The UK’s data centre boom: growth trends, drivers, and the rising power challenge

The UK is experiencing a remarkable growth in its digital infrastructure. Data centres—the facilities that house the servers and computing equipment powering everything from cloud storage to artificial intelligence (AI)—are expanding at an unprecedented rate and fuelling energy demand.

The numbers tell a compelling story. At the turn of the millennium, there were 52 data centres nationwide. By 2024, this number had risen by over 400%, reaching an estimated 266 data centres. This surge has placed the UK at the forefront of the data centre landscape in western Europe.

This growth is set to continue. To quantify it, we carried out a “web scraping” exercise—a technique that uses automated tools to collect and extract data from web pages—to build a dataset of all current and announced data centres in the UK. This analysis identified over $59 billion in announced investments in UK data centre construction since 2023. This investment is expected to add 52 data centres to the UK’s stock over the next nine years. Of these, 50 are expected to come online within the next five years, representing a major near-term expansion.

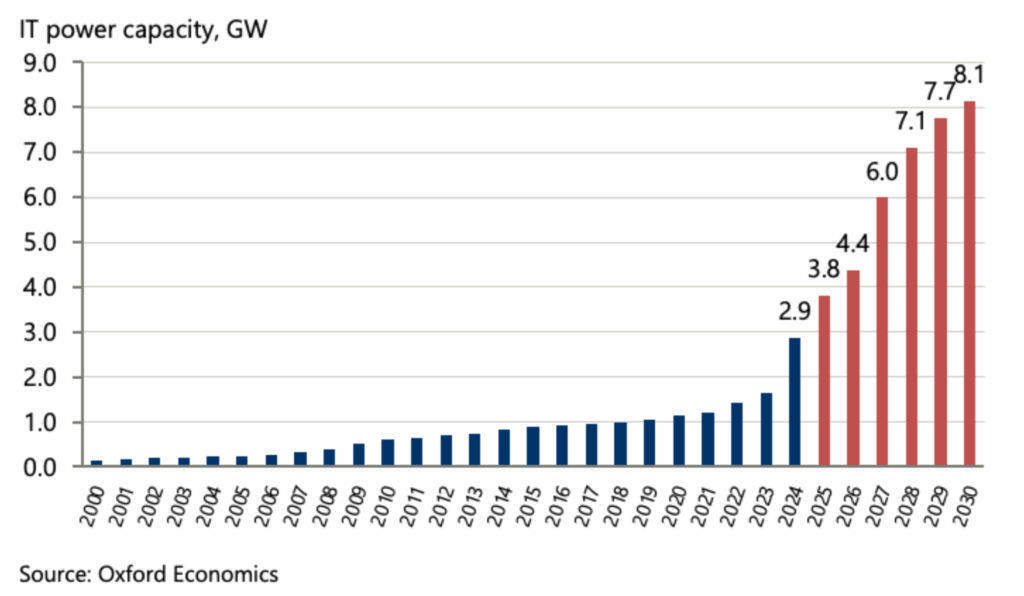

Looking beyond simple site counts, planned IT power capacity provides a meaningful indication of the computing processing scale of the digital infrastructure being built. We estimate that new data centres will add around 6.2 GW of IT power capacity by 2030—more than double the UK’s current 2.9 GW (Fig. 1).

Fig. 1. Announced data centre pipeline to add 6.2 GW of additional IT power capacity by 2030

Rising energy demand

Data centres are energy-intensive operations, consuming between 10 and 50 times more electricity per square metre than a typical commercial building. As the number of facilities in the UK continues to grow, we expect their aggregate electricity demand to increase sharply in the coming years.

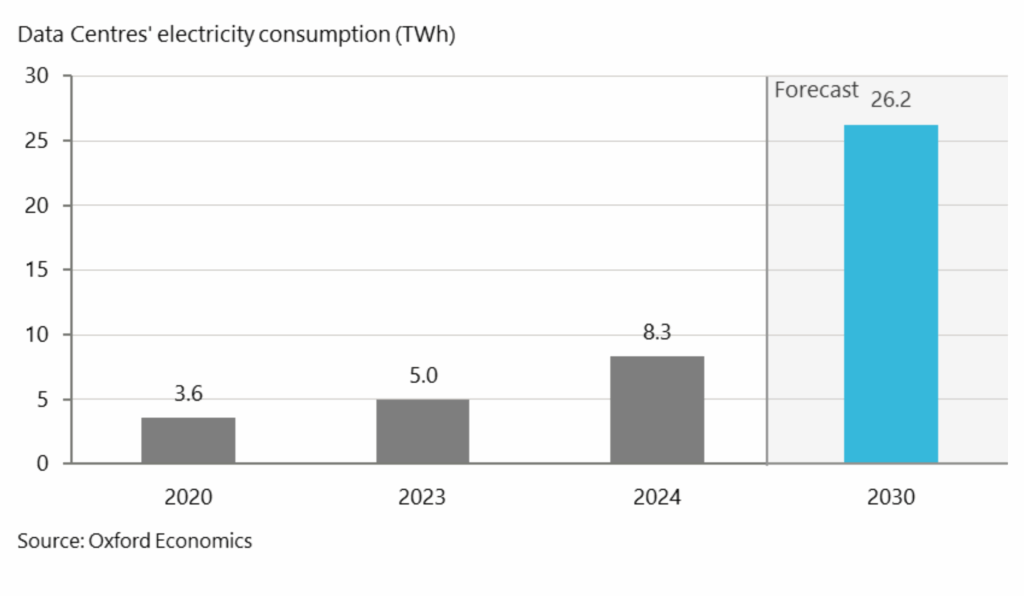

The National Energy System Operator (NESO) estimates that data centres consumed 5.0 TWh of electricity in 2023—equivalent to 2% of total UK electricity demand and 7% of commercial sector consumption. This is comparable to the annual electricity use of over 1.8 million typical British households.

We forecast total demand could grow more than fivefold by 2030—reaching 26.2 TWh (Fig. 2). We estimate that data centres’ demand will represent 8.8% of total UK electricity demand, or 30.4% of UK commercial electricity consumption in 2030. Data centres will constitute a significantly higher share of the UK energy footprint relative to today.

Fig. 2. Data centres’ electricity consumption 2020-2030

Forces behind the boom

The investment in new data centre infrastructure and expansion of IT power capacity has been driven by accelerating digitalisation trends and the widespread uptake of AI. These structural trends are expected to continue gathering pace, placing growing demands on digital and physical infrastructure.

As businesses have migrated workloads to the cloud, demand for data infrastructure has grown in parallel. By 2023 an estimated 69% of UK businesses had adopted cloud-based computing systems or applications. Data centres are also essential for developing AI, providing the computing power and storage needed to train large language models and run the models to generate outputs. The rapid pace of AI adoption is an important contributor to future demand for data infrastructure, generative AI tools reached 50% of adults in the UK within just a year—a much faster uptake than was the case with past technological innovations.

Demand for energy will also be driven by changes in the way that AI is used. Energy tasks such as video and image generation are considerably more energy-intensive than text-based AI functions like summarisation or search. As AI applications diversify into media production, design, and simulation, demand for compute and, by extension, electricity is expected to continue growing. These trends will limit the extent to which efficiency improvements can curb total energy consumption.

Government policies add to pressure

The UK government has recently introduced initiatives that are expected to encourage the build-out of AI infrastructure through its AI Opportunities Action Plan and AI Growth Zones initiatives. Launched in January 2025, the Action Plan outlined 50 strategic measures to make the UK an “AI superpower”. This includes coordinated efforts to increase AI-capable data centre capacity, enhance grid readiness, and align infrastructure planning with technological needs.

Specifically, the AI Growth Zones initiative, launched alongside the Action Plan, seeks to accelerate the deployment of AI-related infrastructure. These zones are areas designated by government where planning and regulatory processes will be streamlined to encourage private investment in AI-related development—particularly AI-ready data centres and high-computing power infrastructure. Growth Zones are designed to overcome key barriers such as access to energy, planning delays, and land availability to allow faster delivery of AI infrastructure.

On top of these domestic measures, the UK and US governments recently announced a tech partnership, which includes planned investments totalling £31 billion to expand data centre capacity, support AI start-ups, advance cutting-edge technology, and develop quantum computing. While the precise portion allocated to new data centre construction is not detailed, these commitments are expected to sustain high levels of construction in the coming years, which will in turn continue to drive electricity demand beyond our current forecasts.

What does the global data centre expansion mean for you and your business?

This blog post was produced by our Industry Consulting team.

We can help you understand how the data centre expansion is affecting the sector and geographies your business operates in. Our capabilities include mapping and analysing data centre build-outs, localising data centre clusters, as well as forecasting future electricity demand and implications for power generators.

If you’d like to learn more, fill in your details below or click here to get in touch.

For more detail on the methodology and data that underpins this blog post, read our report for the Nuclear Industry Association here.

Tags:

You might be interested in

Powering the UK Data Boom: The Nuclear Solution to the UK’s Data Centre Energy Crunch

The UK’s data centre sector is expanding rapidly as digitalisation, cloud computing, and artificial intelligence (AI) drive surging demand for high-performance computing infrastructure.

Find Out More

Estimating Data Centre ‘Phantom Demand’

To support Australia’s planning for cloud and AI growth, Oxford Economics worked with the market operator to assess future electricity demand from data centres. By combining industry data with insights from network providers, the analysis shows that current connection enquiries significantly overstate the grid demand likely to materialise.

Find Out More