Japan’s December rate hike appears likely, though there is a risk of delay

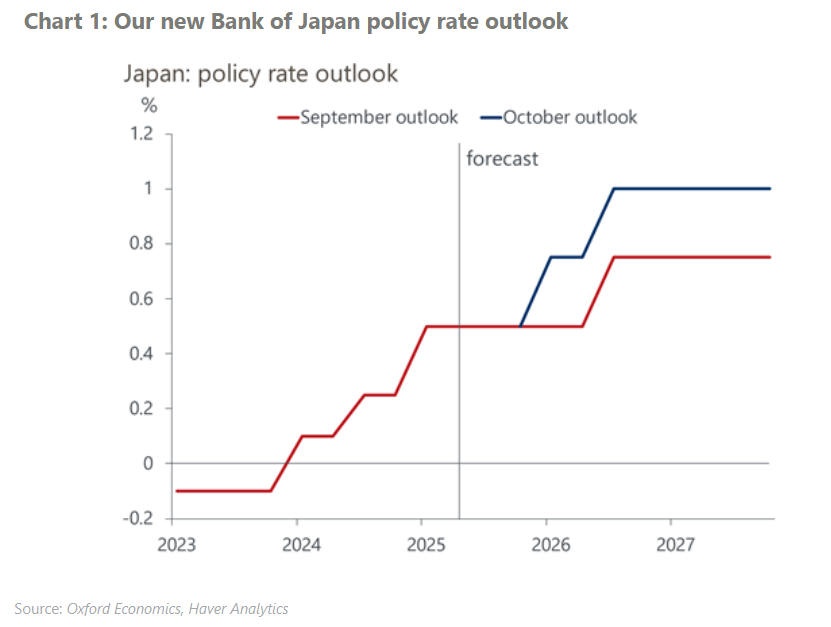

We’ve brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ’s view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy’s resilience.

Although we still expect the global economy to soften in H2, we project less of a slowdown in Japanese growth than before, in line with our global outlook. Downside risks to the US economy, especially, have continued to lessen.

However, there are economic and political risks to our new baseline. The BoJ could delay its next rate increase until January or even later, depending on incoming data and the political climate. And the additional hike to 1% in mid-2026 is subject to higher economic uncertainty.

Sanae Takaichi’s surprise victory in the ruling Liberal Democratic Party’s leadership election on October 4 represents one such downside risk to our forecast. The probable new prime minister favours easy monetary policy, although market pressures – especially the weakening of the yen – will likely leave her no choice but to accept some rate hikes.