Surge in tech borrowing boosts bank profits

An epic burst of capex from the tech sector to build AI and related infrastructure has driven a pick-up in borrowing, in the form of new loans, bond sales, and hybrid financing tied to specific projects. This demand for finance points to rising revenues and improved profitability in the US financial services sector while creating opportunities for businesses across the economy to scale their productivity by taking advantage of innovative technologies.

Until recently, much of the tech sector’s spending has been funded by companies’ cash flows, but in 2025, the spending sums have become so large that they are forcing companies to include more debt financing in their project plans. For example, Meta added a $30 billion bond issue in October—doubling the size of its long-term debt outstanding—while Oracle added close to $18 billion in new bond sales in September.

A new source of income for lenders

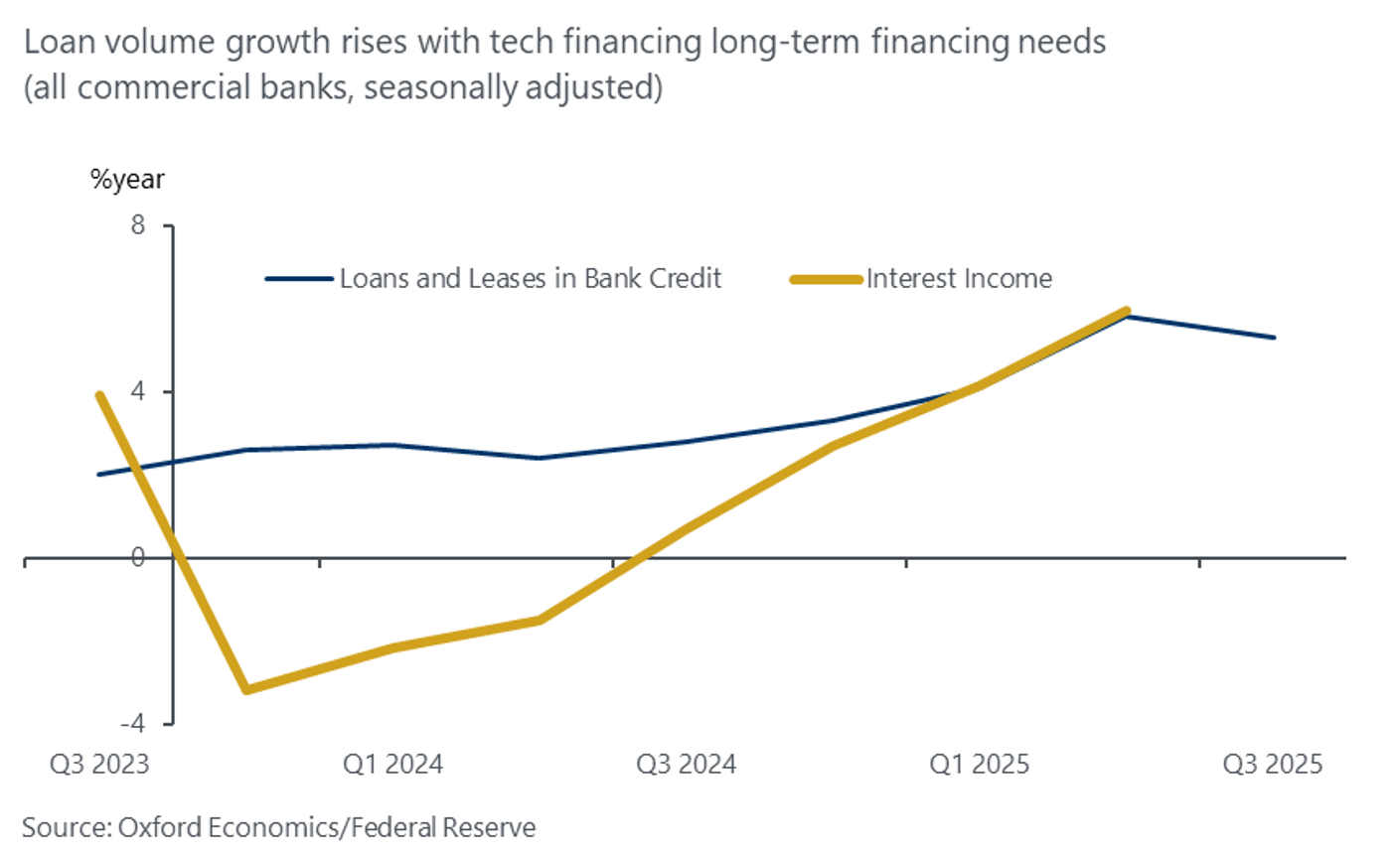

The upswing in lending is expanding bank balance sheets and adding a new stream of interest and fee income. The new business is particularly welcome, as it helps the finance sector recover from a weak lending period between 2022 and 2023, followed by only a tepid recovery in 2024 (Chart 1).

Chart 1: Interest income boosted by stronger loan volumes to tech

The capital-intensive phase of recent years will moderate, but the cumulative effect on productive capacity, efficiency, and competitiveness will be substantial. As the investment wave transitions into an operational one, the payoff will come through improved economic value added across multiple industries.

Unlock exclusive climate and business insights—sign up for our newsletter today

Market concern vs. fundamentals

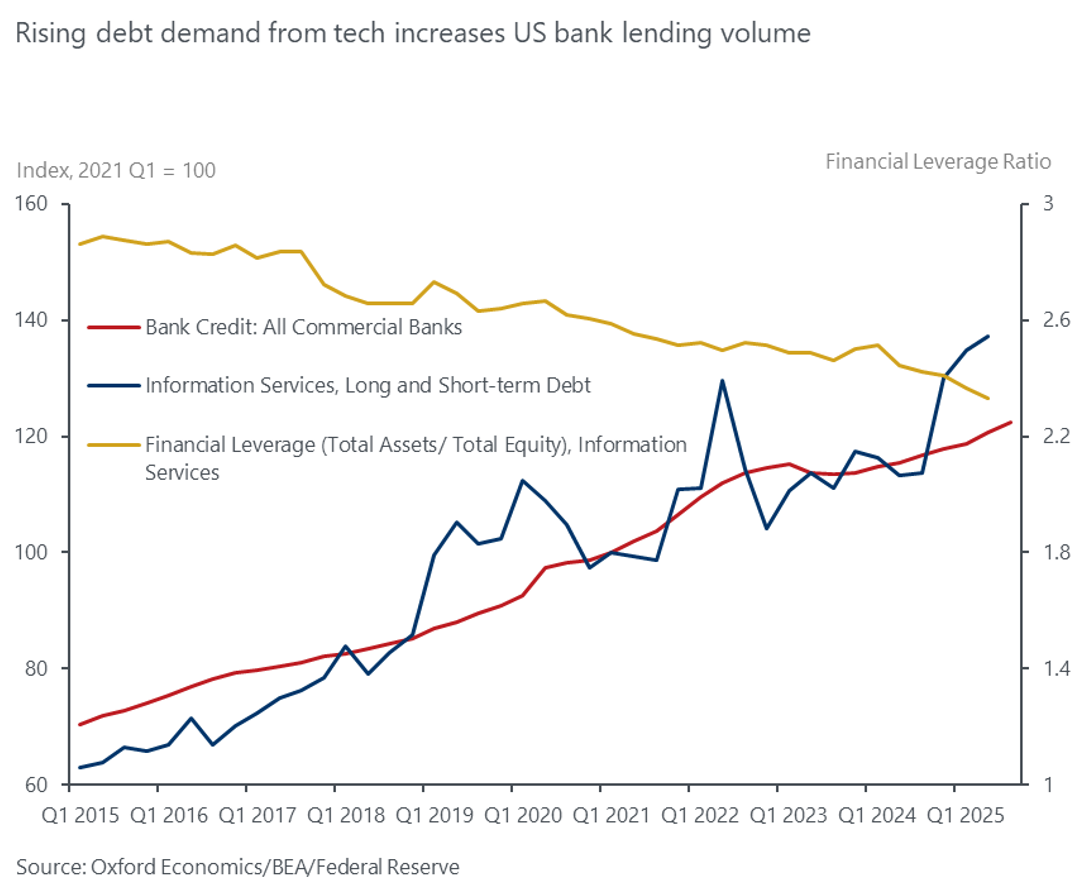

Recent debt issuance has contributed to worries of an ‘AI bubble’ and have lifted risk perceptions and doubts about the sustainability of new debt volumes. While the larger tech companies continue to enjoy strong cash flows—with easily manageable interest burdens and an overall decline in their use of financial leverage—it is the sheer size and rapid build-up of the new borrowing, rather than its impact on the tech sector’s creditworthiness, which is causing anxiety about future finances (Chart 2). Sudden spikes in debt can heighten market volatility and investor caution, creating uncertainty about how financial conditions may evolve and that industry’s credit outlook.

Chart 2: Leverage and liquidity metrics show tech’s strong credit quality

However, as discussed in our recent 2025 report on sector credit quality, the information services industry retains solid credit metrics and ranks among the best in comparative credit metrics among the surveyed industries. Together, robust lending capacity and prudent risk management create a solid platform for sustained performance across the finance and technology sectors, with benefits likely to extend to the wider economy over the years ahead.

Tags:

Related Reports

COP30 in focus: How to bridge the implementation gap?

Ten years since Paris, can COP30 deliver real change? We review the progress of countries, industries and cities on the path to decarbonisation.

Find Out More

How Russia shapes the outlook for global oil prices

The fate of global oil prices hangs on Russia. Sanctions, rerouted exports, and a potential ceasefire could drive Brent and Urals in unexpected directions. What will happen next?

Find Out More

What a fragile peace means for Central and Eastern Europe

Countries in Central and Eastern Europe (CEE) have been among the most exposed to Russia's war in Ukraine and will also be impacted by the nature of any ceasefire. Our baseline assumption is for 'fragile peace' this year, with a high likelihood of renewed hostilities.

Find Out More

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More