Research Briefing

21 Oct 2025

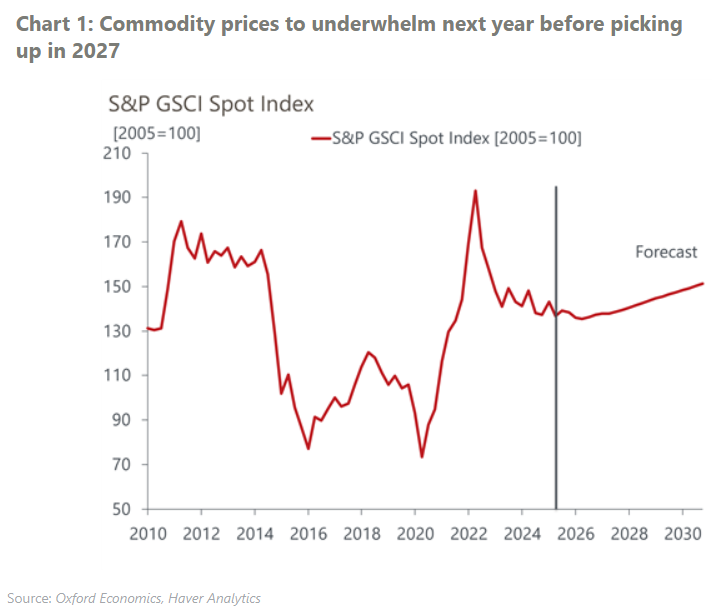

Commodity prices face macroeconomic headwinds in early 2026

Global demand slows while supply pressures persist—are commodities heading for another downturn?

After sharp gains in 2020–2022 and a broad correction in 2023–2024, aggregate commodity prices as measured by the S&P Goldman Sachs Commodity Index are forecast to decline by 1.3% in 2025 and 1.4% in 2026. However, we expect prices to stabilise by mid-2026 and begin recovering into 2027 as global activity improves.

What you will learn:

- The delayed impact of US tariffs on investment spending is expected to weigh on industrial activity and construction, reducing demand for energy and metals. While agricultural commodities are generally less sensitive to business cycles, they too face headwinds from strong harvests and ongoing trade disruptions.

- A weaker US dollar is supporting foreign purchasing power and boosting US export competitiveness. This is providing some support to demand—but not enough to fully offset the broader drag from slowing global growth.

- Natural gas and precious metals are expected to outperform on the back of strong export flows and safe-haven demand. In contrast, oil, agricultural commodities, and base metals face continued pressure from oversupply and subdued industrial demand.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]