What a US government shutdown means for the economy: Key questions answered

On October 1, 2025, the US government entered a shutdown after Congress failed to pass a funding bill to finance operations into October and beyond.

In this blog, we explain how the shutdown could influence the US economy, regional activity, government services, social security and even tariff collection.

What are the macroeconomic costs of the US government shutdown?

Our estimate is that a government shutdown reduces GDP growth by 0.1ppt-0.2ppts per week. For context, a shutdown that lasts an entire quarter, which has never occurred, would reduce Q4 real GDP growth by 1.2ppts-2.4ppts. However, the lack of government economic data during the shutdown will make it more difficult for us to produce our economic forecasts.

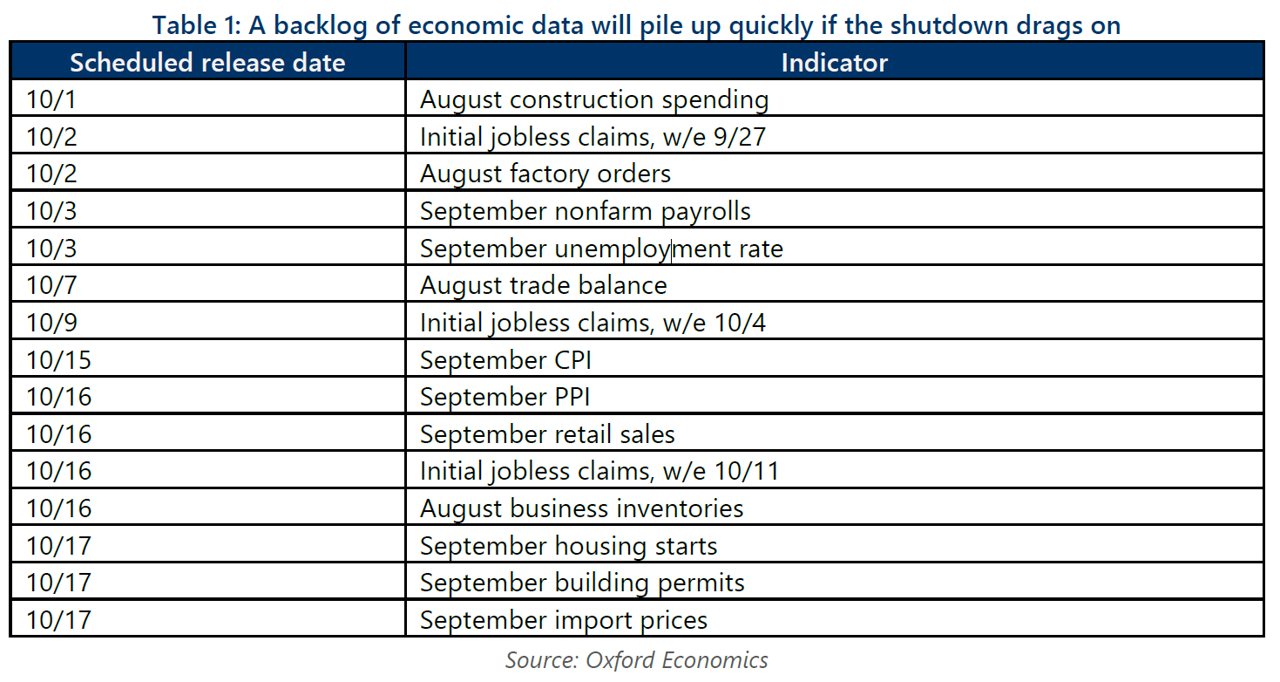

Which economic releases will be delayed by the government shutdown?

Statistical releases compiled and reported by government statistical agencies that are funded through the annual appropriations process will be delayed. Data from the Federal Reserve or private entities, including the ISM, Conference Board, University of Michigan, ADP, and the National Association of Realtors are not affected. Table 1 summarizes the economic releases that either have or could be delayed if the shutdown persists through October 17.

How many federal workers have been furloughed? Where do they work?

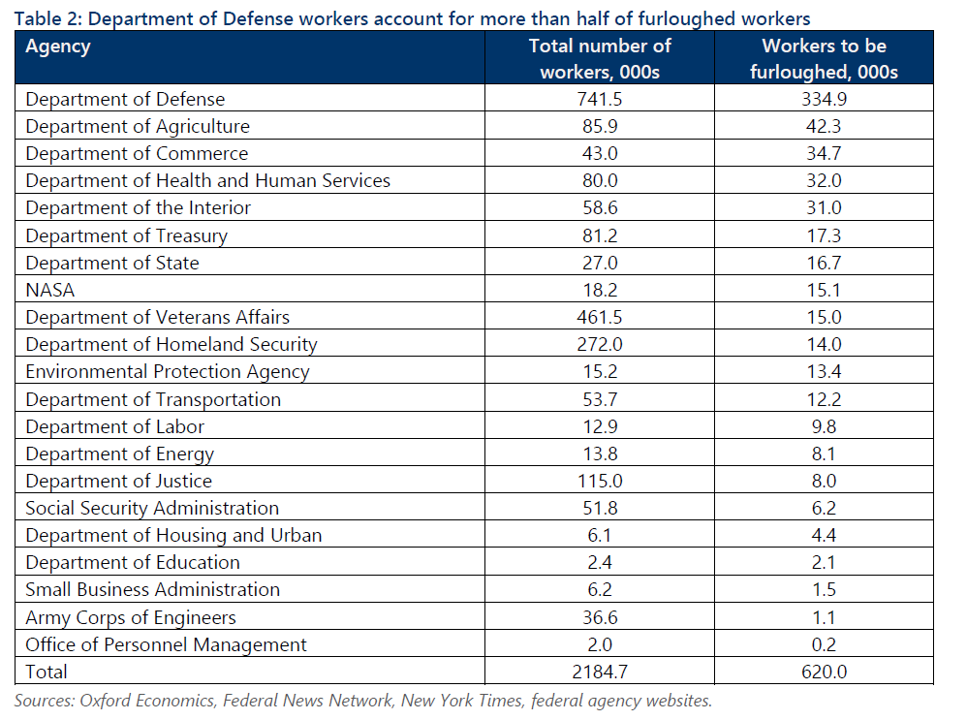

Based on data published through October 2, it appears as though roughly 620,000 workers, or about 28% of workers employed at the reporting agencies, have been or will be furloughed. The number so far is well below the roughly 900,000 we estimated based on prior shutdowns, but this gap could close; federal agencies often keep some workers on for a few days to wind down operations once a shutdown starts.

It’s important to remember that a large number of federal workers are dropping off of payrolls permanently in Q4 because they accepted the Trump administration’s deferred resignation offer. We estimate about 175,000 workers took the offer, and think the majority fell off payrolls on October 1.

Unlock exclusive economic and business insights—sign up for our newsletter today

Civilian employees at the Department of Defense account for more than half of furloughed workers (Table 2). Some agencies have funding outside the annual appropriations process, allowing them to continue to pay some workers, at least initially. That’s the case with the IRS, an agency within the Treasury, which has funds from the Inflation Reduction Act it can use to pay workers for at least five days. The number of workers on furlough can fluctuate, particularly if a shutdown is prolonged, as some workers are called back.

Which regions of the country will be impacted the most by the furlough?

The regional impact varies, and we can lean on our prior work looking at the impact of federal layoffs to assess which metro areas will be most negatively affected by the shutdown. The District of Colombia will be the most impacted, where the federal government workforce is the largest in the country. Federal government directly accounts for 30% of GDP in DC. New York and Los Angeles are home to the secondand third-most federal employees, but as a share of their economies, the federal sector plays a much smaller role.

Other metros that could be hurt are Atlanta, with its significant Department of Health and Human Services presence; Baltimore, with a large Social Security Administration office; and Ogden, Utah, with a large IRS office, although as we noted, the IRS can draw on other funds, at least for a while. Active-duty troops, including reserve component personnel on federal active duty, are required to continue reporting for duty, but some functions at military bases will be affected by the shutdown. Therefore, metro areas with large military bases won’t be immune from a shutdown. According to guidance, officials expect to furlough about half of the Department of Defense’s 741,477 civilian employees, which include some operations on bases. There are rural parts of the country that will be affected, including metro areas in New Mexico, Wyoming, North Dakota, South Dakota, and Alaska. The shutdown will freeze funding for farmers.

Do federal workers get paid during a government shutdown?

No. Federal workers don’t get paid during shutdowns, whether they are furloughed or required to work. Legislation passed by Congress in 2019 provides for back pay once the shutdown ends, although the Trump administration has indicated additional legislation may still be needed. Active-duty members of the military also go without pay, but Congress has at times passed legislation to pay those serving in the military while a shutdown is in progress.

Will private-sector workers be impacted by a shutdown?

Yes, but it’s complicated. There is a wide range of estimates of the number of private-sector workers supported by federal grants and contracts, from as few as 3mn-4mn directly supported to as many as 7mn-10mn directly or indirectly supported. It’s not easy for private employers to immediately lay off workers if their government contracts lapse, since they are still required to comply with federal and state labor laws. However, a prolonged shutdown would likely lead to some private-sector layoffs by government contractors. There could be a reduction in hours worked among service industries that support the federal government.

Will benefits like Social Security continue to be paid during a shutdown?

For the most part, yes, since programs like Social Security, Medicare, Medicaid, and SNAP are essentially on automatic pilot and don’t rely on the annual budgeting process to fund benefits. However, individuals with questions about signing up for benefits or other issues may experience hurdles getting help with fewer workers available to help. There are a few social benefit programs that rely on annual appropriations, including WIC, a nutrition assistance program for women and infant children that has an annual budget of about $7bn.

Which government services will be most impacted by a shutdown?

It’s hard to say. In many cases, key government functions will continue, such as the issuance of visas and passports, but individuals and businesses may experience significant delays in services. Some national parks may remain open but with limited services. Air travel, in theory, shouldn’t be disrupted since air traffic controllers and TSA screeners will remain on the job, but travel delays could still occur if workers going without pay take time off. Most government agencies will cease making new grants or signing new contracts. This shutdown will like halt approvals for IPOs and affect how quickly the government reviews proposed mergers. Student loan collections will continue.

Will tariffs still be collected during the government shutdown?

Yes.

Will Treasury debt auctions continue to be held?

Yes.

Learn more about the economic costs of a US government shutdown

Explore which regions will be most affected by the shutdown

Tags:

Subscribe to our newsletters

Related Reports

US economic outlook 2026: Four key calls for the year

US exceptionalism will continue in 2026—but so will the vulnerabilities beneath the surface.

Find Out More

US Shipping freight rates on track to stay low in 2026

Our supply chain stress index moderated in September as import volumes continue to decline following front loading activity earlier this year. High frequency data shows that this trend has kept up in Q4, meaning port congestion is unlikely to become a concern.

Find Out More

Housing affordability remains strained across US metros

A household needed to earn an annual income of $110,100 to afford a single-family home and pay both property taxes and home insurance costs in Q3 2025, down 2.3% from the peak Q1 2025 ($112,700) but nearly twice that of Q3 2020.

Find Out More

Surge in tech borrowing boosts bank profits

An epic burst of capex from the tech sector to build AI and related infrastructure has driven a pick-up in borrowing, in the form of new loans, bond sales, and hybrid financing tied to specific projects. This demand for finance points to rising revenues and improved profitability in the US financial services sector while creating opportunities for businesses across the economy to scale their productivity by taking advantage of innovative technologies.

Find Out More