How the macroeconomy affects real estate returns in US metros

Economic cycles are critical to explaining the variation in commercial property returns at a local level.

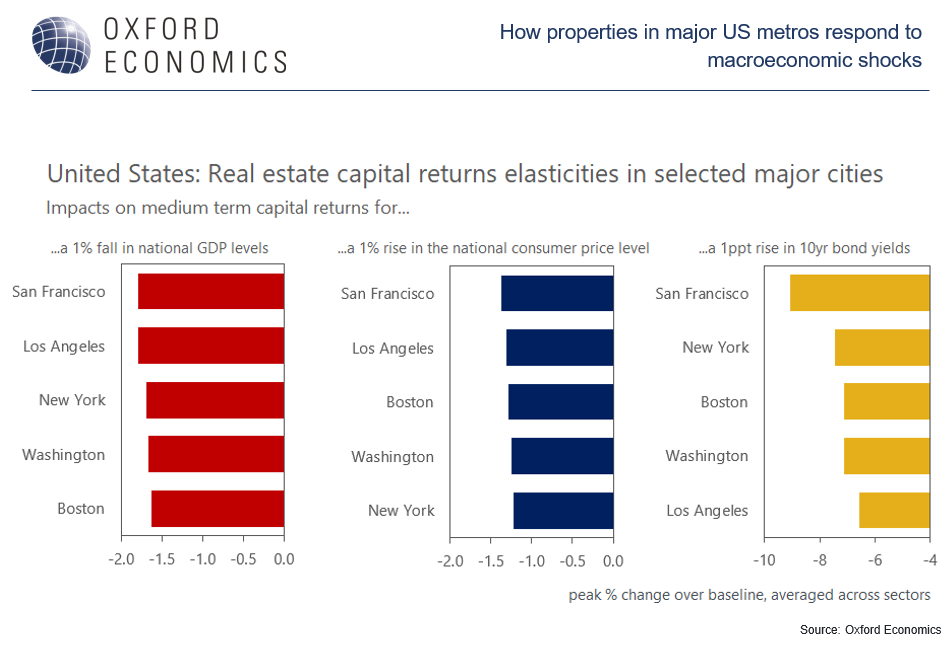

Economic cycles are critical to explaining the variation in commercial property returns at a local level, according to our modelling. This is particularly important today, with the US economy facing the risk of recession, inflationary pressures from tariffs yet to be felt, and fiscal concerns weighing on long-term bond yields.

Linking macroeconomic fluctuations to real estate returns has long been an obstacle for expert investors, especially at a more granular property-per-city level. Our novel Real Estate Economics Service (REES) extension is a response to meet this challenge.

What’s inside this report

In our new report, we how local US real estate markets are likely to respond to declines in GDP, increases in inflation and sharp bond market moves.

- In most US metros, a 1% GDP fall lowers capital returns on property by 1.4%-2%.

- A 1% rise in consumer inflation lowers property prices by 0.3%-1.8% – retail is hit more than industrial.

- Bond yield changes cause the sharpest swings, especially for lower discount rate properties.

- Although a consumer recession can take up to five years to fully feed into property prices, fluctuations in inflation tend to have a much quicker impact on capital returns.

Download the full report to see how these dynamics play out across US metros and property sectors.