Commodities outlook 2026: Another challenging year ahead

Commodity price performance has been mixed in 2025, with roughly half of the basket showing gains and the other half declining. Natural gas and precious metals have led the gains, while soft commodities and oil have been the main losers.

Looking ahead, we anticipate a modest contraction in 2026 for aggregate commodity prices, with US natural gas and precious metals likely to remain relative outperformers. The broader commodity complex, however, faces continued pressure from weak industrial demand, ample supply and lingering tariff impacts.

Global economic slowdown and weaker commodity demand

Commodity markets remain closely tied to the global business cycle. We expect global GDP growth to ease slightly in 2026, due to tariffs and the fading post-tariff front-loading of demand. This slowdown does not signal a global recession, but it represents a soft patch that will subdue commodity demand. Investment-heavy sectors such as construction and manufacturing—major consumers of energy and metals—are particularly exposed.

Unlock exclusive climate and business insights—sign up for our newsletter today

In the meantime, global trade is expected to remain soft as higher US tariffs take effect, with ongoing uncertainty further dampening business investment. Such shocks typically take six to nine months to filter through to production, meaning the full impact on commodities is still unfolding.

Currency dynamics add another layer to the story. The US dollar has weakened sharply since the announcement of new tariffs. Because most commodities are priced in dollars, a weaker dollar improves affordability for foreign buyers, bolsters global demand, enhances US export competitiveness and encourages investment in commodities as a hedge against currency depreciation. However, this will not be enough to fully offset the broader drag from slowing global economic growth.

Geopolitics and policy remain crucial wildcards. US aluminium and secondary copper products—now subject to 50% import tariffs—are expected to remain above pre-tariff levels. By contrast, China’s restrictions on critical minerals—particularly rare earths, where it accounts for over 85% of global refining capacity across 19 of 20 key minerals—pose a risk of tightening supply and sustained price premiums. Meanwhile, US soybeans are likely to remain under pressure, with Chinese buyers prioritising alternative suppliers and global supply remaining abundant.

Bearish outlook for 2026

We maintain a more bearish outlook for commodities in 2026, reflecting our below-consensus expectations for economic and industrial growth, weaker demand and stronger supply conditions.

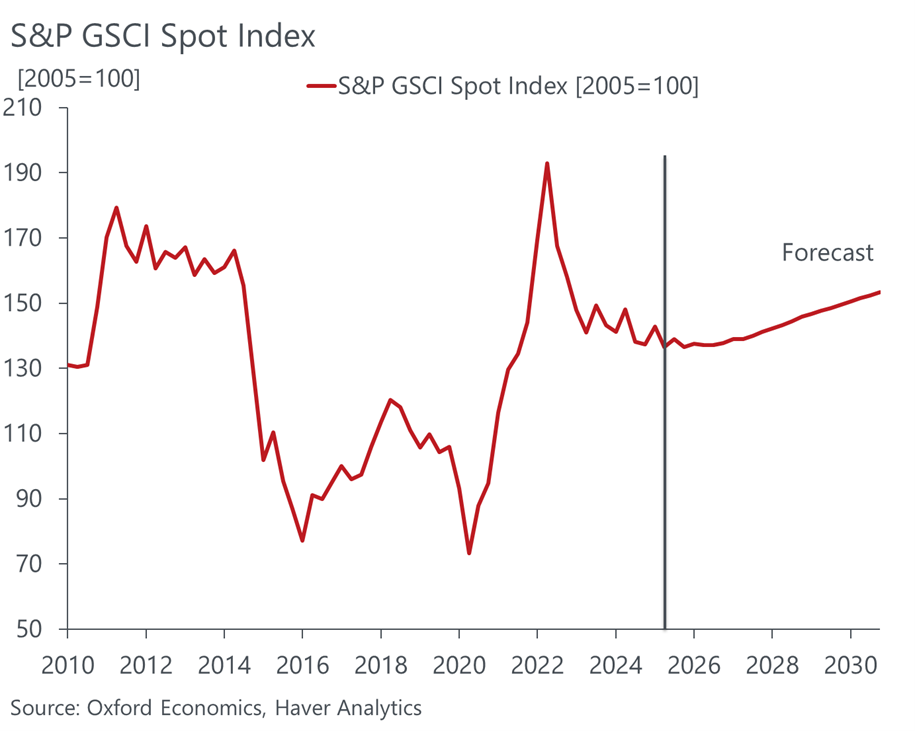

Overall, commodity prices as measured by the S&P Goldman Sachs Commodity Index are forecast to decline by 1.7% in 2025 and 0.9% in 2026.

Chart: Commodity prices to underwhelm in 2026

Relative losers: Oil and agricultural commodities

While our near-term oil price forecasts are above consensus—driven by the expectation that the Russia–Ukraine war will sustain a geopolitical risk premium through 2026—we still anticipate an oversupplied market. As OPEC+ gradually unwinds production cuts, this should limit any significant upward price movement. Meanwhile, weaker industrial activity in China—the world’s largest oil importer—adds to the downside risk.

Base metals face similar headwinds. These are among the most cyclical commodities, and weak construction and manufacturing activity will weigh on demand and prices going into next year.

Agricultural commodities as a whole are less sensitive to macroeconomic business cycles. Staple foods such as wheat and rice are likely to hold up relatively well, as demand is steady even in downturns. Higher-value products such as meat are more sensitive to falling incomes, meaning consumption may weaken. Crops used for biofuel production also face cyclical risks because industrial activity drives that segment of demand.

Raw materials such as cotton and lumber are particularly exposed. Cotton demand is linked to textiles and clothing, areas where consumers cut back when budgets tighten. Lumber is tied to construction cycles, which are slowing in major markets. These dynamics suggest a softer outlook for raw agricultural materials in 2026.

US soybeans are under further pressure due to trade diversification. Chinese buyers are prioritising alternative suppliers, while global harvests remain strong. This combination of abundant supply and shifting demand weighs heavily on US producers.

Relative winners: Natural gas and precious metals

Natural gas and precious metals have led the price gains in 2025, and we expect this trend to continue in 2026. This is reflected in investor positioning, which has turned bullish in US natural gas. The fundamentals align with this sentiment: strong demand from Europe and Asia is expected to support flows, while lower US domestic prices encourage exports. Precious metals will continue to benefit from safe-haven demand amid geopolitical uncertainty and currency weakness.

Medium-term supply risks could reshape markets

After the volatility of the early 2020s, markets are struggling to regain traction. While natural gas and precious metals are poised to outperform, the broader outlook for 2026 remains subdued. Stabilisation is expected by the second half of the year, and we expect a more meaningful upturn in prices in 2027.

Over the medium term, risks may emerge from supply-side dynamics. Reduced investment in mining and energy in 2024 and 2025 could tighten supply further down the line. Commodity cycles often swing between periods of over- and underinvestment. Weak prices today could deter future projects, creating shortages and higher prices in the years beyond 2026.

For businesses and investors, the message is clear: caution in the short term, but preparation for the next cycle. Prices are unlikely to deliver strong gains in 2026, yet opportunities exist in outperforming sectors such as natural gas and precious metals. Beyond 2026, supply-side constraints could set the stage for a sharper upswing. Strategic planning now can provide resilience when the cycle turns.

To learn more, download our Research Briefing, ‘Commodity prices face macroeconomic headwinds in early 2026’.

Tags:

Related Reports

Policy-driven volatility ahead for critical metals

Industrial strategy, not scarcity, has become the new source of commodity price turbulence.

Find Out More

China flexes its rare earths dominance, again

The new rare-earth controls from Beijing mark a pivot from raw material oversight to technological leverage.

Find Out More

Understanding the forces that drive global cotton prices

Forecasting the cotton market goes beyond understanding traditional agricultural metrics and into issues such as trade, energy and global economic trends.

Find Out More

Cotton prices weighed down by loose market fundamentals

Cotton prices are forecast to remain weak in 2024 due to strong global supply and sluggish demand, weighed down by US trade tariffs, weak consumer spending, and rising competition from synthetics.

Find Out More