Economic costs of a government shutdown

Limited near-term impact, growing downside risks

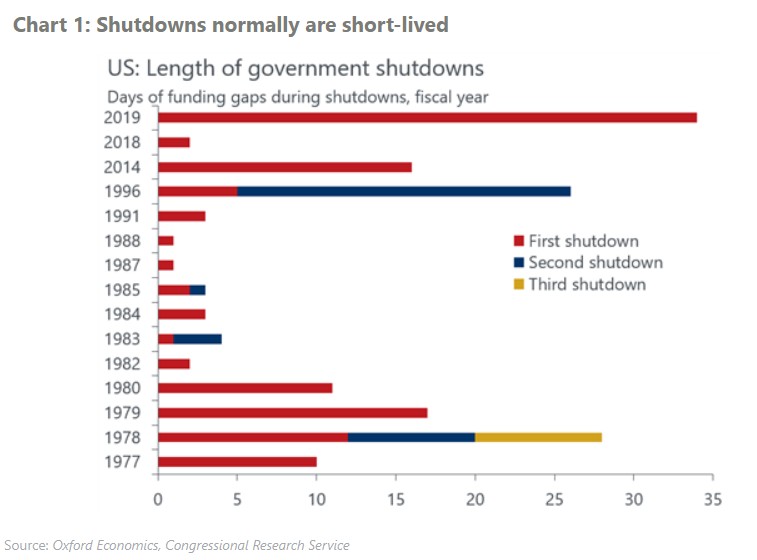

A federal government shutdown won’t change our outlook for GDP, unemployment, or inflation in the next baseline forecast, released October 9, but it would lend some downside risk to real GDP growth in Q4. To warrant a change to the forecast, the shutdown would need to be longer than normal to leave a mark on the economy.

One forecast change that could occur is bringing forward the rate cut from December. The Federal Reserve emphasized the September move as an insurance cut. A shutdown would likely leave the central bank in a fog about the labor market, fueling support for an October cut rather than risk falling behind and having to cut more later.

Our estimate is that a partial government shutdown reduces GDP growth by 0.1ppt-0.2ppts per week. For context, a shutdown that lasts the entire quarter, which has never occurred, would reduce Q4 real GDP growth by 1.2ppts-2.4ppts.

Download the full report for our detailed analysis of the potential economic impacts of government shutdown.