Stock bond correlation will become positive again in 2026

Stock-bond correlation set to normalise by 2026 amid higher volatility and term premia

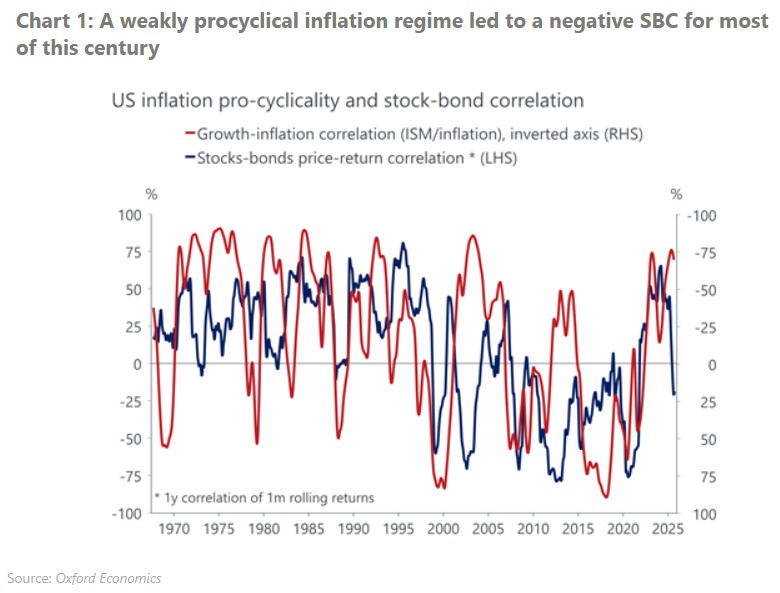

We think the recent collapse in the stock-bond correlation (SBC) – from highly positive to negative – is temporary, driven by market pricing of a Fed funds cutting cycle which is too dovish in our view.

Continued supply shocks, geopolitical risk, and higher macro volatility due to more activist fiscal policy means that term premia will continue to march higher. This will also prevent the SBC from remaining in negative territory over the medium term.

Indeed, we believe the pre-Covid regime of weakly pro-cyclical inflation will not sustainably return, and we see the SBC returning to positive territory in 2026.

This will pose challenges for traditional approaches to asset allocation that rely on government bonds and other long duration fixed income assets to provide a ballast to portfolios.

Download the report to explore whether we could see a sustained negative stock-bond correlation and what it means for portfolios.