Research Briefing

09 Oct 2025

Made in America—Investments Favor Southern Metros

Southern metros are set to see the greatest benefits from the reindustrialization agenda

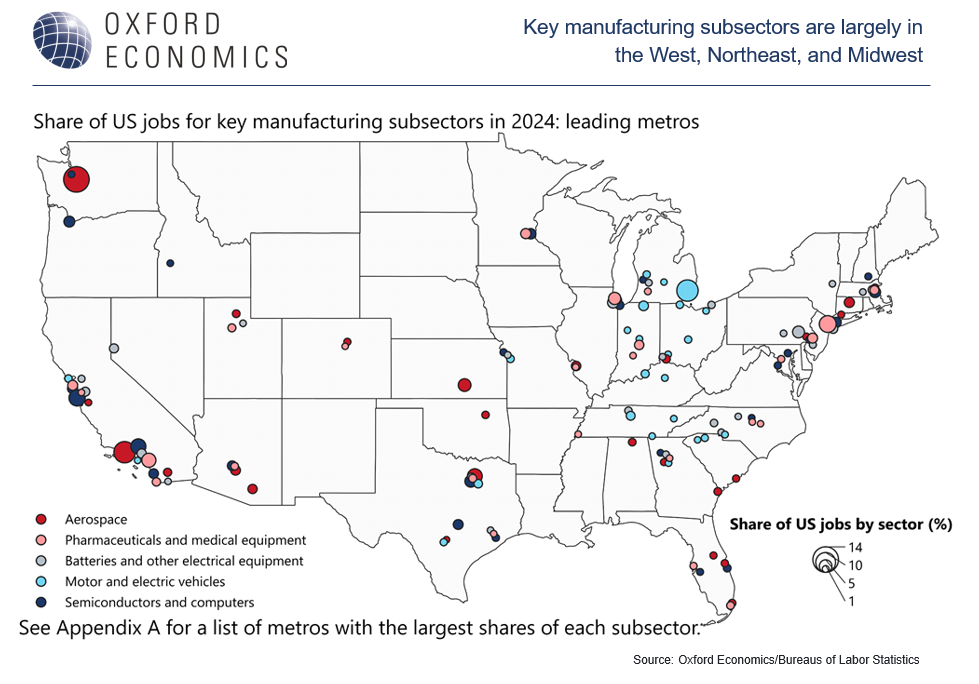

There are several key manufacturing subsectors poised to benefit from the Made in America agenda, given their existing domestic scale and high rates of productivity growth, as we previously reported. These “dynamic” subsectors—aerospace, batteries, semiconductors and computers, electric vehicles (EVs), and pharmaceuticals and medical equipment—serve as the best prospects for continued investment and policy focus. Therefore, metros with an established presence in these sectors, or that have planned investments, should be most poised to benefit.

- Reindustrialization efforts began with the previous administration’s passing of the CHIPS and Inflation Reduction Acts (IRA), which fueled new factory construction in these subsectors, particularly in Phoenix, Austin, Raleigh, Columbus, and Houston. While it will take time for construction to finish and jobs to materialize, we expect these—and Southern metros more broadly—to see the greatest benefits of the reindustrialization agenda.

- Manufacturing-heavy metros, including those with large shares of jobs in these dynamic subsectors—Detroit (autos), San Jose (semiconductors and computers), Seattle (aerospace), Reading (batteries), and New York (pharmaceuticals)—saw healthy job growth through 2023. But many have since incurred declines over the last year as concerns stemming from tariffs, CHIPS and IRA funding, and lower immigration have clouded the outlook. These losses reinforce the need to maintain the momentum of building new capacity to support manufacturing job growth.

- For planners looking to jumpstart more manufacturing, and who are considering criteria for selecting the best sites for new factories—available labor, density of skillsets, established supply chains, and broad-based infrastructure—we found that metros in Midwest states and central Pennsylvania score highest on these measures. Still, decision-makers tend to favor the South for new construction due to tax incentives and lower regulations. We expect this trend to continue.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]