performance computing infrastructure.

Find Out More

Estimating Data Centre ‘Phantom Demand’

To support Australia’s planning for cloud and AI growth, Oxford Economics worked with the market operator to assess future electricity demand from data centres. By combining industry data with insights from network providers, the analysis shows that current connection enquiries significantly overstate the grid demand likely to materialise.

Find Out More