Research Briefing

28 Oct 2025

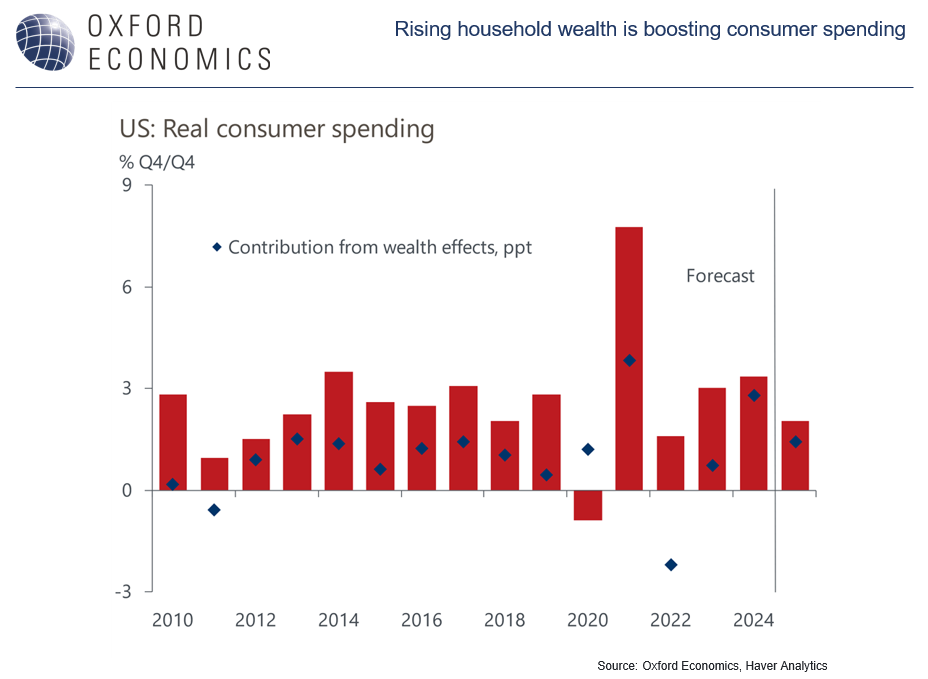

US Consumers still riding the “wealth effect” coattails

Rising household wealth supports consumer spending

With stock markets sitting at or near all-time highs, there is renewed attention on the consumption effects from fluctuations in household wealth. Since the onset of the COVID-19 pandemic, significant gains in net wealth have driven almost a third of the increase in consumer spending. Despite an unfavorable backdrop, consumer spending will grow at a decent pace this year, largely thanks to the stock market rally that started in April.

- Gains in net wealth have meaningfully contributed to consumption since the pandemic.

- Wealth effects have strengthened over the past 15 years, with stocks becoming a bigger driver of consumption than housing.

- Consumer discretionary goods and services are most sensitive to changes in household wealth, while a big chunk of spending in nondiscretionary categories is immune to wealth effects.

- Wealth effects vary across regional economies, with the strongest in the Northeast and the South, where housing wealth effects have had a revival.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]